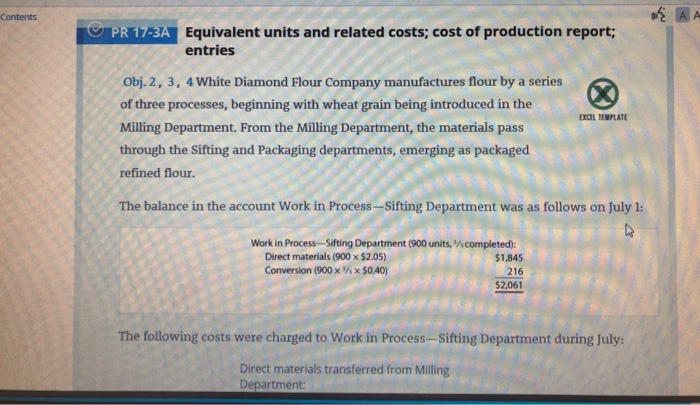

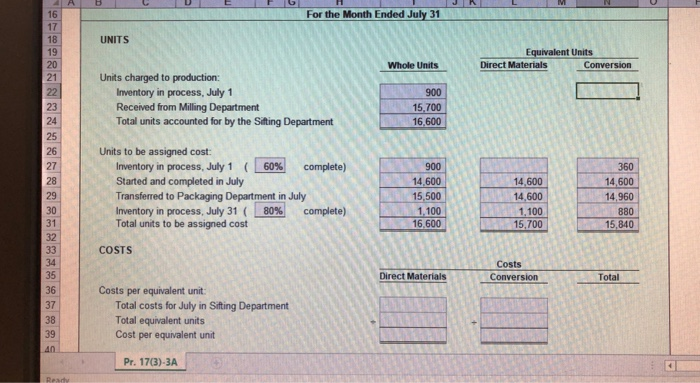

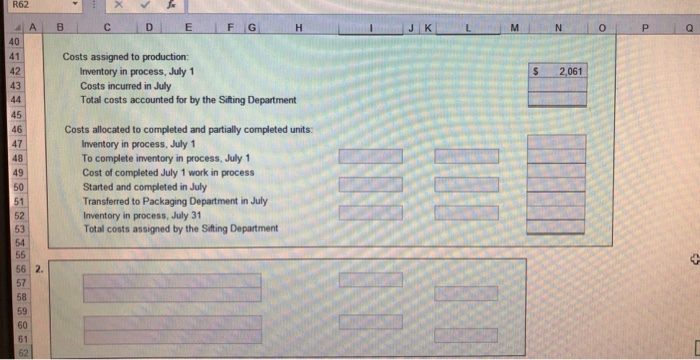

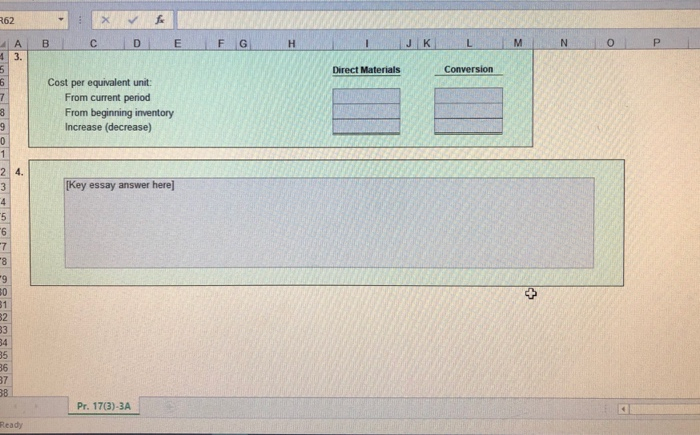

Contents PR17-3A Equivalent units and related costs; cost of production report entries Obj. 2, 3, 4 White Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour. EXCEL TEMPLATE The balance in the account Work in Process-Sifting Department was as follows on July 1: Work in Process-Sifting Department (900 units, /scompleted) Direct materials (900 x $2.05) Conversion (900x $0.40) $1,845 216 $2,061 The following costs were charged to Work in Process-Sifting Department during July: Direct materials transferred from Milling Department The following costs were charged to Work in Process-Sifting Department during july Direct materials transferred from Milling Department 15,700 units at $2.15 a unit Direct labor Factory overhead $33,755 4,420 2,708 During July, 15,500 units of flour were completed. Work in Process-Sifting Department on July 31 was 1,100 units, completed. Instructions 1. Prepare a cost of production report for the Sifting Department for July. 2. Journalize the entries for costs transferred from Milling to Sifting and the costs transferred from Sifting to Packaging. Answer d Check Figure: Transferred to Packaging Dept., $40,183 16 17 For the Month Ended July 31 UNITS 19 20 21 Equivalent Units Whole Units Direct Materials Units charged to production: Inventory in process, July 1 Received from Milling Department Total units accounted for by the Siting Department 900 15,700 16,600 25 26 27 28 29 30 31 32 Units to be assigned cost: Inventory in process, July 1 ( 60%) complete) Started and completed in July Transferred to Packaging Department in July Inventory in process, July 31 ( 1 80% complete) Total units to be assigned cost 900 14,600 15,500 1.100 16,600 14,600 14,600 1,100 15,700 360 14,600 14,960 880 15,840 COSTS 35 36 37 38 Direct Materials Conversion Total Costs per equivalent unit Total costs for July in Sifting Department Total equivalent units Cost per equivalent unit Pr. 17(3)-3A R62 JK 0 40 41 42 43 Costs assigned to production: Inventory in process, July 1 Costs incurred in July Total costs accounted for by the Sifting Department $ 2,061 45 46 47 48 49 Costs allocated to completed and partially completed units: Inventory in process, July 1 To complete inventory in process, July 1 Cost of completed July 1 work in process Started and completed in July Transferred to Packaging Department in July Inventory in process, July 31 Total costs assigned by the Sifting Department 53 54 56 2 57 61 R62 AB 4 3. E F G 0 Direct Materials Cost per equivalent unit: From current period From beginning inventory Increase (decrease) 2 4. [Key essay answer herej Pr, 17(3)-3A Ready