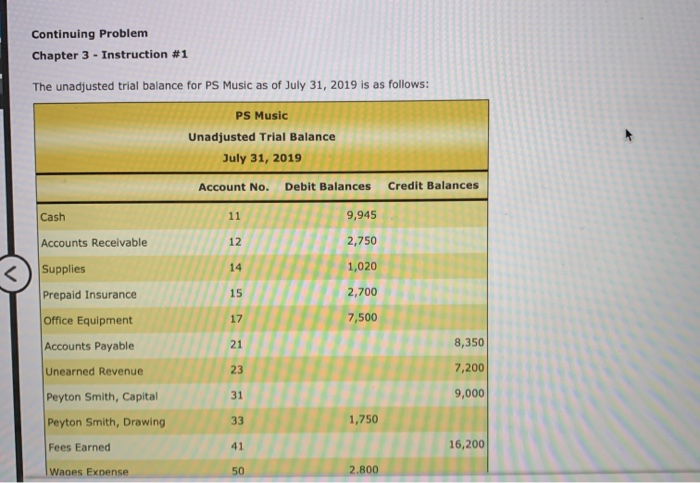

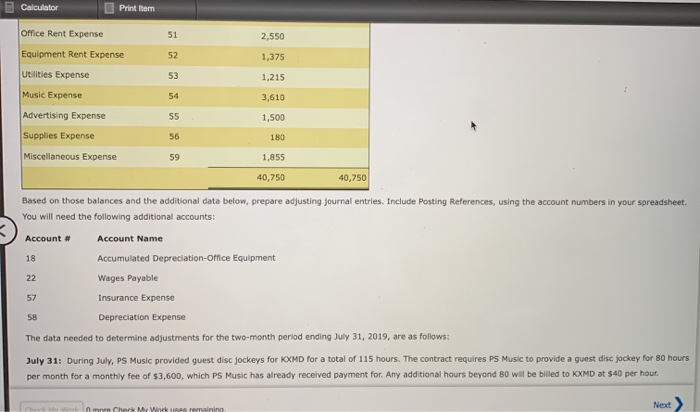

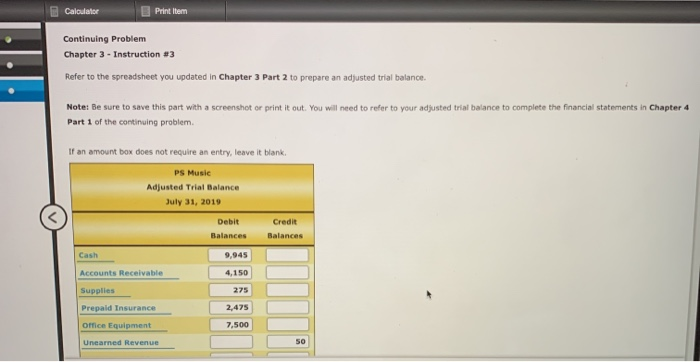

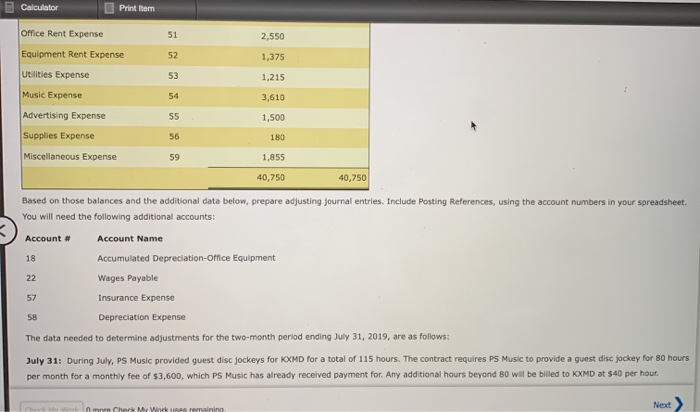

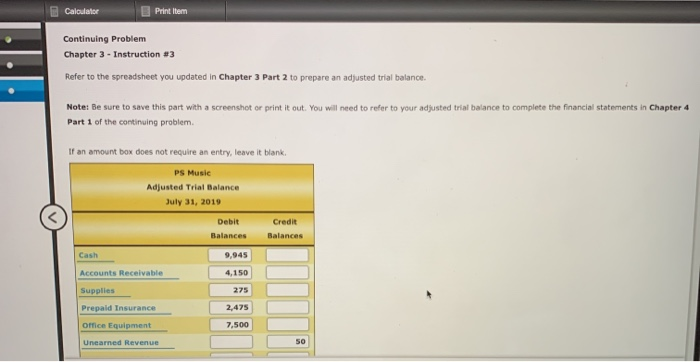

Continuing Problem Chapter 3 - Instruction #1 The unadjusted trial balance for PS Music as of July 31, 2019 is as follows: PS Music Unadjusted Trial Balance July 31, 2019 Debit Balances Credit Balances Account No. 9,945 Cash 11 Accounts Receivable 2,750 12 Supplies Prepaid Insurance 1,020 14 2,700 15 Office Equipment 7,500 17 8,350 Accounts Payable 21 7,200 Unearned Revenue 23 9,000 Peyton Smith, Capital 31 1,750 Peyton Smith, Drawing 33 16,200 Fees Earned 41 2.800 50 Wages Expense Calculator Print Item Office Rent Expense 51 2,550 Equipment Rent Expense 52 1,375 Utilities Expense 53 1,215 Music Expense 54 3,610 Advertising Expense 55 1,500 Supplies Expense 56 180 Miscellaneous Expense 1,855 59 40,750 40,750 Based on those balances and the additional data below, prepare adjusting journal entries. Include Posting References, using the account numbers in your spreadsheet. You will need the following additional accounts: Account # Account Name Accumulated Depreciation-Office Equipment 18 22 Wages Payable Insurance Expense 57 58 Depreciation Expense The data needed to determine adjustments for the two-month period ending July 31, 2019, are as follows: July 31: During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of $3,600, which PS Music has already received payment for. Any additional hours beyond 80 will be billed to KXMD at $40 per hour. Next LOeck My W 0 more Check My Winrk uses remaining Calculator Print Item Continuing Problem Chapter 3 - Instruction #3 Refer to the spreadsheet you updated in Chapter 3 Part 2 to prepare an adjusted trial balance. Note: Be sure to save this part with a screenshot or print it out. You will need to refer to your adjusted trial balance to complete the financial statements in Chapter 4 Part 1 of the continuing problem. If an amount box does not require an entry, leave it blank. PS Music Adjusted Trial Balance July 31, 2019 Credit Debit Balances Balances Cash 9,945 Accounts Receivable 4,150 Supplies Prepaid Insurance 275 2,475 Office Equipment 7.500 50 Unearned Revenue Continuing Problem Chapter 3 - Instruction #1 The unadjusted trial balance for PS Music as of July 31, 2019 is as follows: PS Music Unadjusted Trial Balance July 31, 2019 Debit Balances Credit Balances Account No. 9,945 Cash 11 Accounts Receivable 2,750 12 Supplies Prepaid Insurance 1,020 14 2,700 15 Office Equipment 7,500 17 8,350 Accounts Payable 21 7,200 Unearned Revenue 23 9,000 Peyton Smith, Capital 31 1,750 Peyton Smith, Drawing 33 16,200 Fees Earned 41 2.800 50 Wages Expense Calculator Print Item Office Rent Expense 51 2,550 Equipment Rent Expense 52 1,375 Utilities Expense 53 1,215 Music Expense 54 3,610 Advertising Expense 55 1,500 Supplies Expense 56 180 Miscellaneous Expense 1,855 59 40,750 40,750 Based on those balances and the additional data below, prepare adjusting journal entries. Include Posting References, using the account numbers in your spreadsheet. You will need the following additional accounts: Account # Account Name Accumulated Depreciation-Office Equipment 18 22 Wages Payable Insurance Expense 57 58 Depreciation Expense The data needed to determine adjustments for the two-month period ending July 31, 2019, are as follows: July 31: During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of $3,600, which PS Music has already received payment for. Any additional hours beyond 80 will be billed to KXMD at $40 per hour. Next LOeck My W 0 more Check My Winrk uses remaining Calculator Print Item Continuing Problem Chapter 3 - Instruction #3 Refer to the spreadsheet you updated in Chapter 3 Part 2 to prepare an adjusted trial balance. Note: Be sure to save this part with a screenshot or print it out. You will need to refer to your adjusted trial balance to complete the financial statements in Chapter 4 Part 1 of the continuing problem. If an amount box does not require an entry, leave it blank. PS Music Adjusted Trial Balance July 31, 2019 Credit Debit Balances Balances Cash 9,945 Accounts Receivable 4,150 Supplies Prepaid Insurance 275 2,475 Office Equipment 7.500 50 Unearned Revenue