Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Construct the tax payable schedule for APL: Background APL Limited is considering the purchase of a machine BT-5 which will increase sales by $120,000 per

Construct the tax payable schedule for APL:

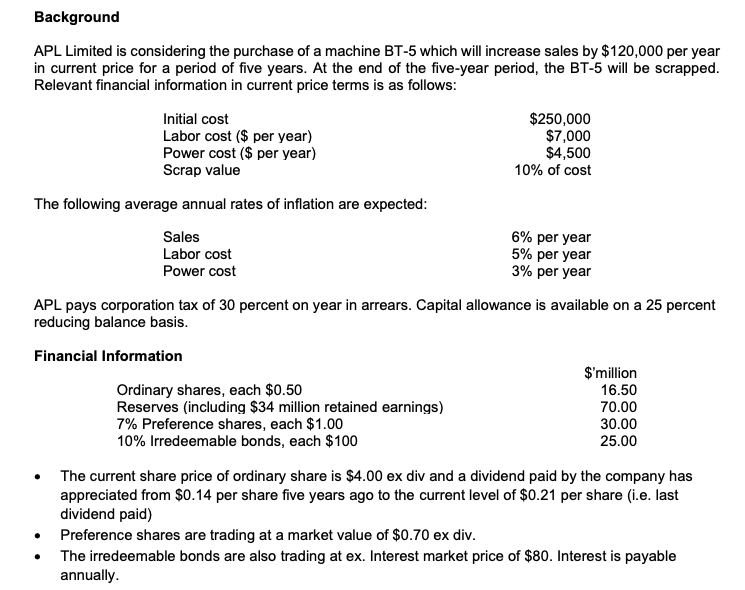

Background APL Limited is considering the purchase of a machine BT-5 which will increase sales by $120,000 per year in current price for a period of five years. At the end of the five-year period, the BT- 5 will be scrapped. Relevant financial information in current price terms is as follows: The following average annual rates of inflation are expected: Sales Labor cost Power cost 6% per year 5% per year 3% per year APL pays corporation tax of 30 percent on year in arrears. Capital allowance is available on a 25 percent reducing balance basis. Financial Information Ordinary shares, each $0.50 Reserves (including $34 million retained earnings) 7% Preference shares, each $1.00 10% Irredeemable bonds, each $100 - The current share price of ordinary share is $4.00 ex div and a dividend paid by the company has appreciated from $0.14 per share five years ago to the current level of $0.21 per share (i.e. last dividend paid) - Preference shares are trading at a market value of $0.70 ex div. - The irredeemable bonds are also trading at ex. Interest market price of $80. Interest is payable annually. Background APL Limited is considering the purchase of a machine BT-5 which will increase sales by $120,000 per year in current price for a period of five years. At the end of the five-year period, the BT- 5 will be scrapped. Relevant financial information in current price terms is as follows: The following average annual rates of inflation are expected: Sales Labor cost Power cost 6% per year 5% per year 3% per year APL pays corporation tax of 30 percent on year in arrears. Capital allowance is available on a 25 percent reducing balance basis. Financial Information Ordinary shares, each $0.50 Reserves (including $34 million retained earnings) 7% Preference shares, each $1.00 10% Irredeemable bonds, each $100 - The current share price of ordinary share is $4.00 ex div and a dividend paid by the company has appreciated from $0.14 per share five years ago to the current level of $0.21 per share (i.e. last dividend paid) - Preference shares are trading at a market value of $0.70 ex div. - The irredeemable bonds are also trading at ex. Interest market price of $80. Interest is payable annually

Background APL Limited is considering the purchase of a machine BT-5 which will increase sales by $120,000 per year in current price for a period of five years. At the end of the five-year period, the BT- 5 will be scrapped. Relevant financial information in current price terms is as follows: The following average annual rates of inflation are expected: Sales Labor cost Power cost 6% per year 5% per year 3% per year APL pays corporation tax of 30 percent on year in arrears. Capital allowance is available on a 25 percent reducing balance basis. Financial Information Ordinary shares, each $0.50 Reserves (including $34 million retained earnings) 7% Preference shares, each $1.00 10% Irredeemable bonds, each $100 - The current share price of ordinary share is $4.00 ex div and a dividend paid by the company has appreciated from $0.14 per share five years ago to the current level of $0.21 per share (i.e. last dividend paid) - Preference shares are trading at a market value of $0.70 ex div. - The irredeemable bonds are also trading at ex. Interest market price of $80. Interest is payable annually. Background APL Limited is considering the purchase of a machine BT-5 which will increase sales by $120,000 per year in current price for a period of five years. At the end of the five-year period, the BT- 5 will be scrapped. Relevant financial information in current price terms is as follows: The following average annual rates of inflation are expected: Sales Labor cost Power cost 6% per year 5% per year 3% per year APL pays corporation tax of 30 percent on year in arrears. Capital allowance is available on a 25 percent reducing balance basis. Financial Information Ordinary shares, each $0.50 Reserves (including $34 million retained earnings) 7% Preference shares, each $1.00 10% Irredeemable bonds, each $100 - The current share price of ordinary share is $4.00 ex div and a dividend paid by the company has appreciated from $0.14 per share five years ago to the current level of $0.21 per share (i.e. last dividend paid) - Preference shares are trading at a market value of $0.70 ex div. - The irredeemable bonds are also trading at ex. Interest market price of $80. Interest is payable annually Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started