Answered step by step

Verified Expert Solution

Question

1 Approved Answer

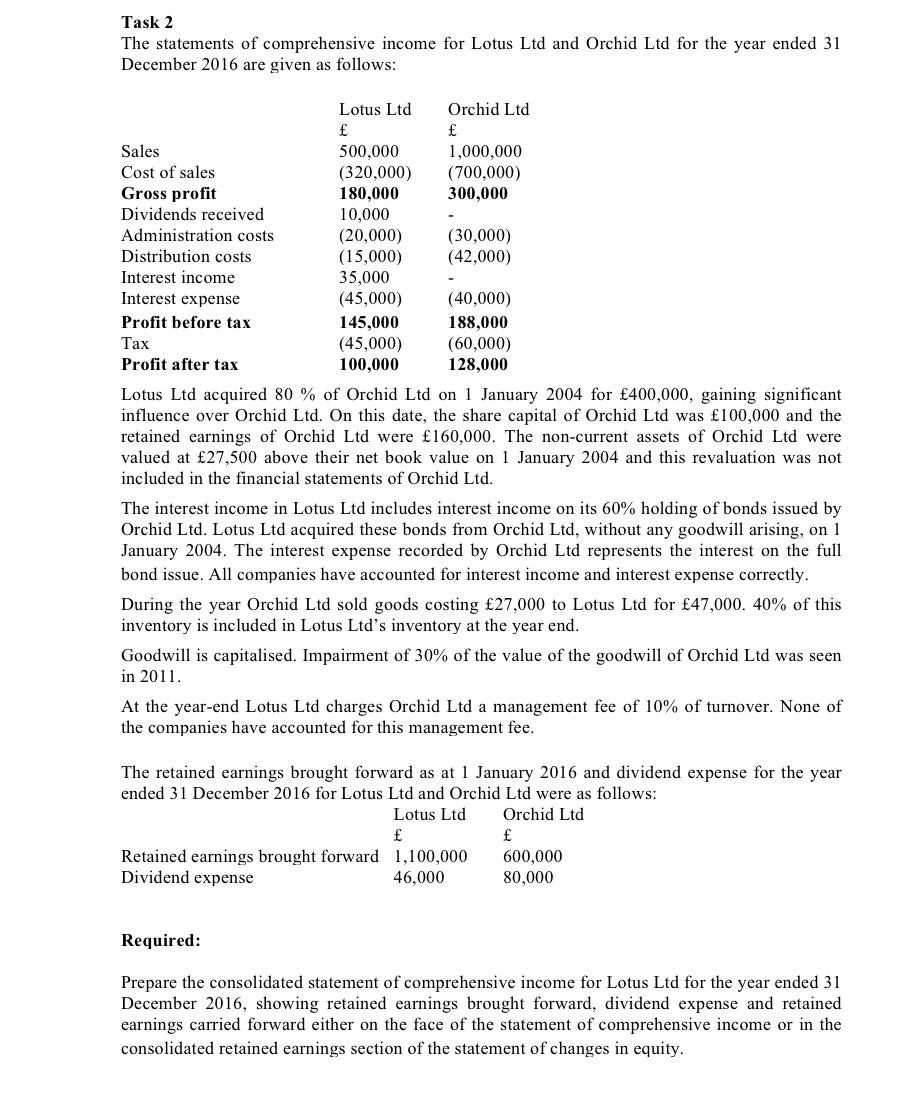

Task 2 The statements of comprehensive income for Lotus Ltd and Orchid Ltd for the year ended 31 December 2016 are given as follows:

Task 2 The statements of comprehensive income for Lotus Ltd and Orchid Ltd for the year ended 31 December 2016 are given as follows: Orchid Ltd Lotus Ltd Sales 500,000 (320,000) 180,000 10,000 1,000,000 (700,000) 300,000 Cost of sales Gross profit Dividends received Administration costs (20,000) (15,000) 35,000 (45,000) (30,000) (42,000) Distribution costs Interest income Interest expense (40,000) 188,000 (60,000) 128,000 Profit before tax 145,000 (45,000) 100,000 Profit after tax Lotus Ltd acquired 80 % of Orchid Ltd on 1 January 2004 for 400,000, gaining significant influence over Orchid Ltd. On this date, the share capital of Orchid Ltd was 100,000 and the retained earnings of Orchid Ltd were 160,000. The non-current assets of Orchid Ltd were valued at 27,500 above their net book value on 1 January 2004 and this revaluation was not included in the financial statements of Orchid Ltd. The interest income in Lotus Ltd includes interest income on its 60% holding of bonds issued by Orchid Ltd. Lotus Ltd acquired these bonds from Orchid Ltd, without any goodwill arising, on 1 January 2004. The interest expense recorded by Orchid Ltd represents the interest on the full bond issue. All companies have accounted for interest income and interest expense correctly. During the year Orchid Ltd sold goods costing 27,000 to Lotus Ltd for 47,000. 40% of this inventory is included in Lotus Ltd's inventory at the year end. Goodwill is capitalised. Impairment of 30% of the value of the goodwill of Orchid Ltd was seen in 2011. At the year-end Lotus Ltd charges Orchid Ltd a management fee of 10% of turnover. None of the companies have accounted for this management fee. The retained earnings brought forward as at 1 January 2016 and dividend expense for the year ended 31 December 2016 for Lotus Ltd and Orchid Ltd were as follows: Lotus Ltd Orchid Ltd Retained earnings brought forward Dividend expense 1,100,000 46,000 600,000 80,000 Required: Prepare the consolidated statement of comprehensive income for Lotus Ltd for the year ended 31 December 2016, showing retained earnings brought forward, dividend expense and retained earnings carried forward either on the face of the statement of comprehensive income or in the consolidated retained earnings section of the statement of changes in equity.

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Answer There are only 5 adjustments in the sum which are as follow...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started