Answered step by step

Verified Expert Solution

Question

1 Approved Answer

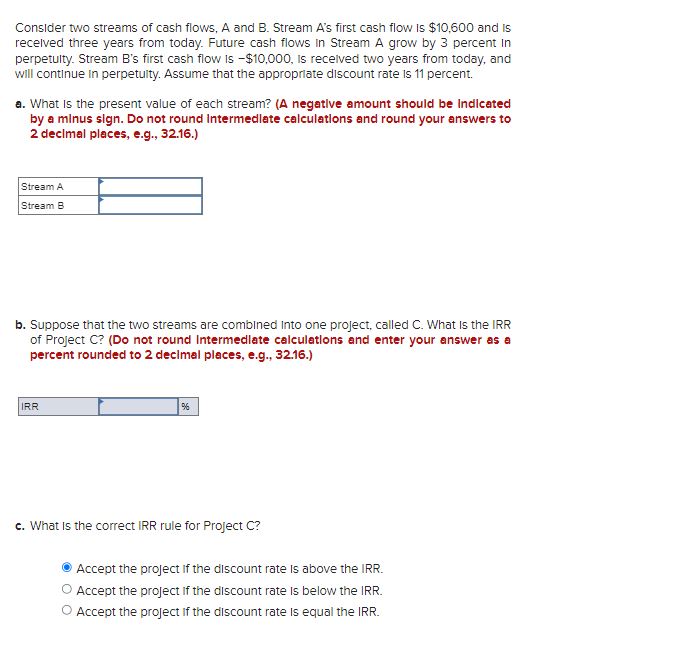

Consider two streams of cash flows, A and B . Stream A ' s first cash flow is $ 1 0 , 6 0 0

Consider two streams of cash flows, A and B Stream As first cash flow is $ and is

recelved three years from today. Future cash flows in Stream A grow by percent in

perpetulty. Stream Bs first cash flow is $ is recelved two years from today, and

will continue in perpetulty. Assume that the approprlate discount rate is percent.

a What is the present value of each stream? A negative amount should be Indlcated

by a minus sign. Do not round intermedlate calculations and round your answers to

decimal places, eg

b Suppose that the two streams are combined Into one project, called What is the IRR

of Project CDo not round Intermedlate calculations and enter your answer as a

percent rounded to decimal places, eg

IRR

c What Is the correct IRR rule for Project C

Accept the project if the discount rate is above the IRR.

Accept the project if the discount rate is below the IRR.

Accept the project if the discount rate is equal the IRR.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started