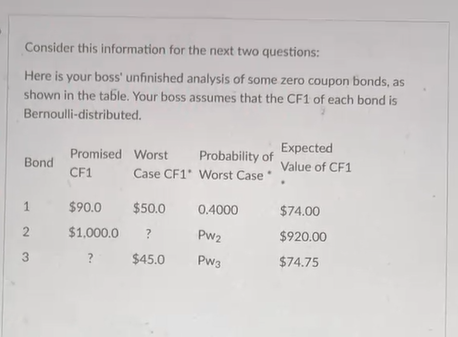

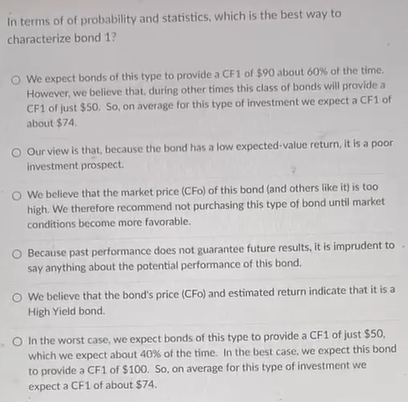

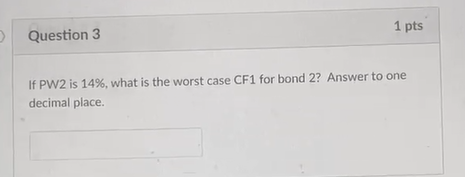

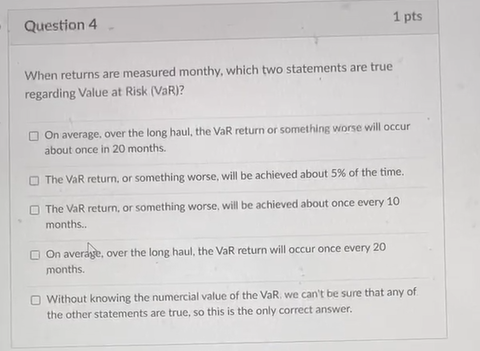

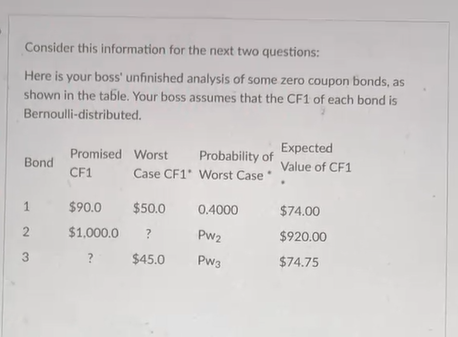

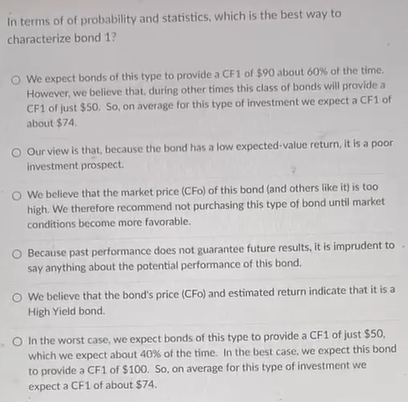

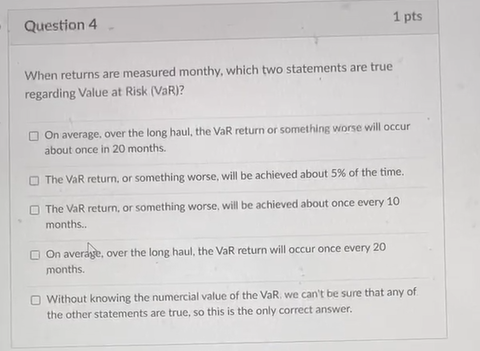

Consider this information for the next two questions: Here is your boss' unfinished analysis of some zero coupon bonds, as shown in the table. Your boss assumes that the CF1 of each bond is Bernoulli-distributed. Bond Promised Worst Expected Probability of Value of CF1 CF1 Case CF1' Worst Case 1 $90.0 $50.0 0.4000 $74.00 N $1,000.0 ? PW2 $920.00 3 ? $45.0 Pw3 $74.75 In terms of of probability and statistics, which is the best way to characterize bond 1? We expect bonds of this type to provide a CF 1 of $90 about 60% of the time. However, we believe that, during other times this class of bonds will provide a CF1 of just $50. So, on average for this type of investment we expect a CF1 of about $74 Our view is that, because the bond has a low expected value return, it is a poor investment prospect. We believe that the market price (CF) of this bond (and others like it) is too high. We therefore recommend not purchasing this type of bond until market conditions become more favorable. O Because past performance does not guarantee future results, it is imprudent to say anything about the potential performance of this bond. We believe that the bond's price (CFO) and estimated return indicate that it is a High Yield bond O In the worst case, we expect bonds of this type to provide a CF1 of just $50, which we expect about 40% of the time. In the best case, we expect this bond to provide a CF1 of $100. So, on average for this type of investment we expect a CF1 of about $74. a 1 pts Question 3 If PW2 is 14%, what is the worst case CF1 for bond 2? Answer to one decimal place. 1 pts Question When returns are measured monthy, which two statements are true regarding Value at Risk (VaR)? On average, over the long haul, the VaR return or something worse will occur about once in 20 months The VaR return, or something worse, will be achieved about 5% of the time. The VaR retum, or something worse, will be achieved about once every 10 months.. On average, over the long haul, the VaR return will occur once every 20 months. Without knowing the numercial value of the VaR we can't be sure that any of the other statements are true, so this is the only correct answer. Consider this information for the next two questions: Here is your boss' unfinished analysis of some zero coupon bonds, as shown in the table. Your boss assumes that the CF1 of each bond is Bernoulli-distributed. Bond Promised Worst Expected Probability of Value of CF1 CF1 Case CF1' Worst Case 1 $90.0 $50.0 0.4000 $74.00 N $1,000.0 ? PW2 $920.00 3 ? $45.0 Pw3 $74.75 In terms of of probability and statistics, which is the best way to characterize bond 1? We expect bonds of this type to provide a CF 1 of $90 about 60% of the time. However, we believe that, during other times this class of bonds will provide a CF1 of just $50. So, on average for this type of investment we expect a CF1 of about $74 Our view is that, because the bond has a low expected value return, it is a poor investment prospect. We believe that the market price (CF) of this bond (and others like it) is too high. We therefore recommend not purchasing this type of bond until market conditions become more favorable. O Because past performance does not guarantee future results, it is imprudent to say anything about the potential performance of this bond. We believe that the bond's price (CFO) and estimated return indicate that it is a High Yield bond O In the worst case, we expect bonds of this type to provide a CF1 of just $50, which we expect about 40% of the time. In the best case, we expect this bond to provide a CF1 of $100. So, on average for this type of investment we expect a CF1 of about $74. a 1 pts Question 3 If PW2 is 14%, what is the worst case CF1 for bond 2? Answer to one decimal place. 1 pts Question When returns are measured monthy, which two statements are true regarding Value at Risk (VaR)? On average, over the long haul, the VaR return or something worse will occur about once in 20 months The VaR return, or something worse, will be achieved about 5% of the time. The VaR retum, or something worse, will be achieved about once every 10 months.. On average, over the long haul, the VaR return will occur once every 20 months. Without knowing the numercial value of the VaR we can't be sure that any of the other statements are true, so this is the only correct