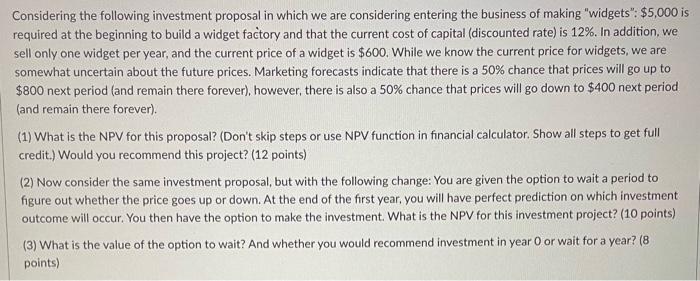

Considering the following investment proposal in which we are considering entering the business of making "widgets": $5,000 is required at the beginning to build a widget factory and that the current cost of capital (discounted rate) is 12%. In addition, we sell only one widget per year, and the current price of a widget is $600. While we know the current price for widgets, we are somewhat uncertain about the future prices. Marketing forecasts indicate that there is a 50% chance that prices will go up to $800 next period (and remain there forever), however, there is also a 50% chance that prices will go down to $400 next period (and remain there forever). (1) What is the NPV for this proposal? (Don't skip steps or use NPV function in financial calculator. Show all steps to get full credit) Would you recommend this project? (12 points) (2) Now consider the same investment proposal, but with the following change: You are given the option to wait a period to figure out whether the price goes up or down. At the end of the first year, you will have perfect prediction on which investment outcome will occur. You then have the option to make the investment. What is the NPV for this investment project? (10 points) (3) What is the value of the option to wait? And whether you would recommend investment in year 0 or wait for a year? (8 points) Considering the following investment proposal in which we are considering entering the business of making "widgets": $5,000 is required at the beginning to build a widget factory and that the current cost of capital (discounted rate) is 12%. In addition, we sell only one widget per year, and the current price of a widget is $600. While we know the current price for widgets, we are somewhat uncertain about the future prices. Marketing forecasts indicate that there is a 50% chance that prices will go up to $800 next period (and remain there forever), however, there is also a 50% chance that prices will go down to $400 next period (and remain there forever). (1) What is the NPV for this proposal? (Don't skip steps or use NPV function in financial calculator. Show all steps to get full credit) Would you recommend this project? (12 points) (2) Now consider the same investment proposal, but with the following change: You are given the option to wait a period to figure out whether the price goes up or down. At the end of the first year, you will have perfect prediction on which investment outcome will occur. You then have the option to make the investment. What is the NPV for this investment project? (10 points) (3) What is the value of the option to wait? And whether you would recommend investment in year 0 or wait for a year? (8 points)