Answered step by step

Verified Expert Solution

Question

1 Approved Answer

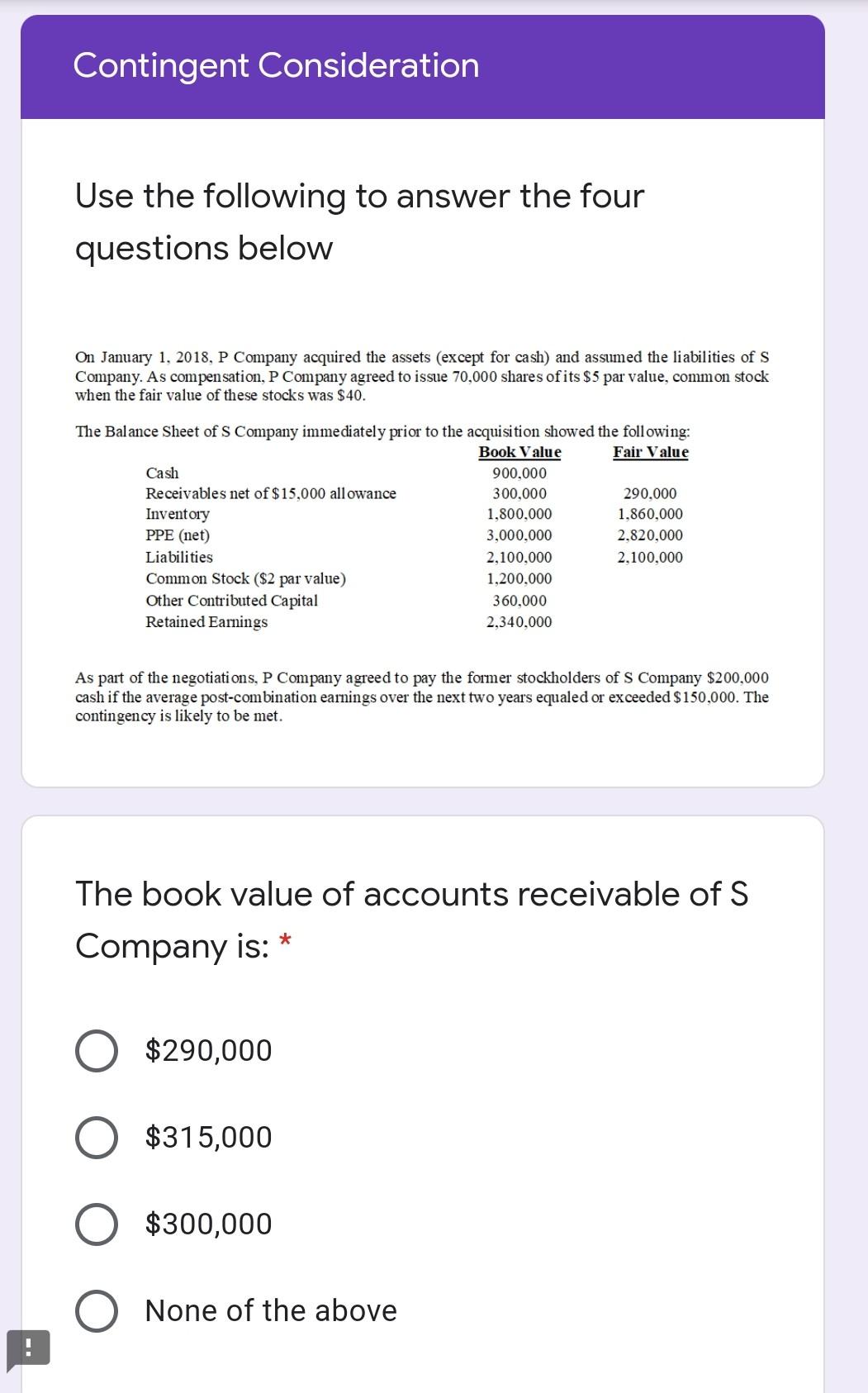

Contingent Consideration Use the following to answer the four questions below On January 1, 2018, P Company acquired the assets (except for cash) and assumed

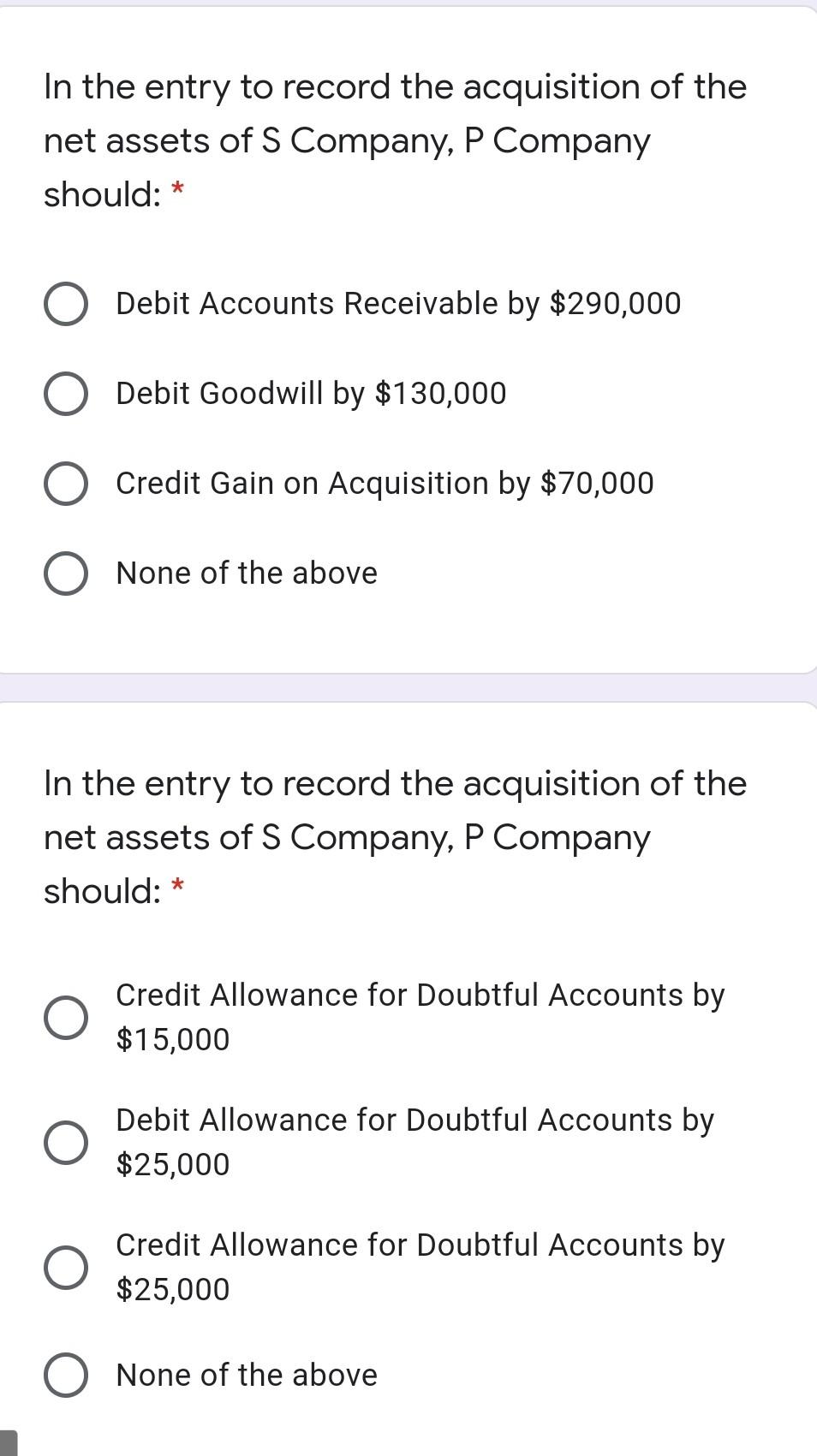

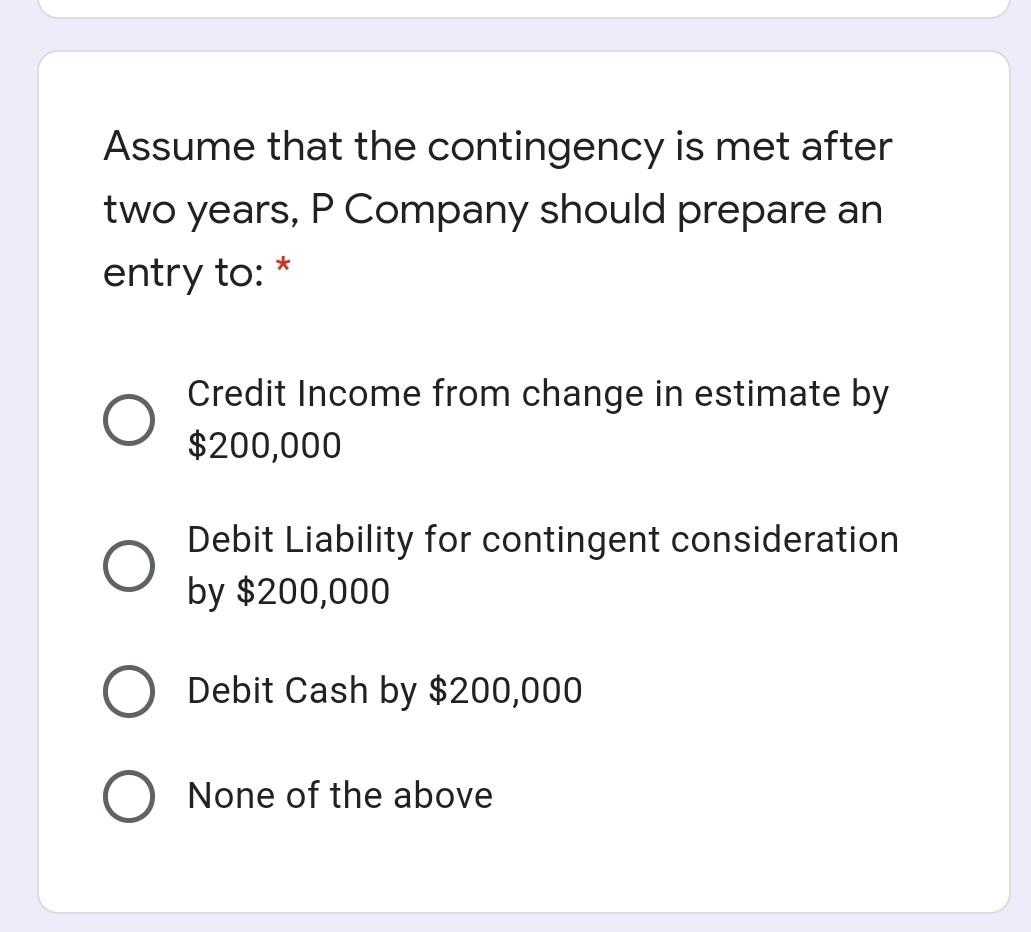

Contingent Consideration Use the following to answer the four questions below On January 1, 2018, P Company acquired the assets (except for cash) and assumed the liabilities of S Company. As compensation, P Company agreed to issue 70,000 shares of its $5 par value, common stock when the fair value of these stocks was $40. The Balance Sheet of S Company immediately prior to the acquisition showed the following: Book Value Fair Value Cash 900.000 Receivables net of $15,000 allowance 300,000 290.000 Inventory 1,800,000 1.860,000 PPE (net) 3,000,000 2.820,000 Liabilities 2,100,000 2.100,000 Common Stock ($2 par value) 1,200.000 Other Contributed Capital 360,000 Retained Earnings 2,340.000 As part of the negotiations, P Company agreed to pay the former stockholders of S Company $200,000 cash if the average post-combination earnings over the next two years equaled or exceeded $150,000. The contingency is likely to be met. The book value of accounts receivable of S Company is: * $290,000 $315,000 $300,000 None of the above In the entry to record the acquisition of the net assets of S Company, P Company should: * Debit Accounts Receivable by $290,000 Debit Goodwill by $130,000 Credit Gain on Acquisition by $70,000 None of the above In the entry to record the acquisition of the net assets of S Company, P Company should: * O Credit Allowance for Doubtful Accounts by $15,000 Debit Allowance for Doubtful Accounts by $25,000 Credit Allowance for Doubtful Accounts by $25,000 None of the above Assume that the contingency is met after two years, P Company should prepare an entry to: * Credit Income from change in estimate by $200,000 Debit Liability for contingent consideration by $200,000 Debit Cash by $200,000 None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started