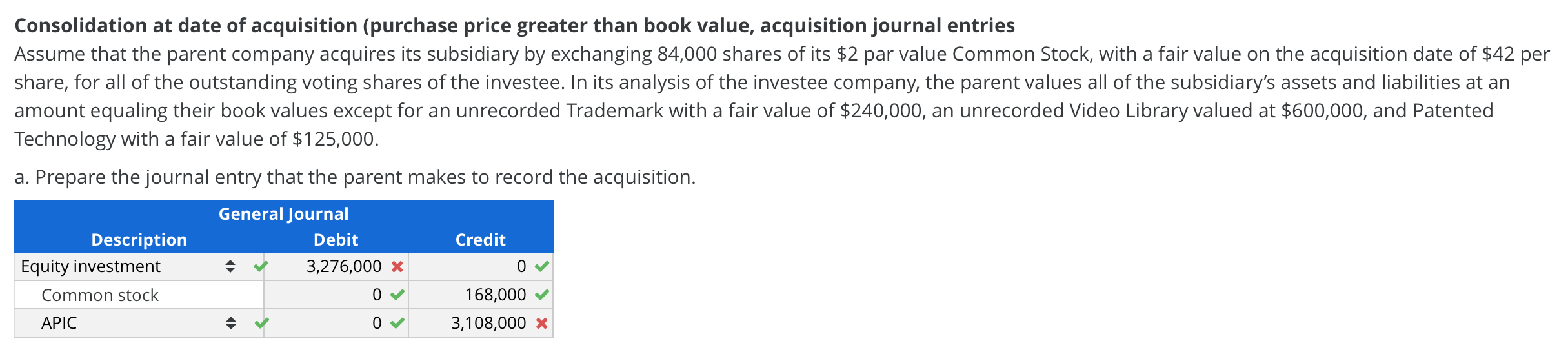

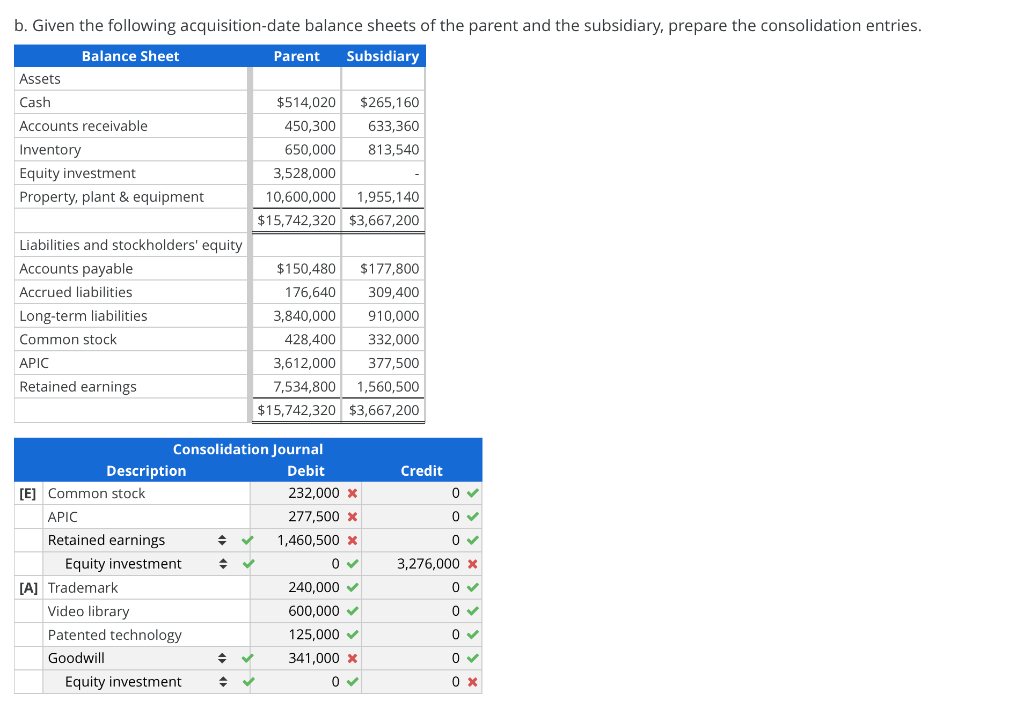

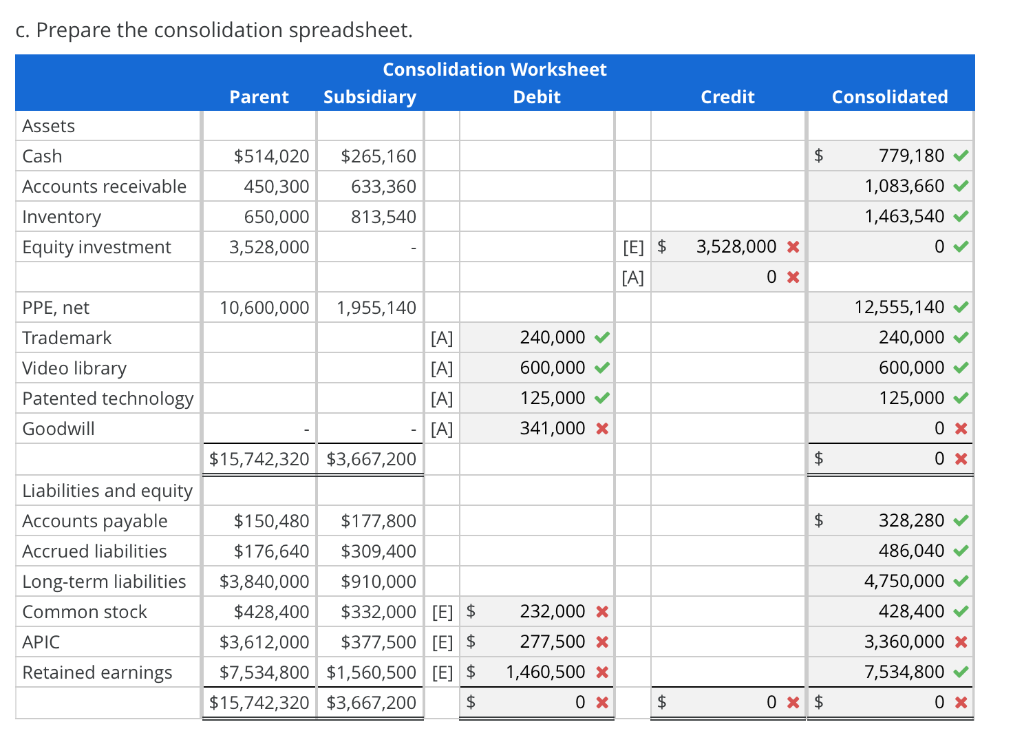

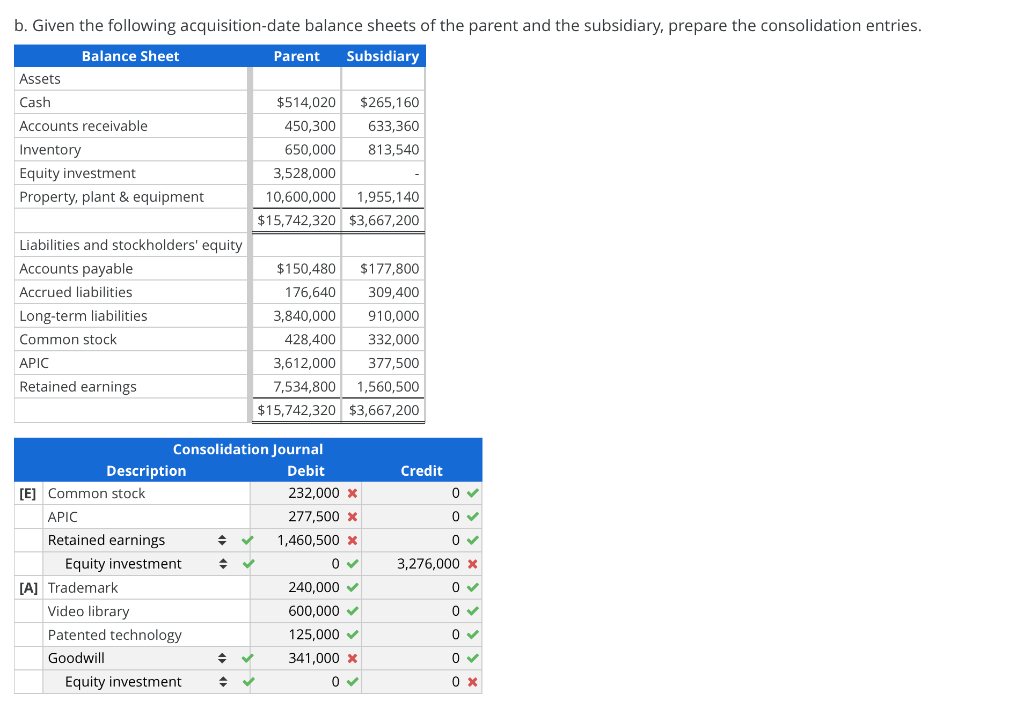

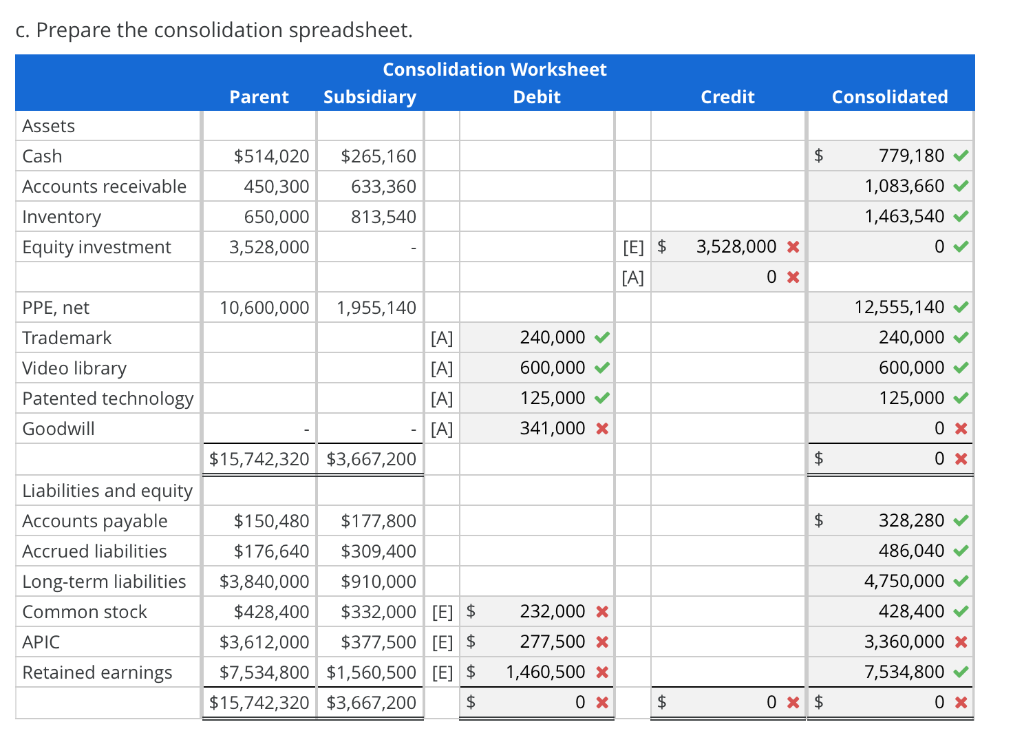

Consolidation at date of acquisition (purchase price greater than book value, acquisition journal entries Assume that the parent company acquires its subsidiary by exchanging 84,000 shares of its $2 par value Common Stock, with a fair value on the acquisition date of $42 per share, for all of the outstanding voting shares of the investee. In its analysis of the investee company, the parent values all of the subsidiary's assets and liabilities at an amount equaling their book values except for an unrecorded Trademark with a fair value of $240,000, an unrecorded Video Library valued at $600,000, and Patented Technology with a fair value of $125,000. a. Prepare the journal entry that the parent makes to record the acquisition. General Journal Debit 3,276,000 x Description Equity investment Common stock Credit 0 0 168,000 3,108,000 X APIC O b. Given the following acquisition-date balance sheets of the parent and the subsidiary, prepare the consolidation entries. Balance Sheet Parent Subsidiary Assets Cash $514,020 $265,160 Accounts receivable 450,300 633,360 Inventory 650,000 813,540 Equity investment 3,528,000 Property, plant & equipment 10,600,000 1,955,140 $15,742,320 $3,667,200 Liabilities and stockholders' equity Accounts payable $150,480 $177,800 Accrued liabilities 176,640 309,400 Long-term liabilities 3,840,000 910,000 Common stock 428,400 332,000 APIC 3,612,000 377,500 Retained earnings 7,534,800 1,560,500 $15,742,320 $3,667,200 Credit 0 0 0 Consolidation Journal Description Debit [E] Common stock 232,000 x APIC 277,500 x Retained earnings 1,460,500 * Equity investment 0 [A] Trademark 240,000 Video library 600,000 Patented technology 125,000 Goodwill 341,000 x Equity investment 0 3,276,000 X 07 0 0 0 OX c. Prepare the consolidation spreadsheet. Consolidation Worksheet Subsidiary Debit Parent Credit Consolidated Assets Cash $ 779,180 1,083,660 Accounts receivable $514,020 450,300 650,000 3,528,000 $265,160 633,360 813,540 1,463,540 Inventory Equity investment 3,528,000 x 0 [E] $ [A] OX PPE, net Trademark Video library Patented technology Goodwill 10,600,000 1,955,140 [A] [A] [A] - [A] $15,742,320 $3,667,200 240,000 600,000 125,000 341,000 x 12,555,140 240,000 600,000 125,000 OX $ 0 x $ 328,280 Liabilities and equity Accounts payable Accrued liabilities Long-term liabilities Common stock $150,480 $177,800 $176,640 $309,400 $3,840,000 $910,000 $428,400 $332,000 [E] $ $3,612,000 $377,500 [E] $ $7,534,800 $1,560,500 [E] $ $15,742,320 $3,667,200 $ 486,040 4,750,000 428,400 3,360,000 x 7,534,800 232,000 x 277,500 x 1,460,500 x OX APIC Retained earnings $ 0 X $ OX