Answered step by step

Verified Expert Solution

Question

1 Approved Answer

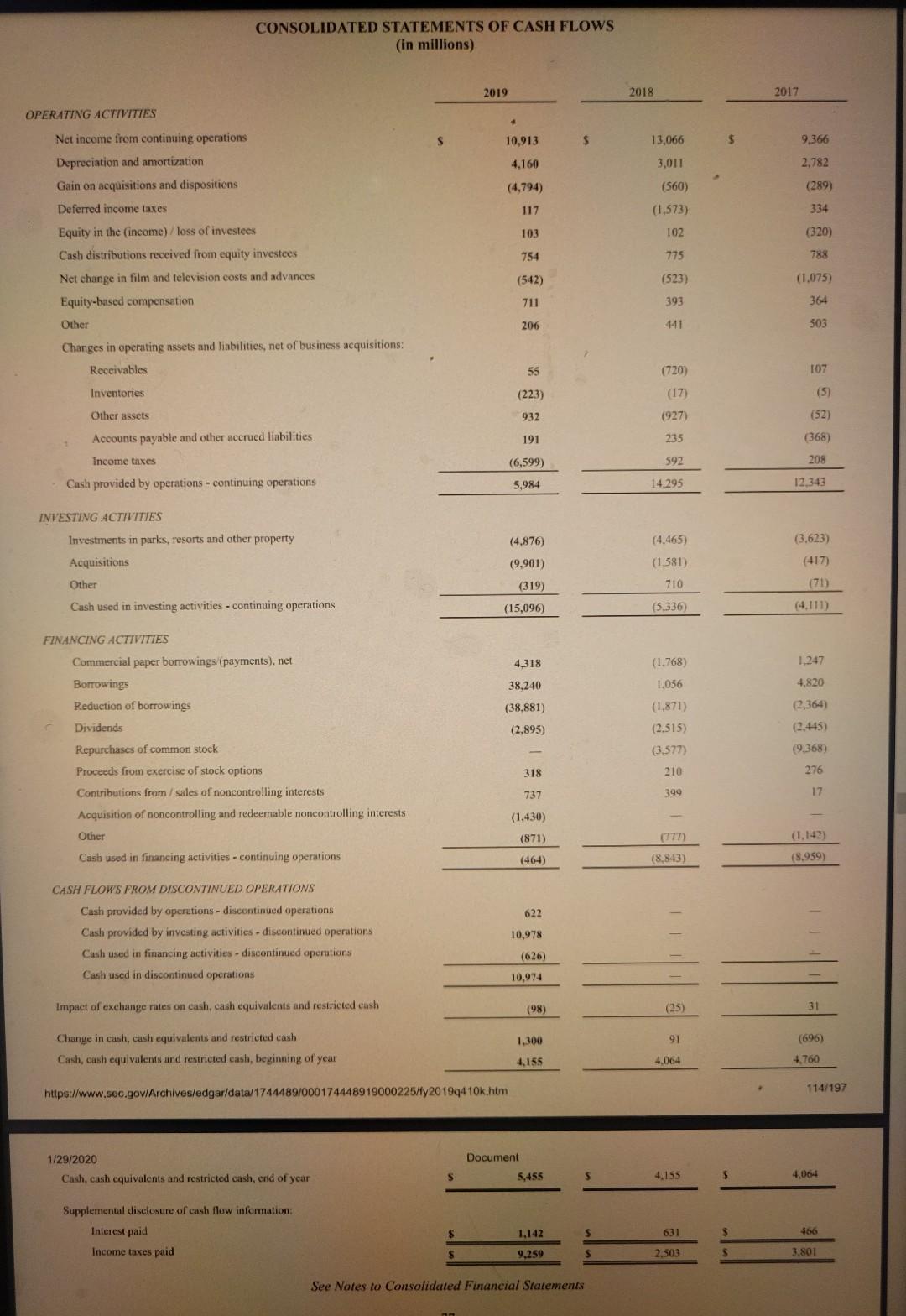

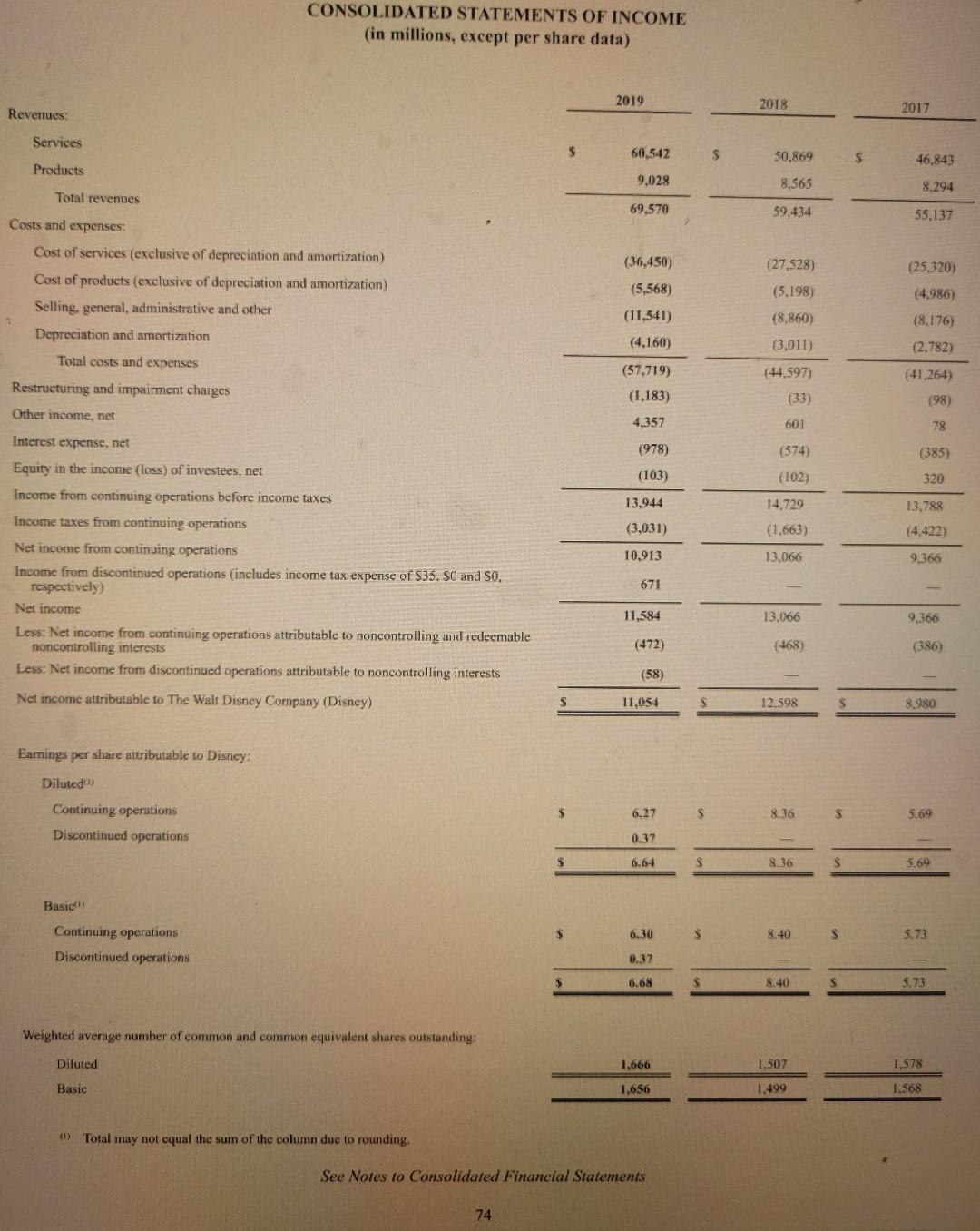

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) See Notes to Consolidated Financial Statements CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) Revenues: Services

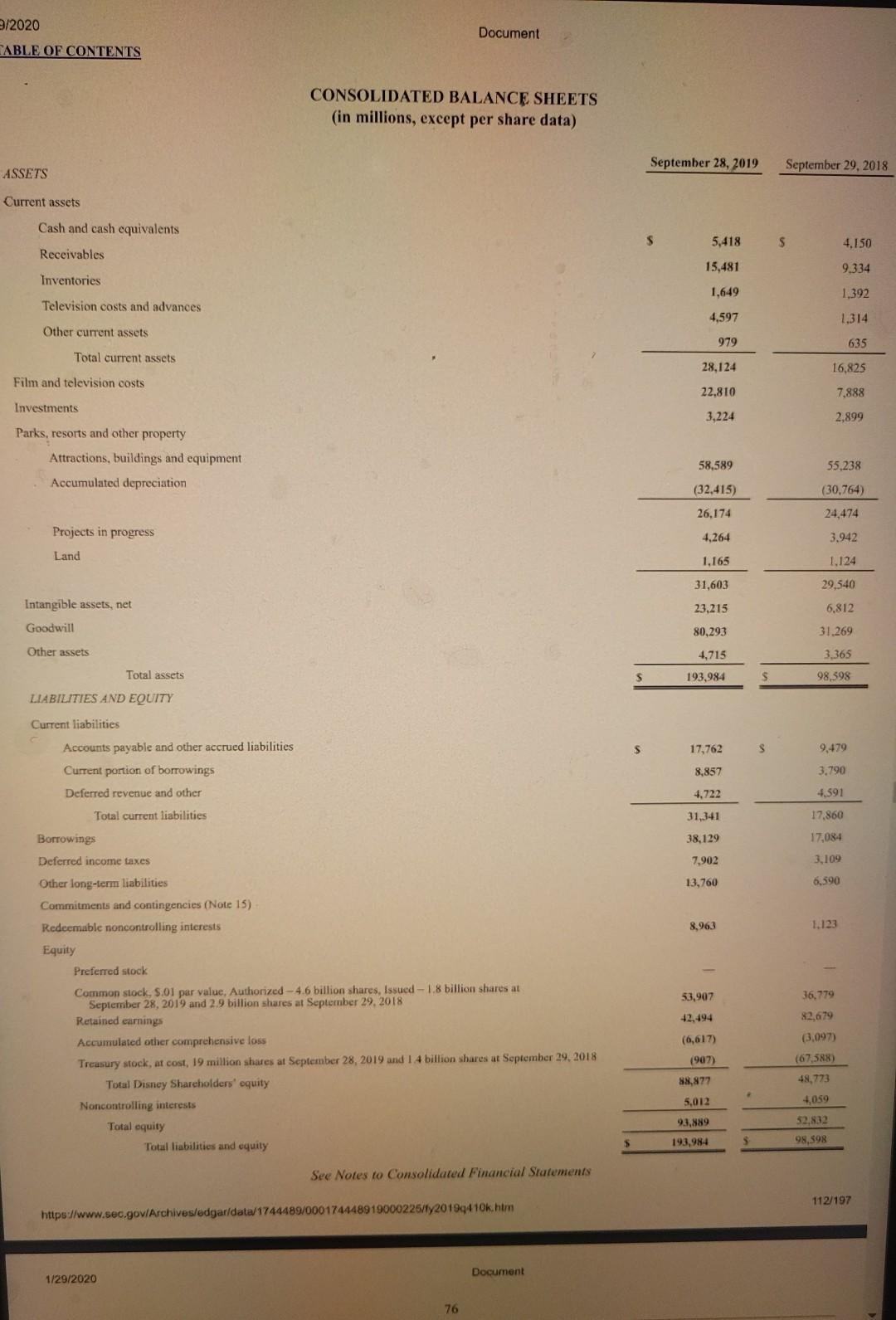

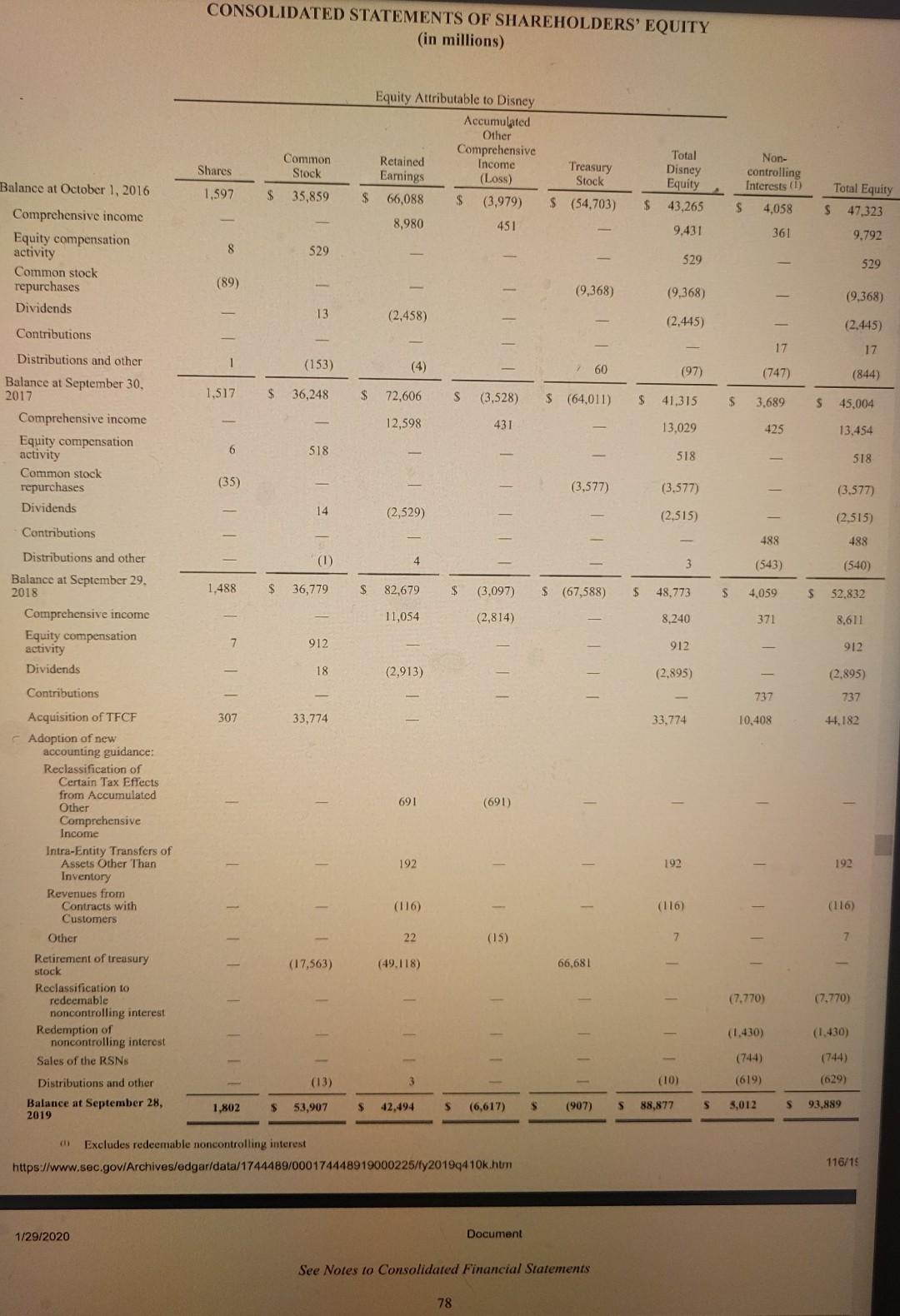

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) See Notes to Consolidated Financial Statements CONSOLIDATED STATEMENTS OF INCOME (in millions, except per share data) Revenues: Services Products Total revenues Costs and expenses: Cost of services (exclusive of depreciation and amortization) Cost of products (exclusive of depreciation and amortization) Selling, general, administrative and other Depreciation and amortization Total costs and expenses Restructuring and impairment charges Other income, net Interest expense, net Equity in the incame (loss) of investees, net Income from continuing operations before income taxes Income taxes from continuing operations Net income from continuing operations Income from discontinued operations (ineludes income tax expense of 535,50 and 50 . respectively) Net income Less: Net income from continuing operations attributable to noncontrolling and redeemable noncontrolling interests Less: Net income from discontinued operations attributable to noncontrolling interests Net income attributable to The Wait Disney Company (Disney) Eamings per share atuributable to Disney: Diluted(1) Continuing operations Discontinued operations Basic(i) Continuing operations Discontinued operations Weighted average number of common and common equivalent shares outstanding: Diluted Basic (1) Total may not equal the sum of the column due to rounding. See Notes to Consolidated Financial Statements Document ABLE OF CONTENTS CONSOLIDATED BALANCE SHEETS (in millions, except per share data) ASSETS September 28,2019 September 29,2018 Current assets Cash and cash equivalents Receivables Inventories Television costs and advances Other current assets Total current assets Film and television costs Investments Parks, resorts and other property Attractions, buildings and equipment Accumulated depreciation Projects in progress Land Intangible assets, net Goodwill Other assets LIABILITIES AND EQUITY \begin{tabular}{rrr} $5,418 & $ & 4,150 \\ 15,481 & 9,334 \\ 1,649 & 1,392 \\ 4,597 & & 1,314 \\ 979 & & 635 \\ \cline { 3 - 3 } \cline { 3 - 3 } 28,124 & & 16,825 \\ 22,810 & & 7,888 \\ 3,224 & & 2,899 \end{tabular} Current liabilities Accounts payable and other accrued liabilities Current portion of borrowings Deferred revenue and other Total current liabilities Borrowings Deferred income taxes Other long-term liabilities Commitments and contingencies (Note 15) Redecmable noncontrolling interests Equity Preferred stock Common stock, $.01 par value, Authorized 4.6 billion shares, Issued 1.8 billion shares at September 28,2019 and 2.9 billion shares at September 29,2018 Retained earnings Accumulated other comprehensive loss Treasury stock, at cost, 19 million shares at September 28, 2019 and 14 billion shares at September 29,2018 Total Disney Shareholders' equity Noncontrolling interests Total equity Total liabilities and equity See Notes to Consolidated Financial Sratements https://www.sec.gov/Archives/edgar/data/1744489/000174448919000225/fy2019g410k.htm 112/197 1/29/2020 Document CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (in millions) 1/29/2020 Document See Notes to Consolidated Financial Statements Disney's most recent income statement is: a. for the year ended December 31, 2019. b. at December 31, 2019. c. for the year ended September 28, 2019. d. at September 28, 2019. Disney's shareholders claims on the company's assets from 2018 to 2019 a. stayed the same b. increased c. decreased For the most recent reporting period, cash provided / (used) by Disney's primary business activity was (in millions) a. $5,984 b. ($15,096) c. ($464) d. $5,455 Was Disney's retained earnings account decreased for dividends during the most recent reporting period? a. No b. Yes c. Cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started