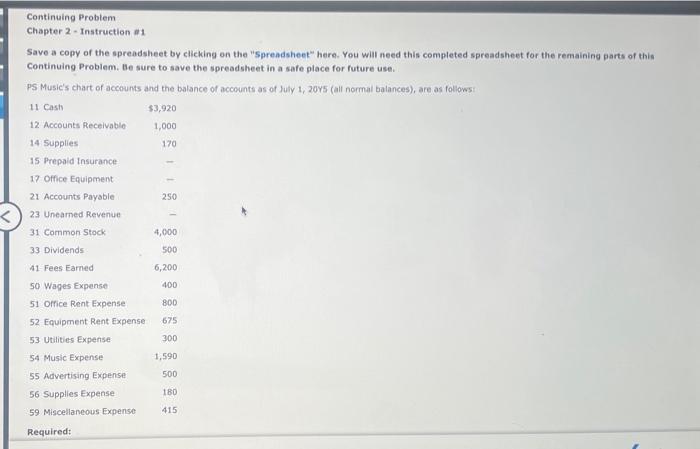

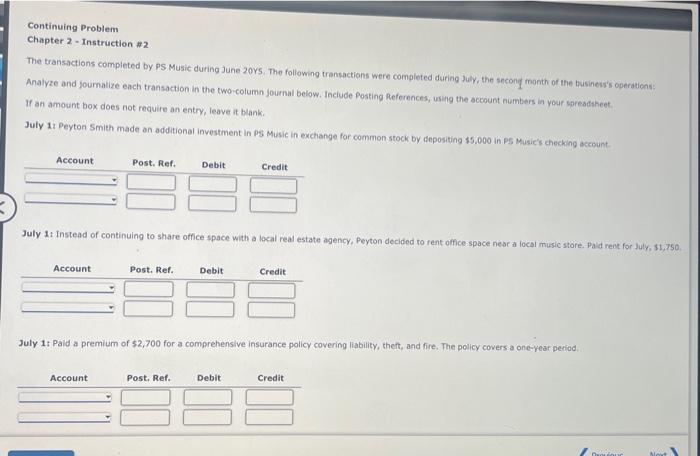

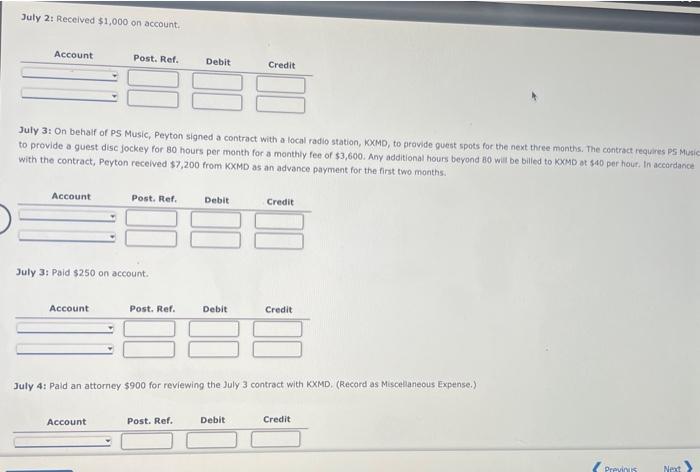

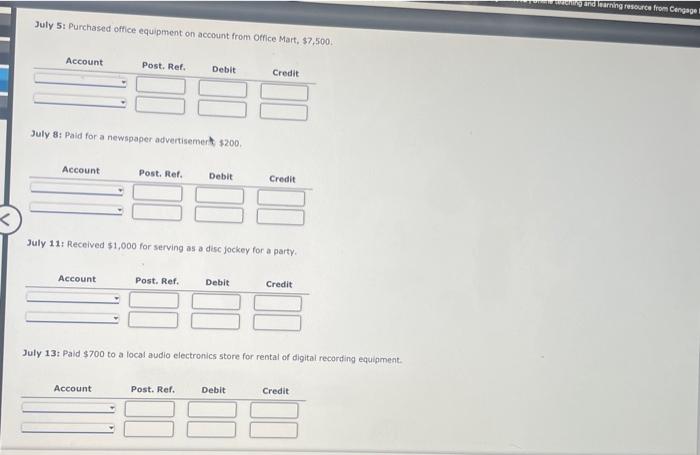

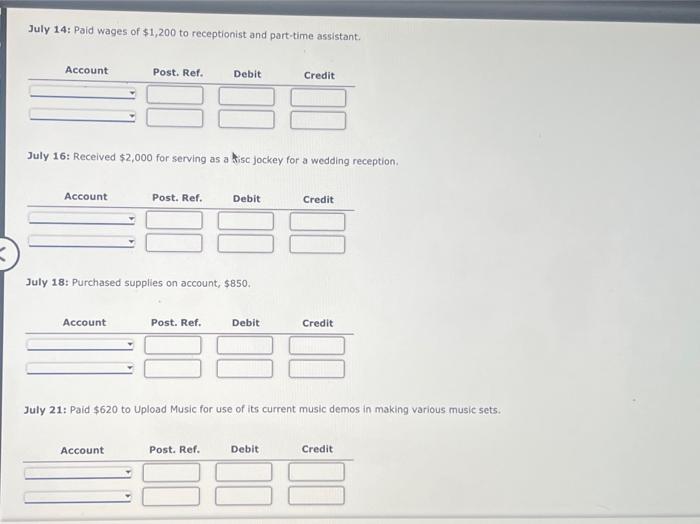

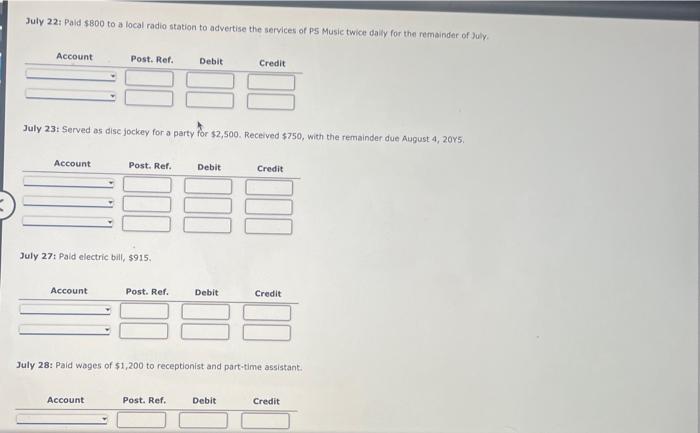

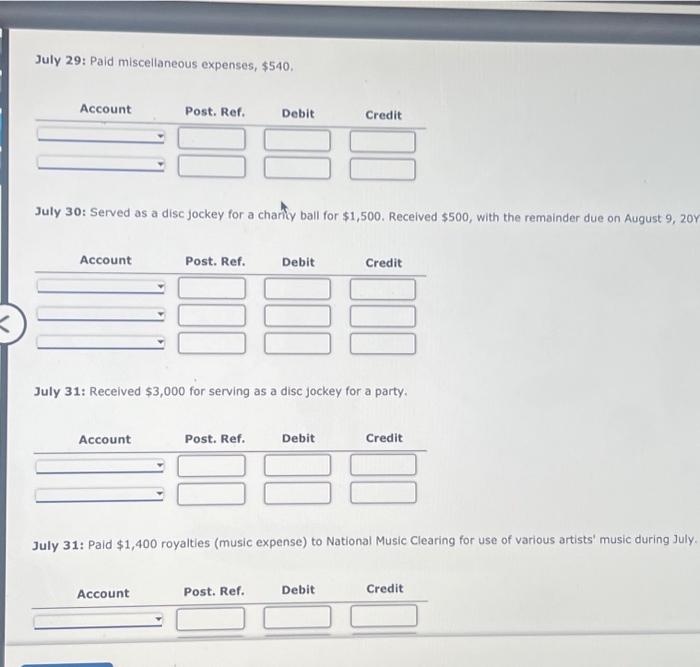

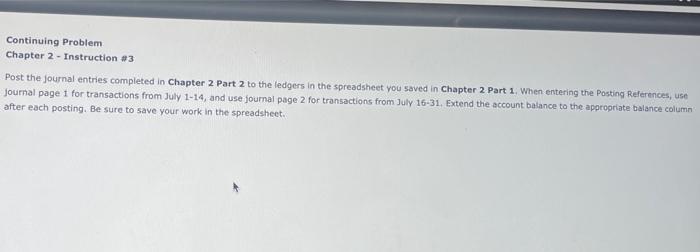

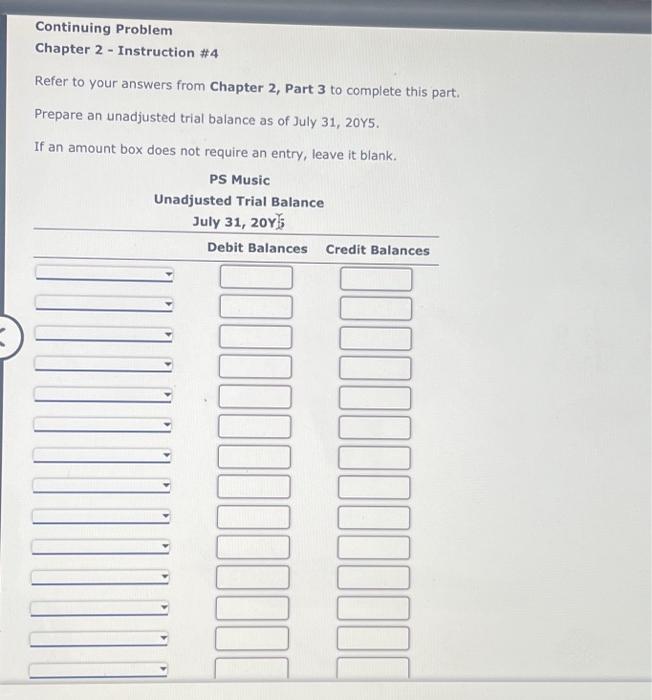

Continuing Problem. Chapter 2 - Instruction #3 Post the journal entries completed in Chapter 2 Part 2 to the ledgers in the spreadsheet you saved in Chapter 2 Part 1. When entering the Posting References, use Journal page 1 for transactions from July 1-14, and use journal page 2 for transactions from July 16-31, Extend the account balance to the appropriate balance column after each posting. Be sure to save your work in the spreadsheet. July 22: Pald $800 to a local radio station to advertise the services of ps Musie twice dalify for the remainder of July. July 23: Served as dise jockey for a party for $2,500. Received $750, with the remainder due August 4,205. July 27: Paid electric bill, $915. July 28: Paid wages of $1,200 to receptionist and part-time assistant. Continuing Problem Chapter 2 - Instruction \#4 Refer to your answers from Chapter 2, Part 3 to complete this part. Prepare an unadjusted trial balance as of July 31,20Y5. Continuing Problem Chapter 2 - Instruction \#2 The transactions completed by PS Music during June 20Y5. The following transactions were completed during July, the second month of the business's operations: Analyze and joumalize each transaction in the two-column journal below. Inciude Posting Reforences, using the account numbers in your spreadtheet. If an amount box does not require an entry, leave it blank. July 13 Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing 15.000 in p5 Musie's cheching account. July 1: Instead of continuing to share office space with a lecal real estate agency, Peyton decided to rent office space near a local music store. Pald rent for July, $1,75 July 1t Paid a premium of $2,700 for a comprehensive insurance policy covering liability, theft, and fire, The policy covers a one-year period. July 5: Purchased office equipment on account from Office Mart, $7,500. July 8: Paid for a newspaper advertisemert $200. July 11: Received $1,000 for serving as a disc jockey for a party. July 13: Paid $700 to a local audio electronics store for rental of digital recording equipment. July 14: Paid wages of $1,200 to receptionist and part-time assistant. July 16: Received $2,000 for serving as a kisc jockey for a wedding reception. July 18: Purchased supplies on account, $850, July 21: Paid $620 to Upload Music for use of its current music demos in making various music sets. July 29: Paid miscellaneous expenses, $540. July 30: Served as a disc jockey for a charity ball for $1,500. Received $500, with the remainder due on August 9,20 July 31: Received $3,000 for serving as a disc jockey for a party. July 31: Paid $1,400 royalties (music expense) to National Music Clearing for use of various artists' music during July Continuing Problem Chapter 2 - Instruction a1 Save a copy of the spreadsheet by clicking on the "Spreadsheet" here. You will need this completed spreadsheet for the remaining parts of this Continuing Problem. Be sure to save the spreadsheet in a safe place for future use. Ps Music's chart of accounts and the balance of accounts as of July 1,20Y5 (all normal balances), are as follows