Consolidation Case

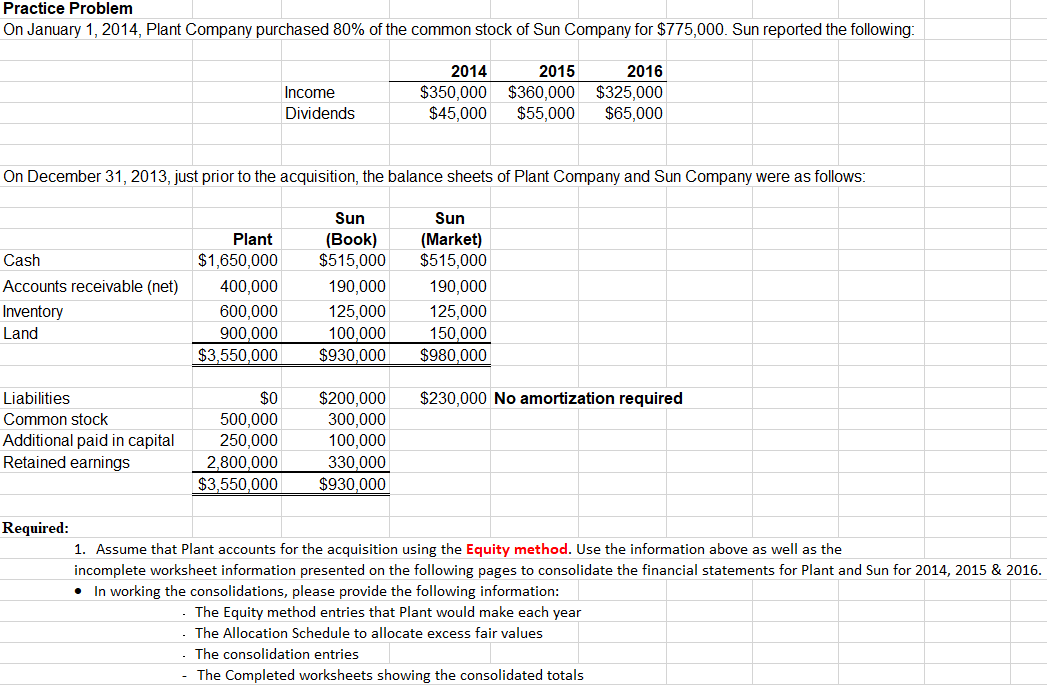

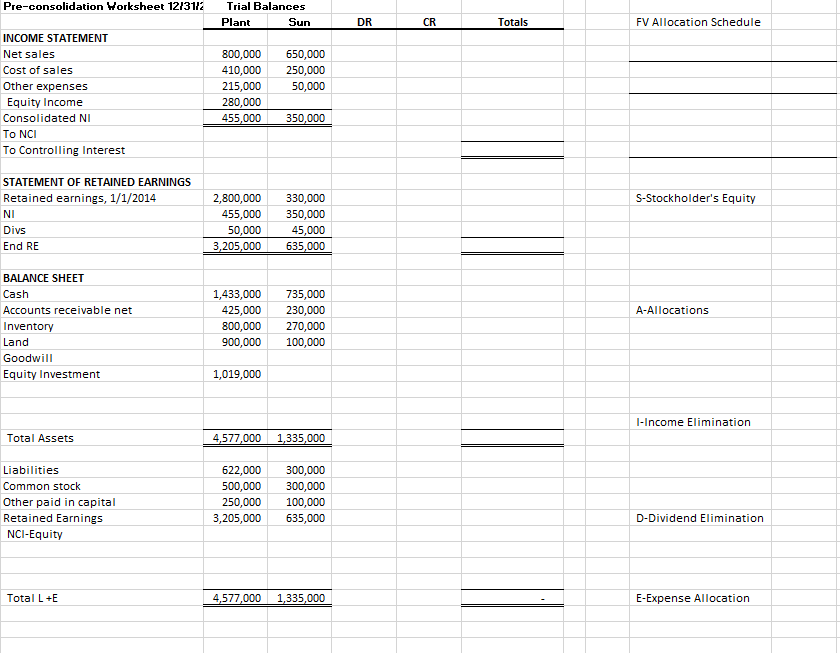

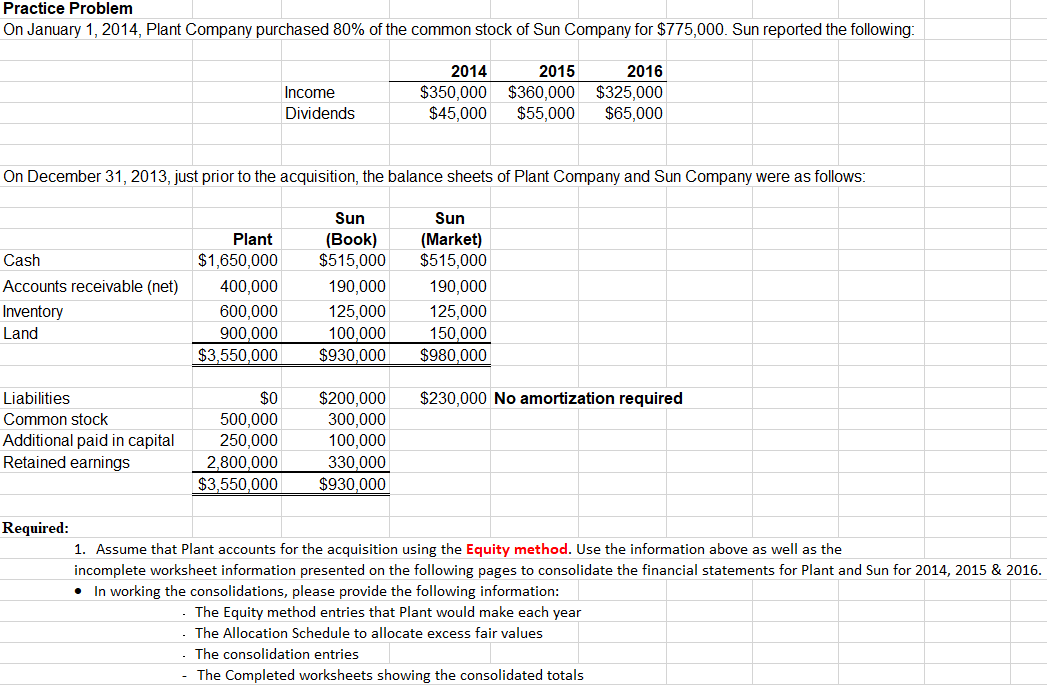

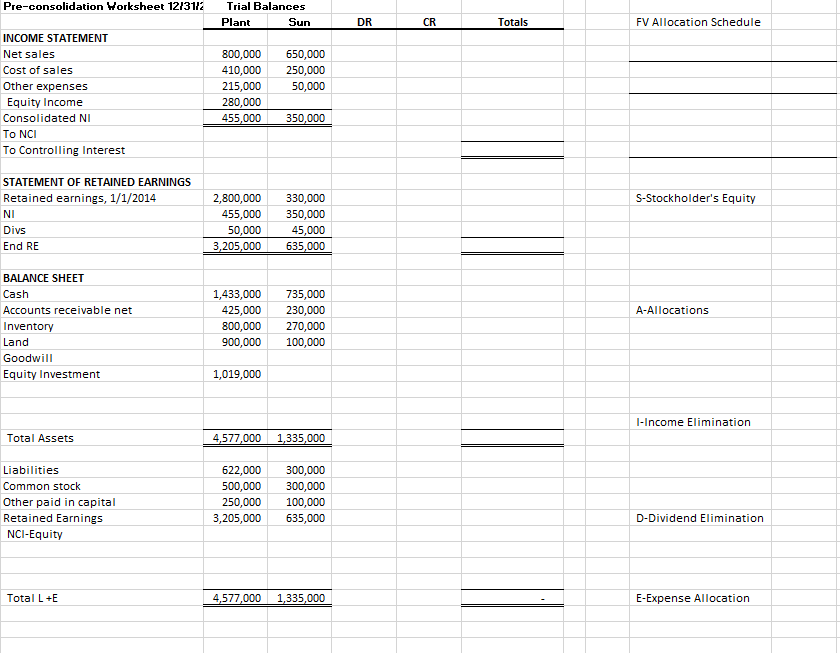

Practice Problem On January 1, 2014, Plant Company purchased 80% of the common stock of Sun Company for $775,000. Sun reported the following: Income Dividends 2014 $350,000 $45,000 2015 $360,000 $55,000 2016 $325,000 $65,000 On December 31, 2013, just prior to the acquisition, the balance sheets of Plant Company and Sun Company were as follows: Cash Accounts receivable (net) Inventory Land Plant $1,650,000 400,000 600,000 900,000 $3,550,000 Sun (Book) $515,000 190,000 125,000 100,000 $930,000 Sun (Market) $515,000 190,000 125,000 150,000 $980,000 $230,000 No amortization required Liabilities Common stock Additional paid in capital Retained earnings $0 500,000 250,000 2,800,000 $3,550,000 $200,000 300,000 100,000 330,000 $930,000 Required: 1. Assume that Plant accounts for the acquisition using the Equity method. Use the information above as well as the incomplete worksheet information presented on the following pages to consolidate the financial statements for Plant and Sun for 2014, 2015 & 2016. In working the consolidations, please provide the following information: The Equity method entries that Plant would make each year The Allocation Schedule to allocate excess fair values The consolidation entries - The Completed worksheets showing the consolidated totals Pre-consolidation Worksheet 12/3112 Trial Balances Plant Sun DR CR Totals FV Allocation Schedule INCOME STATEMENT Net sales Cost of sales Other expenses Equity Income Consolidated NI To NCI To Controlling Interest 800,000 410,000 215,000 280,000 455,000 650,000 250,000 50,000 350,000 STATEMENT OF RETAINED EARNINGS Retained earnings, 1/1/2014 S-Stockholder's Equity NI Divs End RE 2,800,000 455,000 50,000 3,205,000 330,000 350,000 45,000 635,000 A-Allocations BALANCE SHEET Cash Accounts receivable net Inventory Land Goodwill Equity Investment 1,433,000 425,000 800,000 900,000 735,000 230,000 270,000 100,000 1,019,000 l-Income Elimination Total Assets 4,577,000 1,335,000 Liabilities Common stock Other paid in capital Retained Earnings NCI-Equity 622,000 500,000 250,000 3,205,000 300,000 300,000 100,000 635,000 D-Dividend Elimination Total L+E 4,577,000 1,335,000 - E-Expense Allocation Practice Problem On January 1, 2014, Plant Company purchased 80% of the common stock of Sun Company for $775,000. Sun reported the following: Income Dividends 2014 $350,000 $45,000 2015 $360,000 $55,000 2016 $325,000 $65,000 On December 31, 2013, just prior to the acquisition, the balance sheets of Plant Company and Sun Company were as follows: Cash Accounts receivable (net) Inventory Land Plant $1,650,000 400,000 600,000 900,000 $3,550,000 Sun (Book) $515,000 190,000 125,000 100,000 $930,000 Sun (Market) $515,000 190,000 125,000 150,000 $980,000 $230,000 No amortization required Liabilities Common stock Additional paid in capital Retained earnings $0 500,000 250,000 2,800,000 $3,550,000 $200,000 300,000 100,000 330,000 $930,000 Required: 1. Assume that Plant accounts for the acquisition using the Equity method. Use the information above as well as the incomplete worksheet information presented on the following pages to consolidate the financial statements for Plant and Sun for 2014, 2015 & 2016. In working the consolidations, please provide the following information: The Equity method entries that Plant would make each year The Allocation Schedule to allocate excess fair values The consolidation entries - The Completed worksheets showing the consolidated totals Pre-consolidation Worksheet 12/3112 Trial Balances Plant Sun DR CR Totals FV Allocation Schedule INCOME STATEMENT Net sales Cost of sales Other expenses Equity Income Consolidated NI To NCI To Controlling Interest 800,000 410,000 215,000 280,000 455,000 650,000 250,000 50,000 350,000 STATEMENT OF RETAINED EARNINGS Retained earnings, 1/1/2014 S-Stockholder's Equity NI Divs End RE 2,800,000 455,000 50,000 3,205,000 330,000 350,000 45,000 635,000 A-Allocations BALANCE SHEET Cash Accounts receivable net Inventory Land Goodwill Equity Investment 1,433,000 425,000 800,000 900,000 735,000 230,000 270,000 100,000 1,019,000 l-Income Elimination Total Assets 4,577,000 1,335,000 Liabilities Common stock Other paid in capital Retained Earnings NCI-Equity 622,000 500,000 250,000 3,205,000 300,000 300,000 100,000 635,000 D-Dividend Elimination Total L+E 4,577,000 1,335,000 - E-Expense Allocation