Question

Context: It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmarts consolidated

Context: It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmarts consolidated financial statements for the fiscal year ending January 31, 2016 (found online at the text website or available for download in the investor relations section of Walmarts website), provides information on future operating lease commitments.

Questions:

a. Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of each year

Information for problem a: Walmart has long-term leases for stores and equipment. Rentals (including amounts applicable to taxes, insurance, maintenance, other operating expenses and contingent rentals) under operating leases and other short-term rental arrangements were $2.5 billion in fiscal 2016 and $2.8 billion in both fiscal 2015 and 2014. Aggregate minimum annual rentals at January 31, 2016, under non-cancelable leases are as follows:

| (Amounts In Millions) Fiscal Year | Operating Leases | Capital Lease & Financial Obligation |

| 2017 | $2,057 | $815 |

| 2018 | 1,989 | 758 |

| 2019 | 1,794 | 710 |

| 2020 | 1,697 | 655 |

| 2021 | 1,530 | 624 |

| Thereafter | 12,438 | 5,093 |

| Total minimum rentals | $21,505 | $8,655 |

| Less estimated executory costs | 39 | |

| Net minimum lease payments | 8,616 | |

| Noncash gain on future termination of financing obligation | 1,070 | |

| Less imputed interest | (3,319) | |

| Present Value of minimum lease payments | $6,367 |

Certain of the Companys leases provide for the payment of contingent rentals based on a percentage of sales. Such contingent rentals were not material for fiscal 2016, 2015 and 2014. Substantially all of the Companys store leases have renewal options, some of which may trigger an escalation in rentals. The Company has future lease commitments for land and buildings for approximately 215 future locations. These lease commitments have lease terms ranging from 10 to 30 years and provide for certain minimum rentals. If executed, payments under operating leases would increase by $34 million for fiscal 2017, based on current cost estimates. In connection with certain long-term debt issuances, the Company could be liable for early termination payments if certain unlikely events were to occur. At January 31, 2016, the aggregate termination payment would have been $44 million. The arrangement pursuant to which this payment could be made will expire in fiscal 2019.

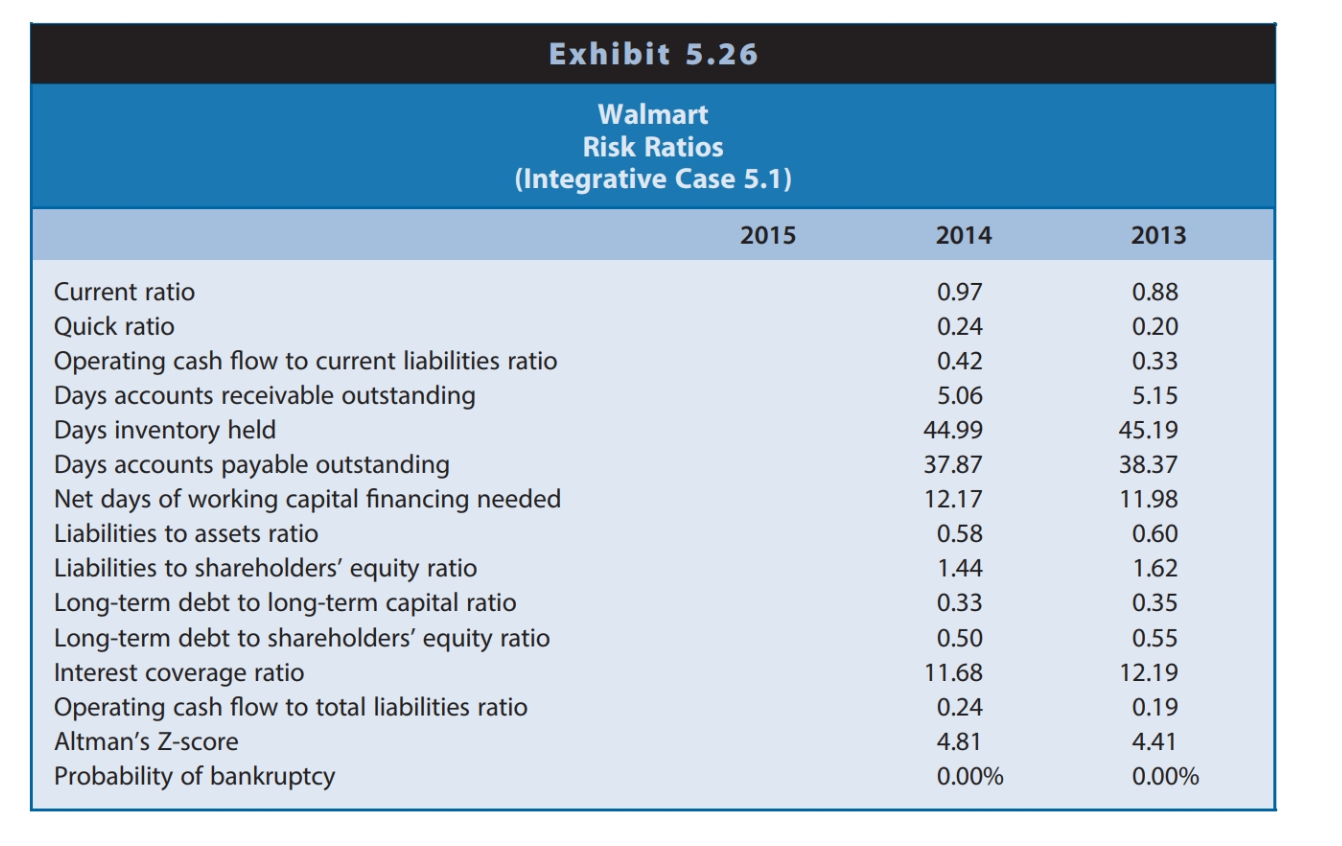

b. Recompute the long-term debt to long-term capital ratio (see Chapter 5) using your capitalized operating leases above. Comment on the results.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started