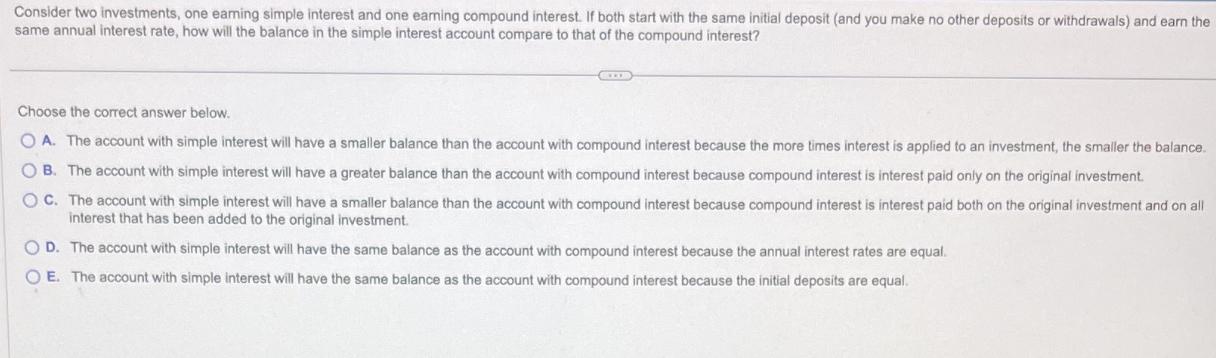

Consider two investments, one earning simple interest and one earning compound interest. If both start with the same initial deposit (and you make no

Consider two investments, one earning simple interest and one earning compound interest. If both start with the same initial deposit (and you make no other deposits or withdrawals) and earn the same annual interest rate, how will the balance in the simple interest account compare to that of the compound interest? CELOR Choose the correct answer below. OA. The account with simple interest will have a smaller balance than the account with compound interest because the more times interest is applied to an investment, the smaller the balance. OB. The account with simple interest will have a greater balance than the account with compound interest because compound interest is interest paid only on the original investment. OC. The account with simple interest will have a smaller balance than the account with compound interest because compound interest is interest paid both on the original investment and on all interest that has been added to the original investment. OD. The account with simple interest will have the same balance as the account with compound interest because the annual interest rates are equal. OE. The account with simple interest will have the same balance as the account with compound interest because the initial deposits are equal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The correct answer is OC The account ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started