Answered step by step

Verified Expert Solution

Question

1 Approved Answer

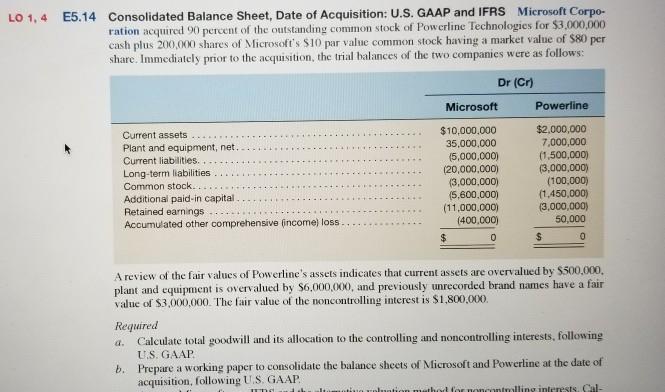

Consolidated Balance Sheet, Date of Acquisition: U.S. GAAP and IFRS ration acquired 90 percent of the outstanding common stock of Powcrline Technologies for cash plus

Consolidated Balance Sheet, Date of Acquisition: U.S. GAAP and IFRS ration acquired 90 percent of the outstanding common stock of Powcrline Technologies for cash plus 200,000 shares of Microsoft's $10 par value common stock having a market value of $80 per share. Immediately prior to the acquisition, the trial balances of the two companies were as follows: Microsoft Corpo- $3,000,000 LO 1, 4 E5.14 Dr (Cr) Microsoft Powerline $10,000,000 35,000,000 (5,000,000) (20,000,000) 3,000,000) .(5,600,000 (11,000,000) (400,000) $2,000,000 7,000,000 (1,500,000) (3,000,000) (100,000) (1,450,000) (3,000,000) 50,000 Current assets Plant and equipment, net. . Long-term liabilities.... Common stock. Additional paid-in capital... Retained earnings Accumulated other comprehensive (income) loss A review of the fair values of Powerline's assets indicates that current assets are overvalued by $500,000, plant and equipment is overvalued by s6,000,000, and previously unrecorded brand names have a fair value of $3,000,000. The fair value of the noncontrolling interest is $1,800,000 Required a. Calculate total goodwill and its allocation to the controlling and noncontrolling interests, following U.S. GAAP Prepare a working paper to consolidate the balance sheets of Microsoft and Powerline at the date of acquisition, following U.S. GAAP b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started