Question

Consortium is preparing to open a new retail strip mall and have multiple businesses that would like lease space in it. Each business will pay

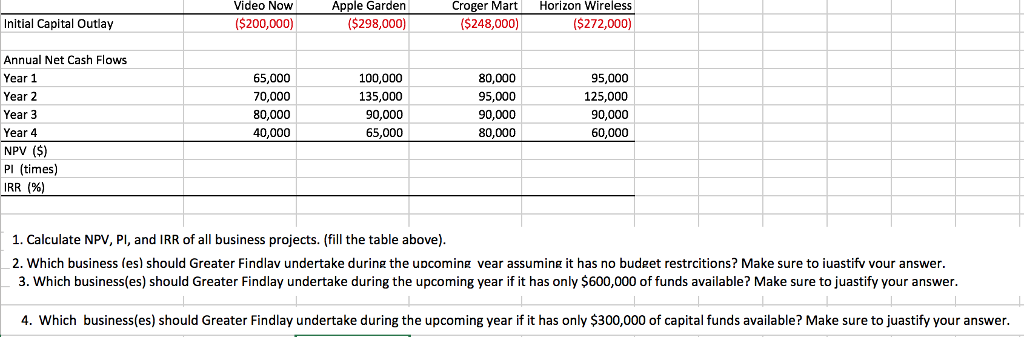

Consortium is preparing to open a new retail strip mall and have multiple businesses that would like lease space in it. Each business will pay a fixed amount of rent plus a percentage of the gross sales generated each year. The cash flows from each of the businesses has approximately the same amount of risk. The business names, annual expected cash flows, and initial capital outflow for each of the businesses that would like to lease space in the strip mall are provided below. Greater Findlay Development Consortium uses a 12% hurdle rate which is its cost of capital. All business will be evaluated based on 4-year term because the contract will expire in four years.

Please answer all of the questions, and show all work, etc. I appreciate your help.

Video Now Apple Garden Croger Mart Horizon Wireless (S200,000 ($298,000) ($248,000) Initial Capital Outlay ($272,000) Annual Net Cash Flows Year 1 65,000 100,000 80,000 95,000 Year 2 135,000 70,000 95,000 125,000 Year 3 80,000 90,000 90,000 90,000 Year 4 40,000 65,000 60,000 80,000 NPV Pl (times) IRR (56) 1. Calculate NPV, PI, and IRR of all business projects. (fill the table above 2. Which business (es) should Greater Findlav undertake during the upcoming vear assuming it has no budget restrcitions? Make sure to iuastifv vour answer. 3. Which business (es) should Greater Findlay undertake during the upcoming year if it has only $600,000 of funds available? Make sure to juastify your answer. 4. Which business(es) should Greater F ndlay undertake during the upcoming year if it has only $300,000 of capital funds available? Make sure to juastify yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started