Answered step by step

Verified Expert Solution

Question

1 Approved Answer

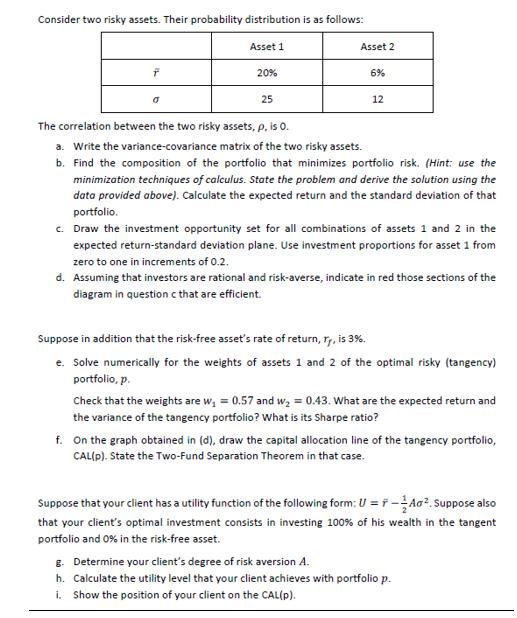

Consider two risky assets. Their probability distribution is as follows: F Asset 1 20% 25 Asset 2 6% 12 The correlation between the two

Consider two risky assets. Their probability distribution is as follows: F Asset 1 20% 25 Asset 2 6% 12 The correlation between the two risky assets, p, is 0. a. Write the variance-covariance matrix of the two risky assets. b. Find the composition of the portfolio that minimizes portfolio risk. (Hint: use the minimization techniques of calculus. State the problem and derive the solution using the data provided above). Calculate the expected return and the standard deviation of that portfolio. c. Draw the investment opportunity set for all combinations of assets 1 and 2 in the expected return-standard deviation plane. Use investment proportions for asset 1 from zero to one in increments of 0.2. d. Assuming that investors are rational and risk-averse, indicate in red those sections of the diagram in question c that are efficient. Suppose in addition that the risk-free asset's rate of return, Ty, is 3%. e. Solve numerically for the weights of assets 1 and 2 of the optimal risky (tangency) portfolio, p. Check that the weights are w = 0.57 and w = 0.43. What are the expected return and the variance of the tangency portfolio? What is its Sharpe ratio? f. On the graph obtained in (d), draw the capital allocation line of the tangency portfolio, CAL(p). State the Two-Fund Separation Theorem in that case. Suppose that your client has a utility function of the following form: U=Aa. Suppose also that your client's optimal investment consists in investing 100% of his wealth in the tangent portfolio and 0% in the risk-free asset. g. Determine your client's degree of risk aversion A. h. Calculate the utility level that your client achieves with portfolio p. i. Show the position of your client on the CAL(p).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The variancecovariance matrix of the two risky assets is V 25 0 0 12 b We want to minimize the ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started