Answered step by step

Verified Expert Solution

Question

1 Approved Answer

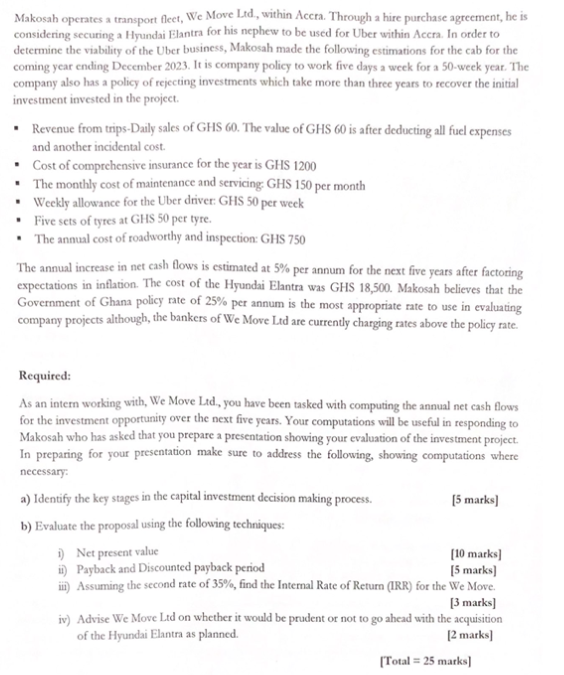

considering securing a Hyundai Elantra for his nephew to be used for Uber within Accra. In order to determine the viability of the Uber business,

considering securing a Hyundai Elantra for his nephew to be used for Uber within Accra. In order to determine the viability of the Uber business, Makosah made the following estimations for the cab for the coming year ending December 2023. It is company policy to work five days a week for a 50-week year. The company also has a policy of rejecting investments which take more than three years to recover the initial investment invested in the project. - Revenue from trips-Daily sales of GHS 60. The value of GHS 60 is after deducting all fuel expenses and another incidental cost. - Cost of comprehensive insurance for the year is GHS 1200 - The monthly cost of maintenance and servicing. GHS 150 per month - Weckly allowance for the Uber driver: GHS 50 per week - Five sets of tyres at GHS 50 per tyre. - The annual cost of roadworthy and inspection: GHS 750 The annual increase in net cash flows is estimated at 5% per annum for the next five years after factoring expectations in inflation. The cost of the Hyundai Elantra was GHS 18,500. Makosah believes that the Government of Ghan policy rate of 25% per annum is the most appropriate rate to use in evaluating company projects although, the bankers of We Move Ltd are currently charging rates above the policy rate. Required: As an intern working with, We Move Ltd., you have been tasked with computing the annual net cash flows for the investment opportunity over the next five years. Your computations will be useful in responding to Makosah who has asked that you prepare a presentation showing your evaluation of the investment project. In preparing for your presentation make sure to address the following, showing computations where necessary: a) Identify the key stages in the capital investment decision making process. [5 marks] b) Evaluate the proposal using the following techniques: i) Net present value ii) Payback and Discounted payback peniod [10 marks] iii) Assuming the second rate of 35%, find the Internal Rate of Return (IRR) for the We Move. [3 marks] iv) Advise We Move Led on whether it would be prudent or not to go ahead with the acquisition

considering securing a Hyundai Elantra for his nephew to be used for Uber within Accra. In order to determine the viability of the Uber business, Makosah made the following estimations for the cab for the coming year ending December 2023. It is company policy to work five days a week for a 50-week year. The company also has a policy of rejecting investments which take more than three years to recover the initial investment invested in the project. - Revenue from trips-Daily sales of GHS 60. The value of GHS 60 is after deducting all fuel expenses and another incidental cost. - Cost of comprehensive insurance for the year is GHS 1200 - The monthly cost of maintenance and servicing. GHS 150 per month - Weckly allowance for the Uber driver: GHS 50 per week - Five sets of tyres at GHS 50 per tyre. - The annual cost of roadworthy and inspection: GHS 750 The annual increase in net cash flows is estimated at 5% per annum for the next five years after factoring expectations in inflation. The cost of the Hyundai Elantra was GHS 18,500. Makosah believes that the Government of Ghan policy rate of 25% per annum is the most appropriate rate to use in evaluating company projects although, the bankers of We Move Ltd are currently charging rates above the policy rate. Required: As an intern working with, We Move Ltd., you have been tasked with computing the annual net cash flows for the investment opportunity over the next five years. Your computations will be useful in responding to Makosah who has asked that you prepare a presentation showing your evaluation of the investment project. In preparing for your presentation make sure to address the following, showing computations where necessary: a) Identify the key stages in the capital investment decision making process. [5 marks] b) Evaluate the proposal using the following techniques: i) Net present value ii) Payback and Discounted payback peniod [10 marks] iii) Assuming the second rate of 35%, find the Internal Rate of Return (IRR) for the We Move. [3 marks] iv) Advise We Move Led on whether it would be prudent or not to go ahead with the acquisition Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started