Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all one question, please show as much work as possible so that i may try to understand this question better. many thanks :)

This is all one question, please show as much work as possible so that i may try to understand this question better. many thanks :)

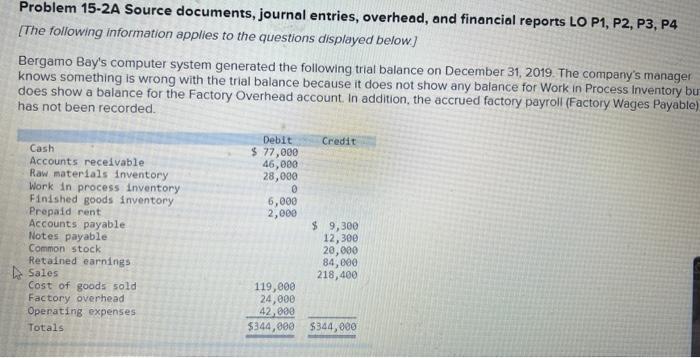

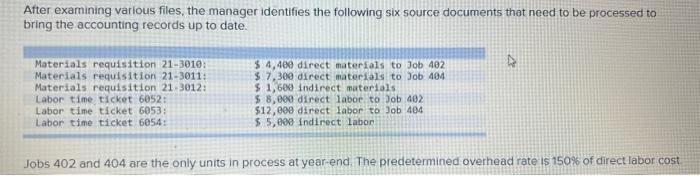

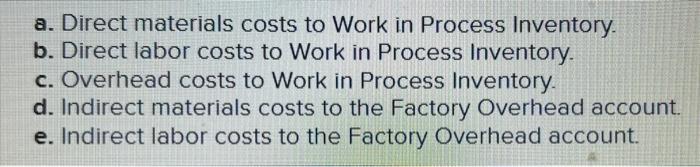

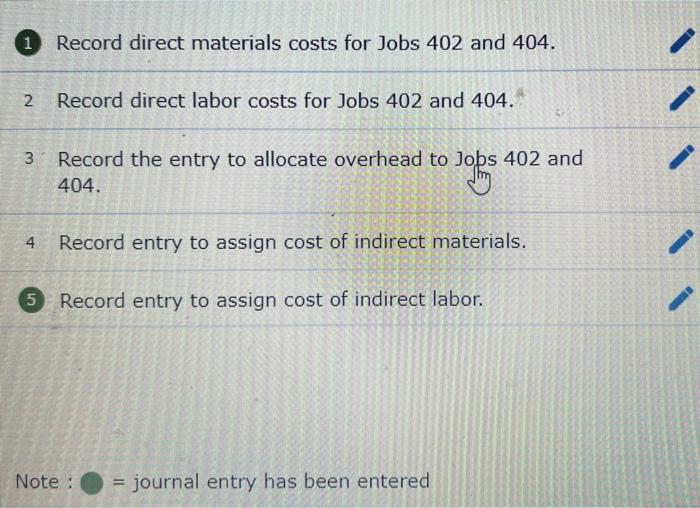

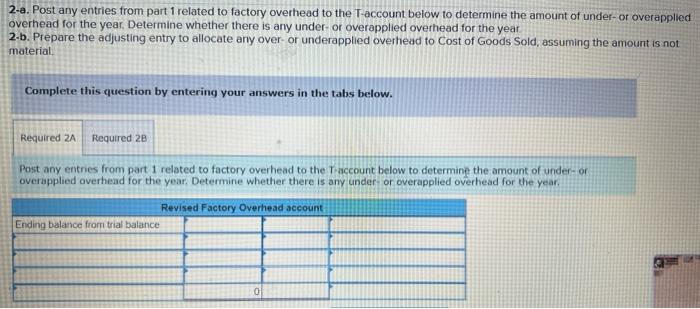

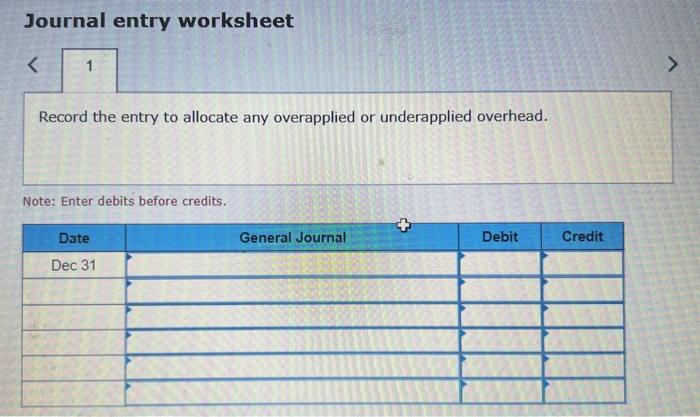

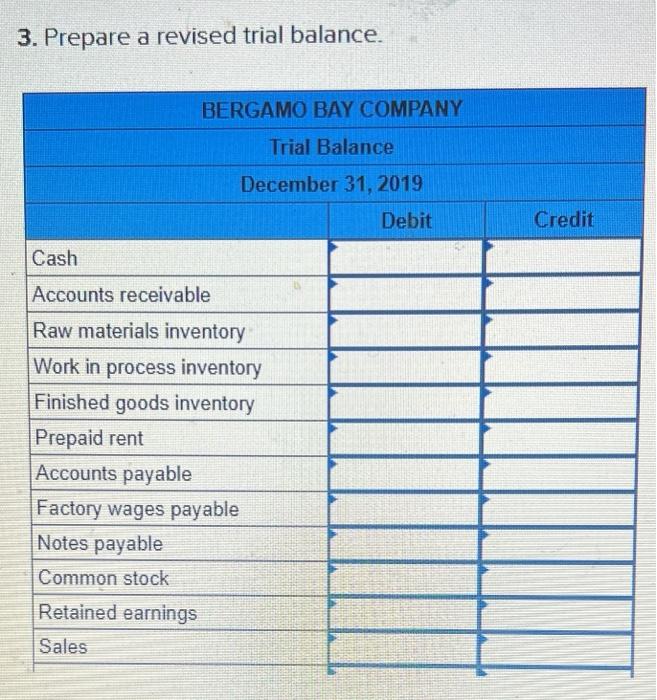

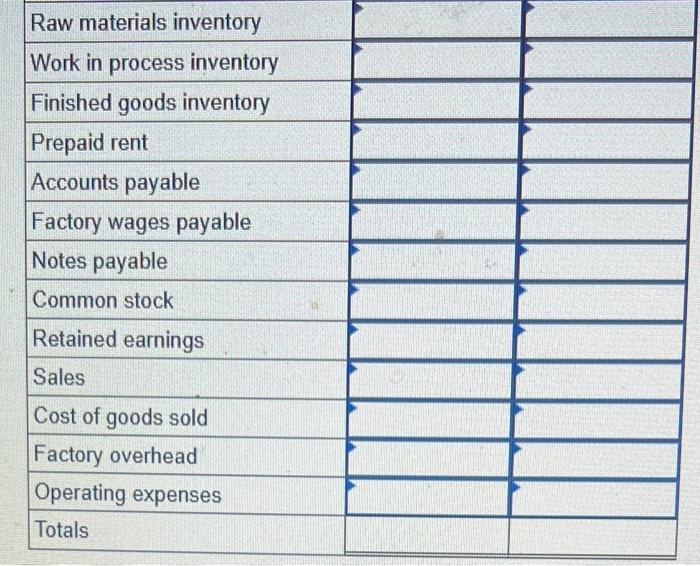

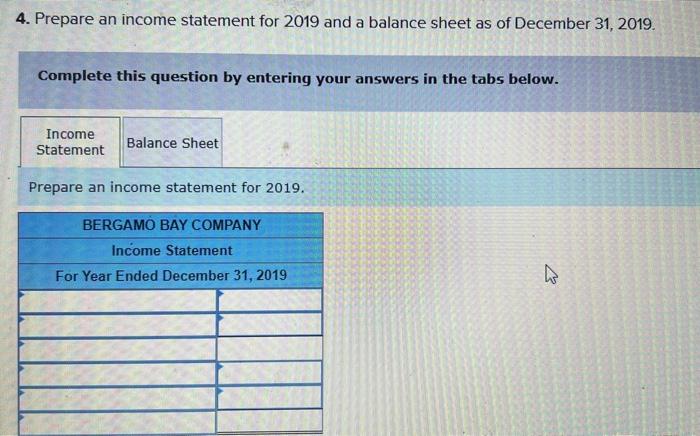

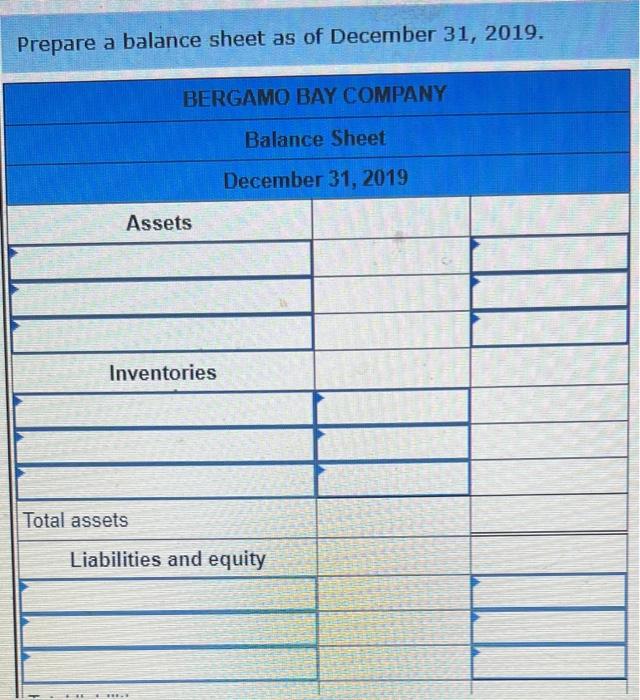

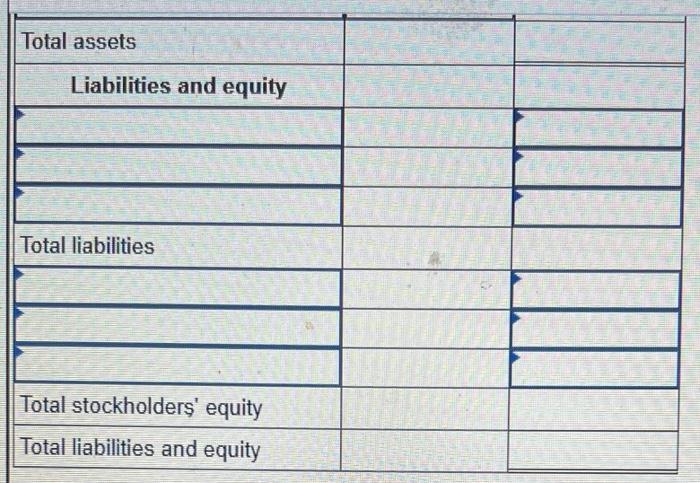

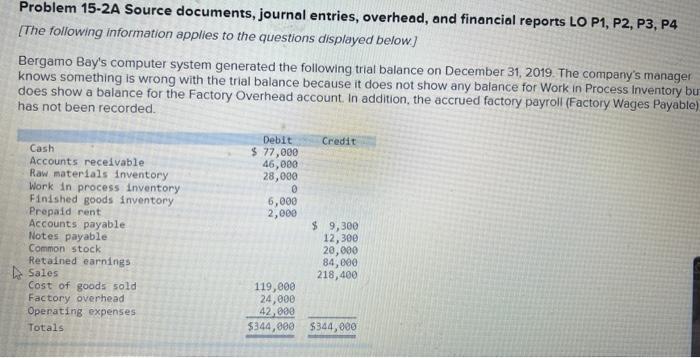

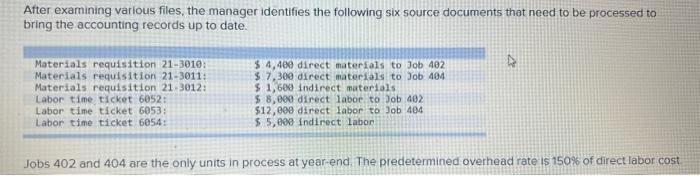

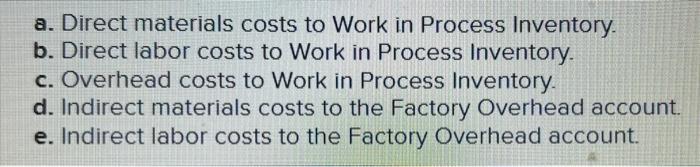

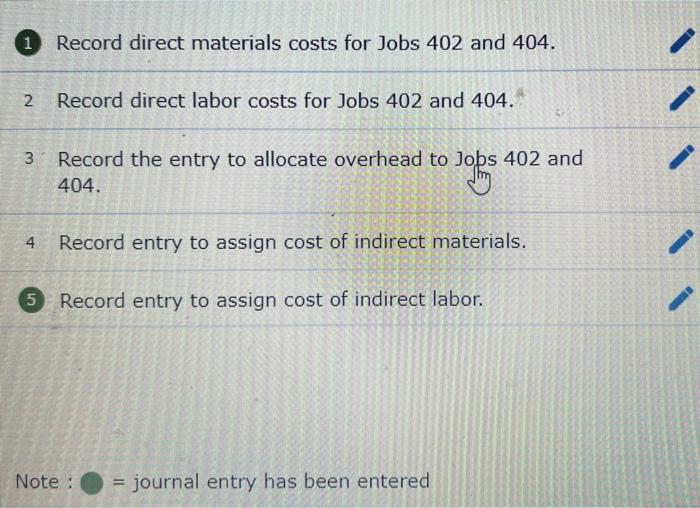

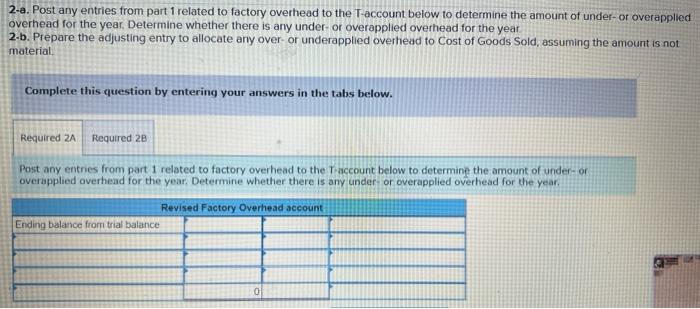

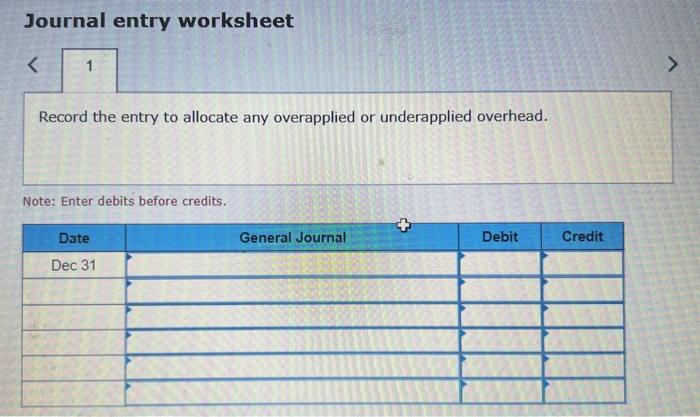

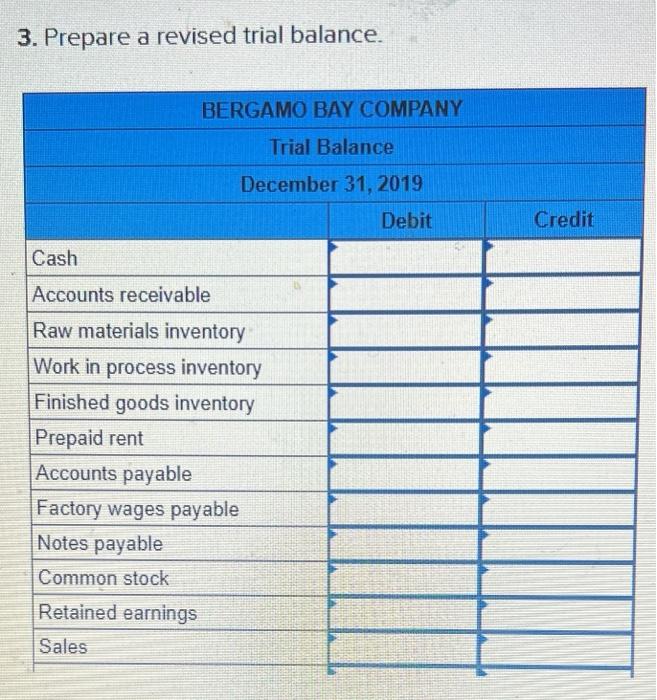

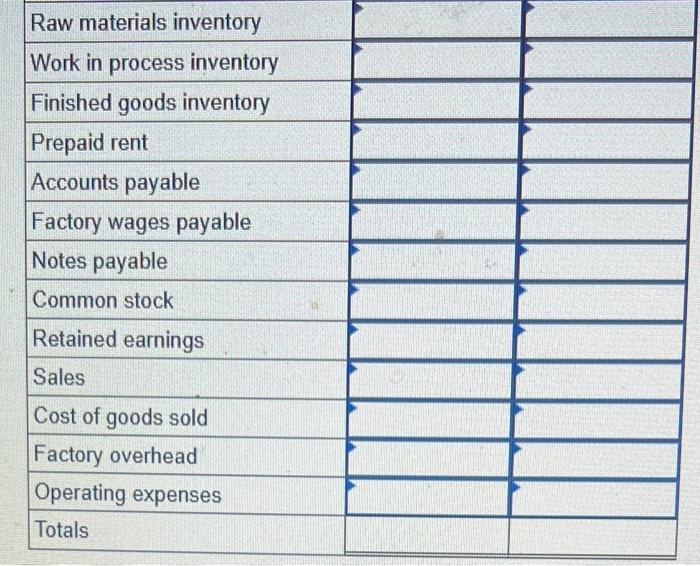

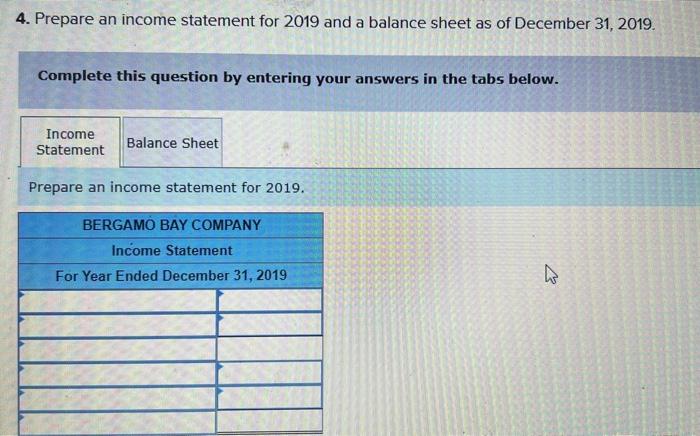

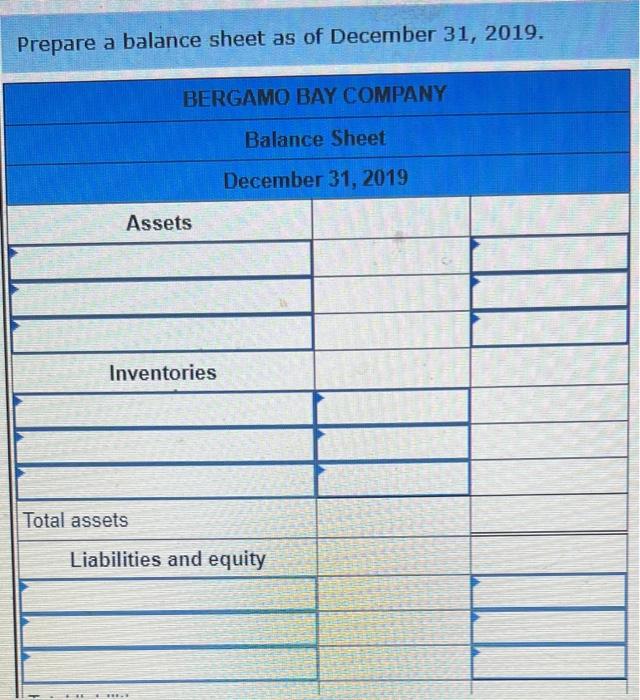

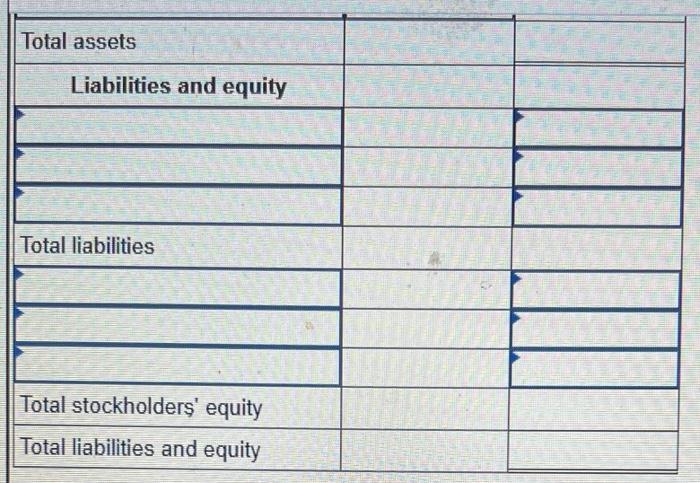

Problem 15-2A Source documents, journal entries, overhead, and financial reports LOP1, P2, P3, P4 [The following information applies to the questions displayed below. Bergamo Bay's computer system generated the following trial balance on December 31, 2019. The company's manager knows something is wrong with the trial balance because it does not show any balance for Work in Process inventory bu does show a balance for the Factory Overhead account. In addition, the accrued factory payroll (Factory Wages Payable) has not been recorded. After examining various files, the manager identifies the following six source documents that need to be processed to bring the accounting records up to date. Jobs 402 and 404 are the only units in process at year-end. The predetermined overhead rate is 150% of direct labor cos a. Direct materials costs to Work in Process Inventory. b. Direct labor costs to Work in Process Inventory. c. Overhead costs to Work in Process Inventory. d. Indirect materials costs to the Factory Overhead account. e. Indirect labor costs to the Factory Overhead account. Record direct materials costs for Jobs 402 and 404 . Record direct labor costs for Jobs 402 and 404. Record the entry to allocate overhead to Jobs 402 and 404. Record entry to assign cost of indirect materials. Record entry to assign cost of indirect labor. 2-a. Post any entries from part 1 related to factory overhead to the T-account below to determine the amount of under-or overappl overhead for the year. Determine whether there is ary under-or overapplied overhead for the year 2-b. Prepare the adjusting entry to allocate ary over-or underapplied overhead to Cost of Goods Sold, assuming the amount is no material. Complete this question by entering your answers in the tabs below. Post any entries from part 1 related to factory overhead to the T-raccount below to determine the amount of under-or overapplied averhead for the year. Determine whether there is any under or overapplied overhead for the year. Journal entry worksheet Record the entry to allocate any overapplied or underapplied overhead. Note: Enter debits before credits. 3. Prepare a revised trial balance. 4. Prepare an income statement for 2019 and a balance sheet as of December 31,2019. Complete this question by entering your answers in the tabs below. Prepare an income statement for 2019. Prepare a balance sheet as of December 31,2019. \begin{tabular}{|c|c|c|} \hline \multicolumn{2}{|c|}{ BERGAMO BAY COMPANY } \\ \hline Dalance Sheet & & \\ \hline Assets & & \\ \hline & & \\ \hline Inventories & & \\ \hline & & \\ \hline Total assets & & \\ \hline Liabilities and equity & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|} \hline Total assets & & \\ \hline \multicolumn{1}{|c|}{ Liabilities and equity } & & \\ \hline & & \\ \hline & & \\ \hline Total liabilities & & \\ \hline & & \\ \hline \hline & & \\ \hline \hline & & \\ \hline Total stockholders' equity & & \\ \hline Total liabilities and equity & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started