Question: Consider three securities: Asset 1 with expected return of 14% and standard deviation of return of 6%, Asset 2 with average return of 8%

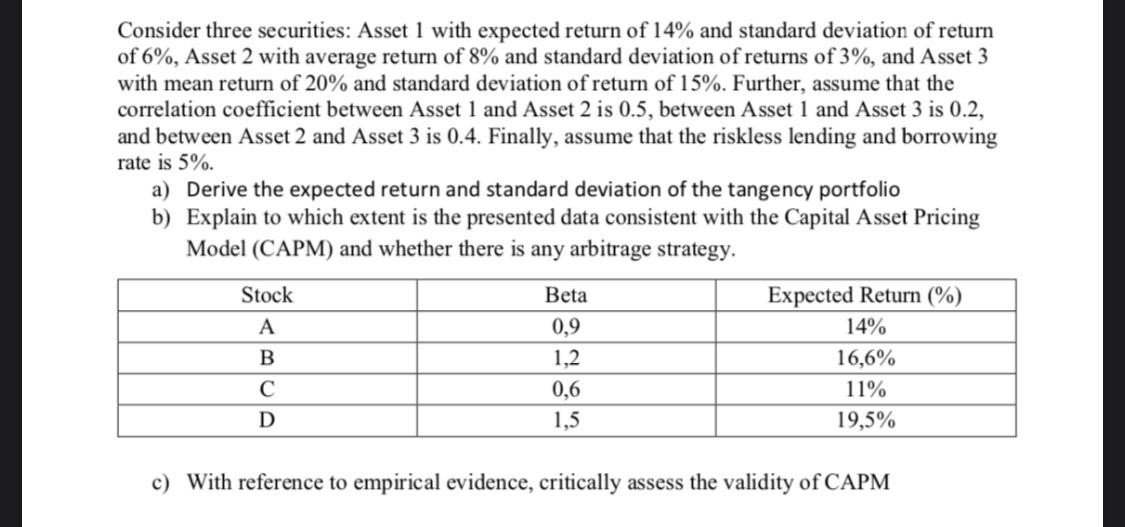

Consider three securities: Asset 1 with expected return of 14% and standard deviation of return of 6%, Asset 2 with average return of 8% and standard deviation of returns of 3%, and Asset 3 with mean return of 20% and standard deviation of return of 15%. Further, assume that the correlation coefficient between Asset 1 and Asset 2 is 0.5, between Asset 1 and Asset 3 is 0.2, and between Asset 2 and Asset 3 is 0.4. Finally, assume that the riskless lending and borrowing rate is 5%. a) Derive the expected return and standard deviation of the tangency portfolio b) Explain to which extent is the presented data consistent with the Capital Asset Pricing Model (CAPM) and whether there is any arbitrage strategy. Expected Return (%) Stock Beta 0,9 14% 1,2 16,6% 0,6 11% 19,5% 1,5 c) With reference to empirical evidence, critically assess the validity of CAPM

Step by Step Solution

3.31 Rating (148 Votes )

There are 3 Steps involved in it

To solve this question lets break it down step by step a Derive the expected return and standard deviation of the tangency portfolio Step 1 Inputs Exp... View full answer

Get step-by-step solutions from verified subject matter experts