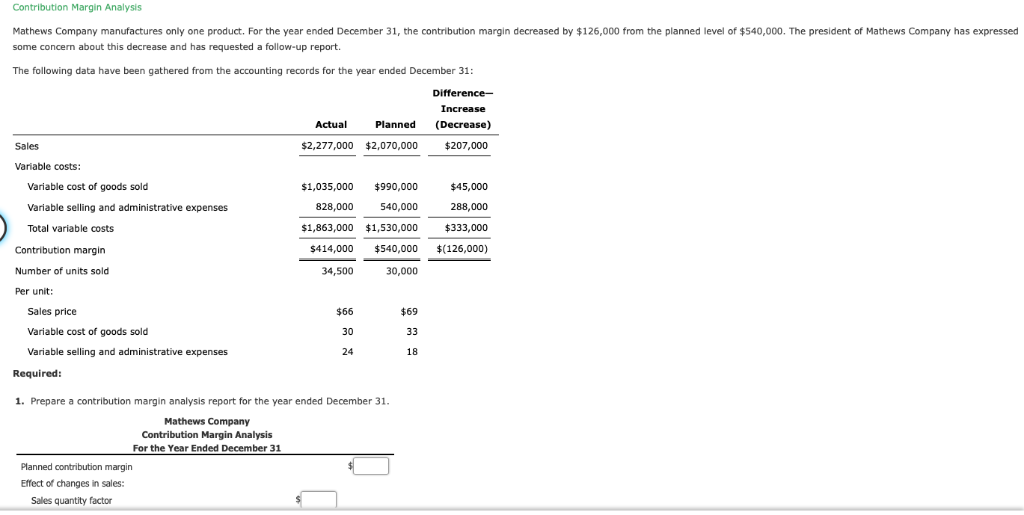

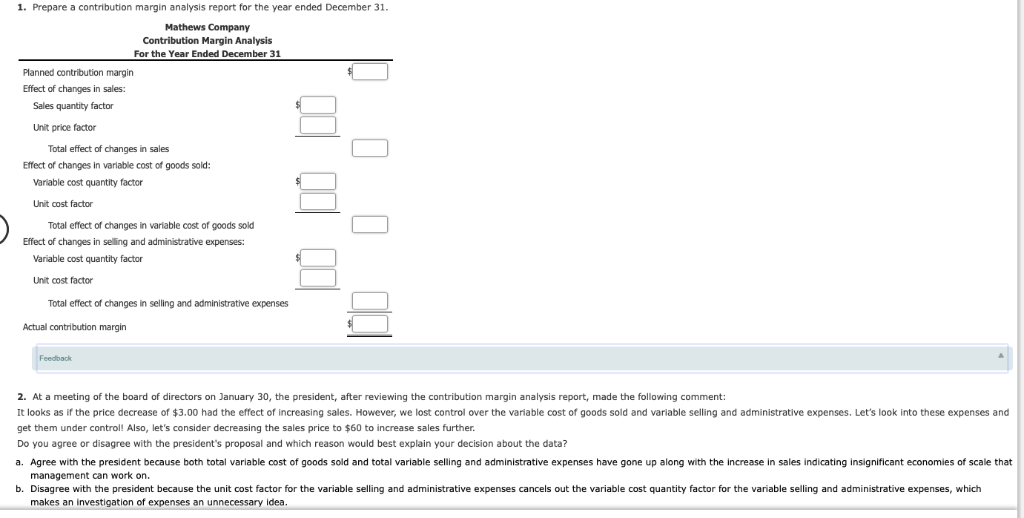

Contribution Margin Analysis Mathews Company manufactures only one product. For the year ended December 31, the contribution margin decreased by $126,000 from the planned level of $540,000. The president of Mathews Company has expressed some concern about this decrease and has requested a follow-up report. The following data have been gathered from the accounting records for the year ended December 31 Planned (Decrease) Actual Sales $2,277,000 $2,070,000 $207,000 Variable costs: Variable cost of goods sold Variable selling and administrative expenses Total variable costs $1,035,000 $990,000 $45,000 540,000 $1,863,000 $1,530,000 $333,000 $414,000 $540,000 $(126,000) 30,000 828,000 288,000 Contribution margin Number of units sold Per unit: 34,500 Sales price Variable cost of goods sold Variable selling and administrative expenses $66 $69 30 18 Required: 1. Prepare a contribution margin analysis report for the year ended December 31 Mathews Company Contribution Margin Analysis For the Year Ended December 31 Planned contribution margin Effect of changes in sales: Sales quantity factor 1. Prepare a contribution margin analysis report for the year ended December 31 Mathews Company Contribution Margin Analysis For the Year Ended December 31 Planned contribution margin Effect of changes in sales Sales quantity factor Unit price factor Total effect of changes in sales Effect of changes in variable cost of goods sold: Variable cost quantity factor Unit cost factor Total effect of changes in variable cost of goods sold Effect of changes in selling and administrative expenses: Variable cost quantity factor Unit cost factor Total effect of changes in selling and administrative expenses Actual contribution margin Feedback 2. At a meeting of the board of directors on January 30, the president, after reviewing the contribution margin analysis report, made the following comment: It looks as if the price decrease of $3.00 had the effect of increasing sales. However, we lost control over the variable cost of goods sold and variable selling and administrative expenses. Let's look into these expenses and get them under control! Also, let's consider decreasing the sales price to $60 to increase sales further. Do you agree or disagree with the president's proposal and which reason would best explain your decision about the data? a. Agree with the president because both total variable cost of goods sold and total variable selling and administrative expenses have gone up along with the increase in sales indicating insignificant economies of scale that management can work on. b. Disagree with the president because the unit cost factor for the variable selling and administrative expenses cancels out the variable cost quantity factor for the variable selling and administrative expenses, which makes an investigation of expenses an un idea