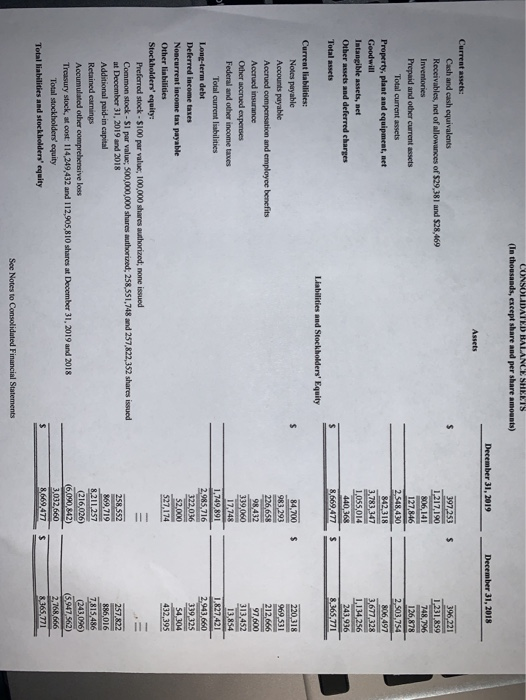

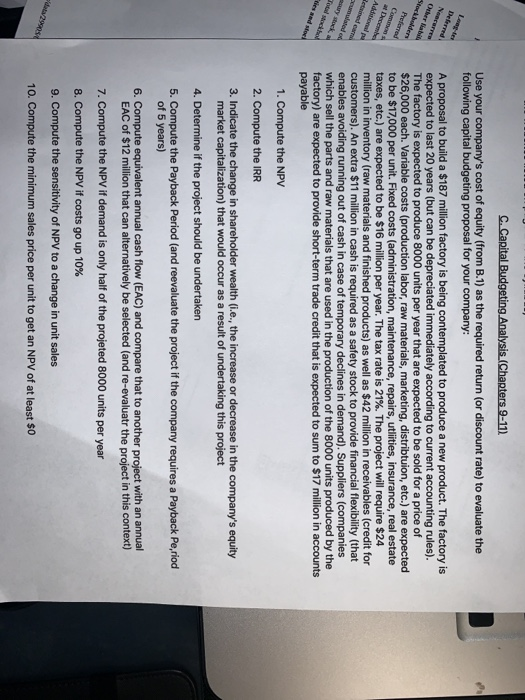

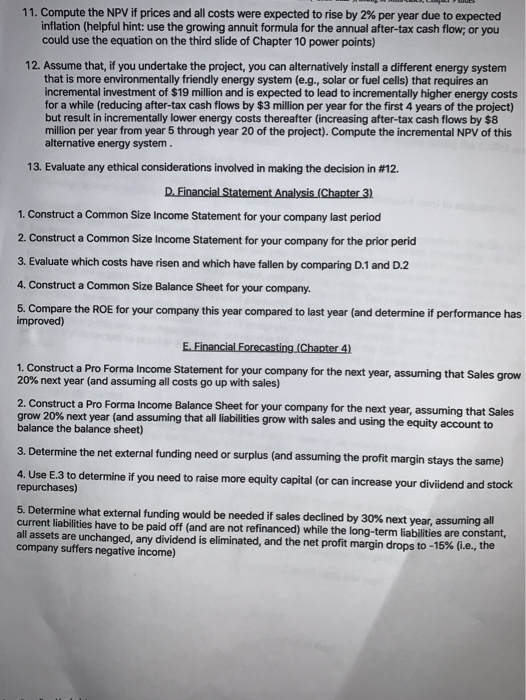

CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) December 31, 2019 December 31, 2018 397,253 1,217,190 806,141 127,846 2.548.430 842,318 3.783,347 1,055,014 440 368 8,669.477 396,221 1 231.859 748 796 126,878 2.503.754 806,497 3,677,328 1.134256 243.936 8.365.771 Assets Current assets: Cash and cash equivalents Receivables, net of allowances of $29,381 and $28,469 Inventories Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Other assets and deferred charges Total assets Liabilities and Stockholders' Equity Current liabilities: Notes payable Accounts payable Accrued compensation and employee benefits Accrued insurance Other accrued expenses Federal and other income taxes Total current liabilities Long-term debt Deferred income taxes Noncurrent income tax payable Other liabilities Stockholders' equity: Preferred stock - $100 par value 100,000 shares authorized: none issued Common stock - $1 par value, 500,000,000 shares authorized, 258,551,748 and 257,822,352 shares issued at December 31, 2019 and 2018 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 114,249,432 and 112,905,810 shares at December 31, 2019 and 2018 Total stockholders' equity Total liabilities and stockholders' equity 84,700 983,293 226,658 98.432 339,060 17.748 1.749,891 298 716 322.036 52.000 527,174 220,318 969.531 212,666 97,600 313,452 13,854 1.827,421 2.943 660 339,325 54 304 432,395 258.552 869,719 8211 257 216.026) (6,090,842) 3,032660 8,669,477 257,822 886,016 7.815,486 (243,096) (5.947.562) 2.768,666 8.365.771 See Notes to Consolidated Financial Statements C. Capital Budgeting Analysis (Chapters 9-11) Use your company's cost of equity (from B.1) as the required return for discount rate) to evaluate the following capital budgeting proposal for your company: A proposal to build a $187 million factory is being contemplated to produce a new product. The factory is expected to last 20 years (but can be depreciated immediately according to current accounting rules). The factory is expected to produce 8000 units per year that are expected to be sold for a price of $26,000 each. Variable costs (production labor, raw materials, marketing, distribtuion, etc.) are expected to be $17,000 per unit. Fixed costs (administration, maintenance, repairs, utliities, insurance, real estate taxes, etc.) are expected to be $16 million per year. The tax rate is 21%. The project will require $24 million in inventory (raw materials and finished products) as well as $42 million in receivables (credit for customers). An extra $11 million in cash is required as a safety stock to provide financial flexibility (that enables avoiding running out of cash in case of temporary declines in demand). Suppliers (companies which sell the parts and raw materials that are used in the production of the 8000 units produced by the factory) are expected to provide short-term trade credit that is expected to sum to $17 million in accounts payable Adid 1. Compute the NPV 2. Compute the IRR 3. Indicate the change in shareholder wealth (.e., the increase or decrease in the company's equity market capitalization) that would occur as a result of undertaking this project 4. Determine if the project should be undertaken 5. Compute the Payback Period (and reevaluate the project if the company requires a Payback Period of 5 years) 6. Compute equivalent annual cash flow (EAC) and compare that to another project with an annual EAC of $12 million that can alternatively be selected (and re-evaluatr the project in this context) 7. Compute the NPV If demand is only half of the projeted 8000 units per year 8. Compute the NPV if costs go up 10% 9. Compute the sensitivity of NPV to a change in unit sales 10. Compute the minimum sales price per unit to get an NPV of at least $0 11. Compute the NPV if prices and all costs were expected to rise by 2% per year due to expected inflation (helpful hint: use the growing annuit formula for the annual after-tax cash flow; or you could use the equation on the third slide of Chapter 10 power points) 12. Assume that, if you undertake the project, you can alternatively install a different energy system that is more environmentally friendly energy system (e.g., solar or fuel cells) that requires an incremental investment of $19 million and is expected to lead to incrementally higher energy costs for a while (reducing after-tax cash flows by $3 million per year for the first 4 years of the project) but result in incrementally lower energy costs thereafter (increasing after-tax cash flows by $8 million per year from year 5 through year 20 of the project). Compute the incremental NPV of this alternative energy system. 13. Evaluate any ethical considerations involved in making the decision in #12. D. Financial Statement Analysis (Chapter 3) 1. Construct a Common Size Income Statement for your company last period 2. Construct a Common Size Income Statement for your company for the prior perid 3. Evaluate which costs have risen and which have fallen by comparing D.1 and D.2 4. Construct a Common Size Balance Sheet for your company. 5. Compare the ROE for your company this year compared to last year (and determine if performance has improved) E. Financial Forecasting (Chapter 4) 1. Construct a Pro Forma Income Statement for your company for the next year, assuming that Sales grow 20% next year (and assuming all costs go up with sales) 2. Construct a Pro Forma Income Balance Sheet for your company for the next year, assuming that Sales grow 20% next year (and assuming that all liabilities grow with sales and using the equity account to balance the balance sheet) 3. Determine the net external funding need or surplus (and assuming the profit margin stays the same) 4. Use E.3 to determine if you need to raise more equity capital (or can increase your dividend and stock repurchases) 5. Determine what external funding would be needed if sales declined by 30% next year, assuming all current liabilities have to be paid off (and are not refinanced) while the long-term liabilities are constant, all assets are unchanged, any dividend is eliminated, and the net profit margin drops to -15% (.e., the company suffers negative income) CONSOLIDATED BALANCE SHEETS (In thousands, except share and per share amounts) December 31, 2019 December 31, 2018 397,253 1,217,190 806,141 127,846 2.548.430 842,318 3.783,347 1,055,014 440 368 8,669.477 396,221 1 231.859 748 796 126,878 2.503.754 806,497 3,677,328 1.134256 243.936 8.365.771 Assets Current assets: Cash and cash equivalents Receivables, net of allowances of $29,381 and $28,469 Inventories Prepaid and other current assets Total current assets Property, plant and equipment, net Goodwill Intangible assets, net Other assets and deferred charges Total assets Liabilities and Stockholders' Equity Current liabilities: Notes payable Accounts payable Accrued compensation and employee benefits Accrued insurance Other accrued expenses Federal and other income taxes Total current liabilities Long-term debt Deferred income taxes Noncurrent income tax payable Other liabilities Stockholders' equity: Preferred stock - $100 par value 100,000 shares authorized: none issued Common stock - $1 par value, 500,000,000 shares authorized, 258,551,748 and 257,822,352 shares issued at December 31, 2019 and 2018 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Treasury stock, at cost: 114,249,432 and 112,905,810 shares at December 31, 2019 and 2018 Total stockholders' equity Total liabilities and stockholders' equity 84,700 983,293 226,658 98.432 339,060 17.748 1.749,891 298 716 322.036 52.000 527,174 220,318 969.531 212,666 97,600 313,452 13,854 1.827,421 2.943 660 339,325 54 304 432,395 258.552 869,719 8211 257 216.026) (6,090,842) 3,032660 8,669,477 257,822 886,016 7.815,486 (243,096) (5.947.562) 2.768,666 8.365.771 See Notes to Consolidated Financial Statements C. Capital Budgeting Analysis (Chapters 9-11) Use your company's cost of equity (from B.1) as the required return for discount rate) to evaluate the following capital budgeting proposal for your company: A proposal to build a $187 million factory is being contemplated to produce a new product. The factory is expected to last 20 years (but can be depreciated immediately according to current accounting rules). The factory is expected to produce 8000 units per year that are expected to be sold for a price of $26,000 each. Variable costs (production labor, raw materials, marketing, distribtuion, etc.) are expected to be $17,000 per unit. Fixed costs (administration, maintenance, repairs, utliities, insurance, real estate taxes, etc.) are expected to be $16 million per year. The tax rate is 21%. The project will require $24 million in inventory (raw materials and finished products) as well as $42 million in receivables (credit for customers). An extra $11 million in cash is required as a safety stock to provide financial flexibility (that enables avoiding running out of cash in case of temporary declines in demand). Suppliers (companies which sell the parts and raw materials that are used in the production of the 8000 units produced by the factory) are expected to provide short-term trade credit that is expected to sum to $17 million in accounts payable Adid 1. Compute the NPV 2. Compute the IRR 3. Indicate the change in shareholder wealth (.e., the increase or decrease in the company's equity market capitalization) that would occur as a result of undertaking this project 4. Determine if the project should be undertaken 5. Compute the Payback Period (and reevaluate the project if the company requires a Payback Period of 5 years) 6. Compute equivalent annual cash flow (EAC) and compare that to another project with an annual EAC of $12 million that can alternatively be selected (and re-evaluatr the project in this context) 7. Compute the NPV If demand is only half of the projeted 8000 units per year 8. Compute the NPV if costs go up 10% 9. Compute the sensitivity of NPV to a change in unit sales 10. Compute the minimum sales price per unit to get an NPV of at least $0 11. Compute the NPV if prices and all costs were expected to rise by 2% per year due to expected inflation (helpful hint: use the growing annuit formula for the annual after-tax cash flow; or you could use the equation on the third slide of Chapter 10 power points) 12. Assume that, if you undertake the project, you can alternatively install a different energy system that is more environmentally friendly energy system (e.g., solar or fuel cells) that requires an incremental investment of $19 million and is expected to lead to incrementally higher energy costs for a while (reducing after-tax cash flows by $3 million per year for the first 4 years of the project) but result in incrementally lower energy costs thereafter (increasing after-tax cash flows by $8 million per year from year 5 through year 20 of the project). Compute the incremental NPV of this alternative energy system. 13. Evaluate any ethical considerations involved in making the decision in #12. D. Financial Statement Analysis (Chapter 3) 1. Construct a Common Size Income Statement for your company last period 2. Construct a Common Size Income Statement for your company for the prior perid 3. Evaluate which costs have risen and which have fallen by comparing D.1 and D.2 4. Construct a Common Size Balance Sheet for your company. 5. Compare the ROE for your company this year compared to last year (and determine if performance has improved) E. Financial Forecasting (Chapter 4) 1. Construct a Pro Forma Income Statement for your company for the next year, assuming that Sales grow 20% next year (and assuming all costs go up with sales) 2. Construct a Pro Forma Income Balance Sheet for your company for the next year, assuming that Sales grow 20% next year (and assuming that all liabilities grow with sales and using the equity account to balance the balance sheet) 3. Determine the net external funding need or surplus (and assuming the profit margin stays the same) 4. Use E.3 to determine if you need to raise more equity capital (or can increase your dividend and stock repurchases) 5. Determine what external funding would be needed if sales declined by 30% next year, assuming all current liabilities have to be paid off (and are not refinanced) while the long-term liabilities are constant, all assets are unchanged, any dividend is eliminated, and the net profit margin drops to -15% (.e., the company suffers negative income)