context:

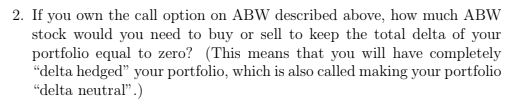

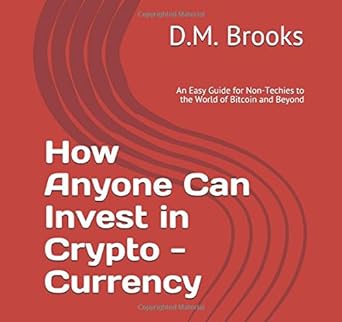

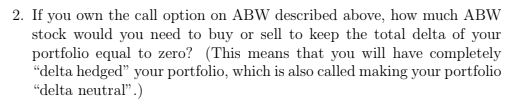

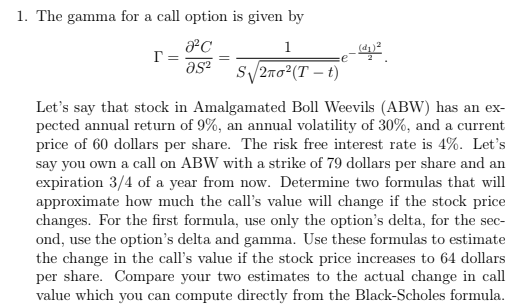

2. If you own the call option on ABW described above, how much ABW stock would you need to buy portfolio equal to zero? (This means that you will have completely "delta hedged" your portfolio, which is also called making your portfolio "delta neutral" .) sell to keep the total delta of your or 1. The gamma for a call option is given by S/2To2(T-t) Let's say that stock in Amalgamated Boll Weevils (ABW) has an ex- pected annual return of 9%, price of 60 dollars per share. The risk free interest rate is 4%. Let's say you own a call on ABW with a strike of 79 dollars per share and an expiration 3/4 of a year from now. Determine two formulas that will approximate how much the call's value will change if the stock price changes. For the first formula, use only the option's delta, for the ond the change in the call's value if the stock price increases to 64 dollars per share. Compare your two estimates to the actual change in call value which you can compute directly from the Black-Scholes formula annual volatility of 30%, and a current an 1 sec- the option's delta and gamma. Use these formulas to estimate use 2. If you own the call option on ABW described above, how much ABW stock would you need to buy portfolio equal to zero? (This means that you will have completely "delta hedged" your portfolio, which is also called making your portfolio "delta neutral" .) sell to keep the total delta of your or 1. The gamma for a call option is given by S/2To2(T-t) Let's say that stock in Amalgamated Boll Weevils (ABW) has an ex- pected annual return of 9%, price of 60 dollars per share. The risk free interest rate is 4%. Let's say you own a call on ABW with a strike of 79 dollars per share and an expiration 3/4 of a year from now. Determine two formulas that will approximate how much the call's value will change if the stock price changes. For the first formula, use only the option's delta, for the ond the change in the call's value if the stock price increases to 64 dollars per share. Compare your two estimates to the actual change in call value which you can compute directly from the Black-Scholes formula annual volatility of 30%, and a current an 1 sec- the option's delta and gamma. Use these formulas to estimate use