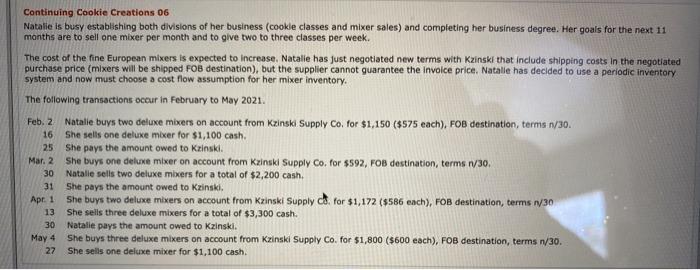

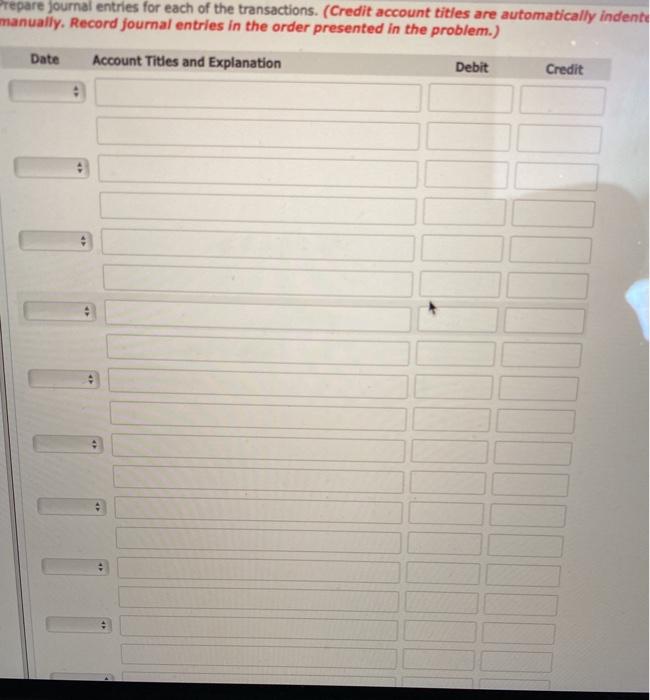

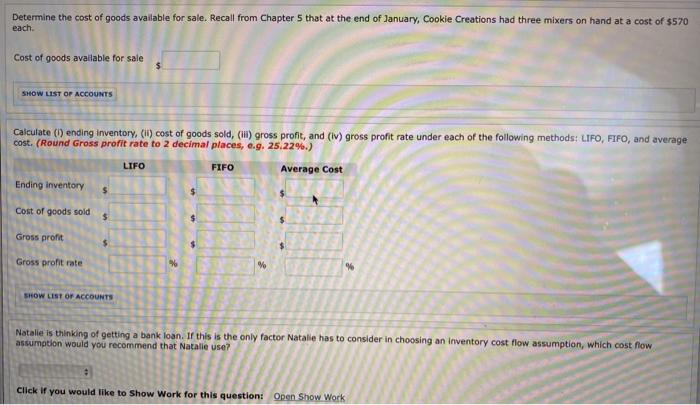

Continuing Cookie Creations 06 Natalie is busy establishing both divisions of her business (cookle classes and mixer sales) and completing her business degree. Her goals for the next 11 months are to sell one mixer per month and to give two to three classes per week. The cost of the fine European mixers is expected to increase. Natalie has just negotiated new terms with Kzinski that include shipping costs in the negotiated purchase price (mixers will be shipped FOB destination), but the supplier cannot guarantee the involce price, Natalie has decided to use a periodic inventory system and now must choose a cost flow assumption for her mixer inventory. The following transactions occur in February to May 2021. Feb. 2 Natalle buys two deluxe Mixers on account from Kzinski Supply Co, for $1,150 ($575 each), FOB destination, terms 1/30. 16 She sells one deluxe mixer for $1,100 cash. 25 She pays the amount owed to Kzinski. Mar. 2 She buys one deluxe mixer on account from Keinski Supply Co. for $592, FOB destination, terms 1/30 30 Natalie sells two deluxe mixers for a total of $2,200 cash. 31 She pays the amount owed to Kzinski. Apr. 1 She buys two deluxe mixers on account from Kzinski Supply Co. for $1,172 ($586 each), FOB destination, terms 1/30 13 She sells three deluxe mixers for a total of $3,300 cash. 30 Natalie pays the amount owed to Kzinski. May 4 She buys three deluxe mixers on account from Kzinski Supply Co. for $1,800 (5600 each), FOB destination, terms 1/30. 27 She sells one deluxe mixer for $1,100 cash. Prepare journal entries for each of the transactions. (Credit account tities are automatically indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit . Determine the cost of goods available for sale. Recall from Chapter 5 that at the end of January, Cookie Creations had three mixers on hand at a cost of $570 each. Cost of goods available for sale $ SHOW LIST OF ACCOUNTS Calculate (1) ending inventory, (ll) cost of goods sold, (1) gross profit, and (iv) gross profit rate under each of the following methods: LIFO, FIFO, and average cost. (Round Gross profit rate to 2 decimal places, e.g. 25,22%.) LIFO FIFO Average Cost Ending Inventory $ Cost of goods sold $ Gross profit $ Gross profit rate SHOW LIST OF ACCOUNTS Natalie is thinking of getting a bank loan. If this is the only factor Natalie has to consider in choosing an inventory cost flow assumption, which cost how assumption would you recommend that Natalie use? Click if you would like to Show Work for this question: Open Show Work