Answered step by step

Verified Expert Solution

Question

1 Approved Answer

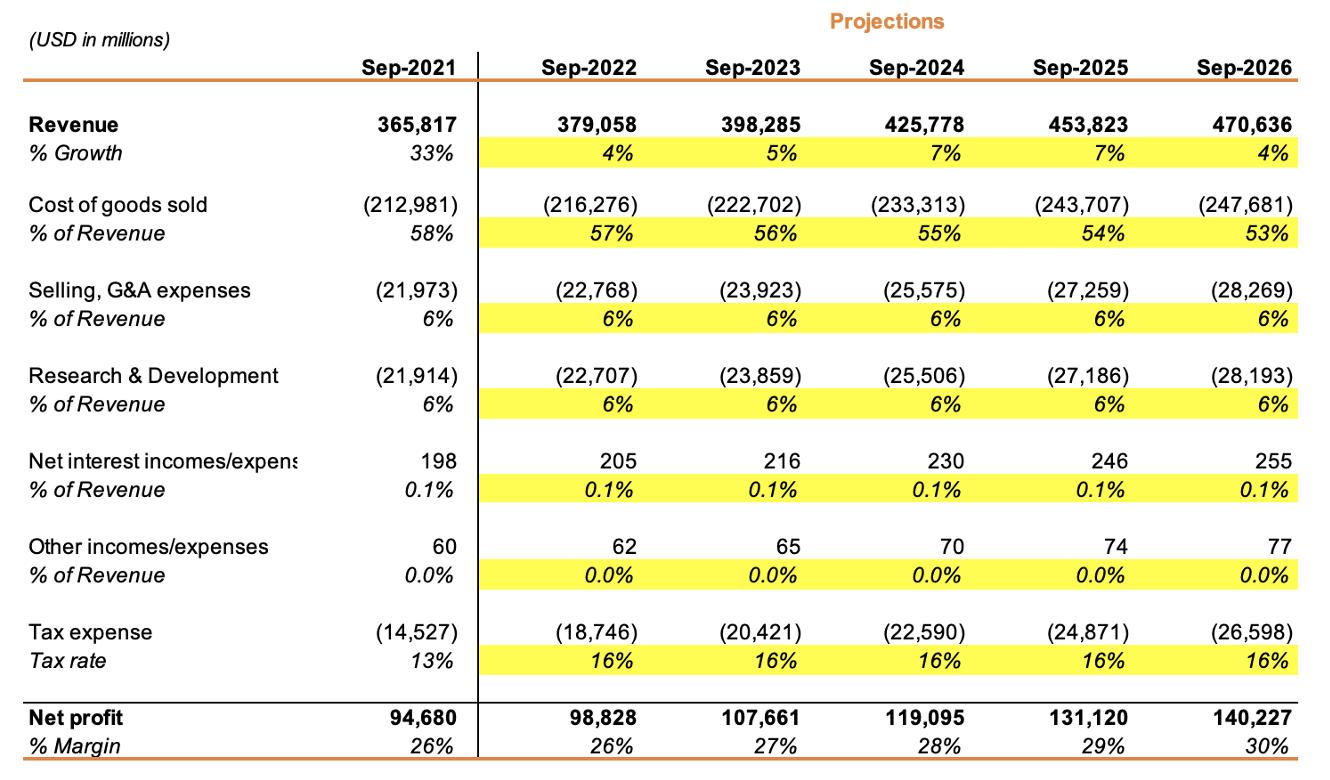

Convert net income into free cash flow (FCF) for the forecasted periods (2023, 2024, 2025, 2026). Elaborate a chart. (USD in millions) Revenue % Growth

Convert net income into free cash flow (FCF) for the forecasted periods (2023, 2024, 2025, 2026). Elaborate a chart.

(USD in millions) Revenue % Growth Cost of goods sold % of Revenue Selling, G&A expenses % of Revenue Research & Development % of Revenue Net interest incomes/expens % of Revenue Other incomes/expenses % of Revenue Tax expense Tax rate Net profit % Margin Sep-2021 365,817 33% (212,981) 58% (21,973) 6% (21,914) 6% 198 0.1% 60 0.0% (14,527) 13% 94,680 26% Sep-2022 379,058 4% (216,276) 57% (22,768) 6% (22,707) 6% 205 0.1% 62 0.0% (18,746) 16% 98,828 26% Sep-2023 398,285 5% (222,702) 56% (23,923) 6% (23,859) 6% 216 0.1% 65 0.0% (20,421) 16% 107,661 27% Projections Sep-2024 425,778 7% (233,313) 55% (25,575) 6% (25,506) 6% 230 0.1% 70 0.0% (22,590) 16% 119,095 28% Sep-2025 453,823 7% (243,707) 54% (27,259) 6% (27,186) 6% 246 0.1% 74 0.0% (24,871) 16% 131,120 29% Sep-2026 470,636 4% (247,681) 53% (28,269) 6% (28,193) 6% 255 0.1% 77 0.0% (26,598) 16% 140,227 30%

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

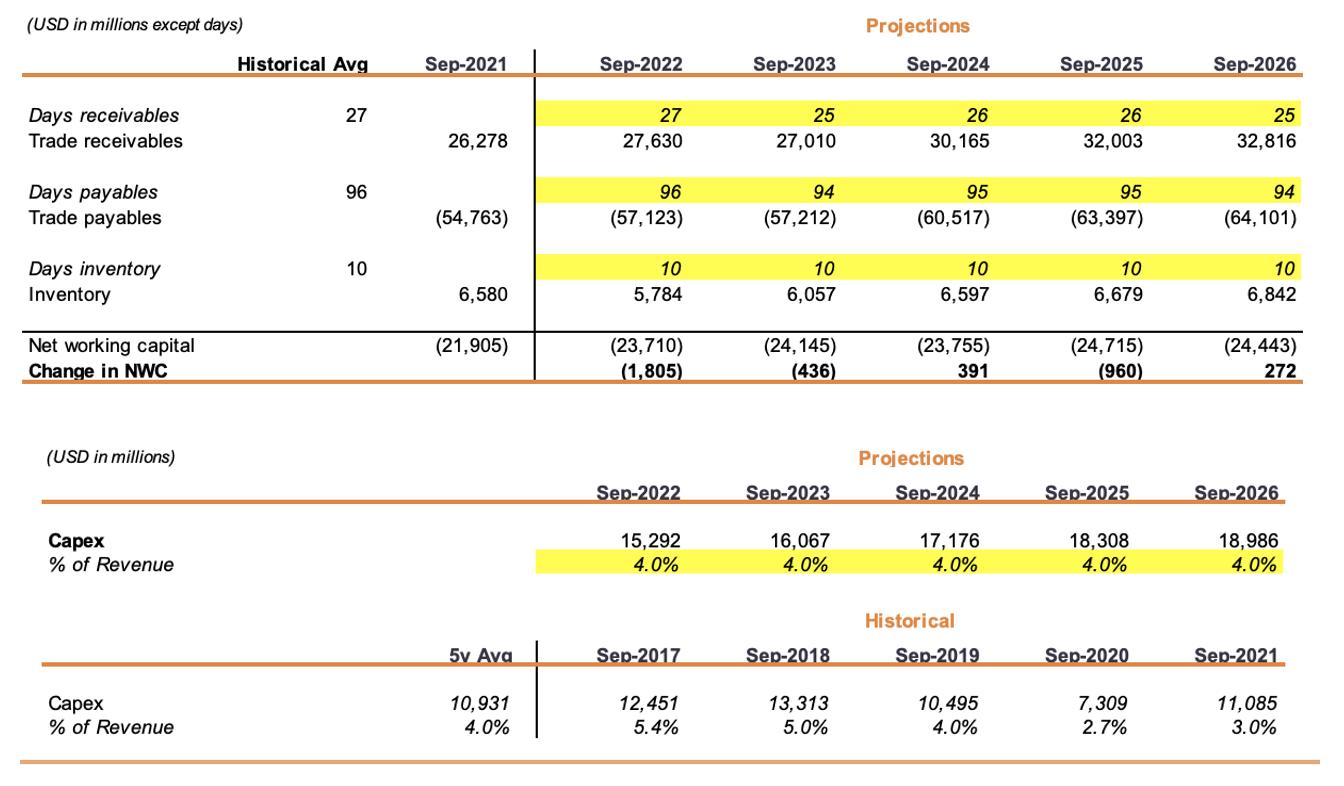

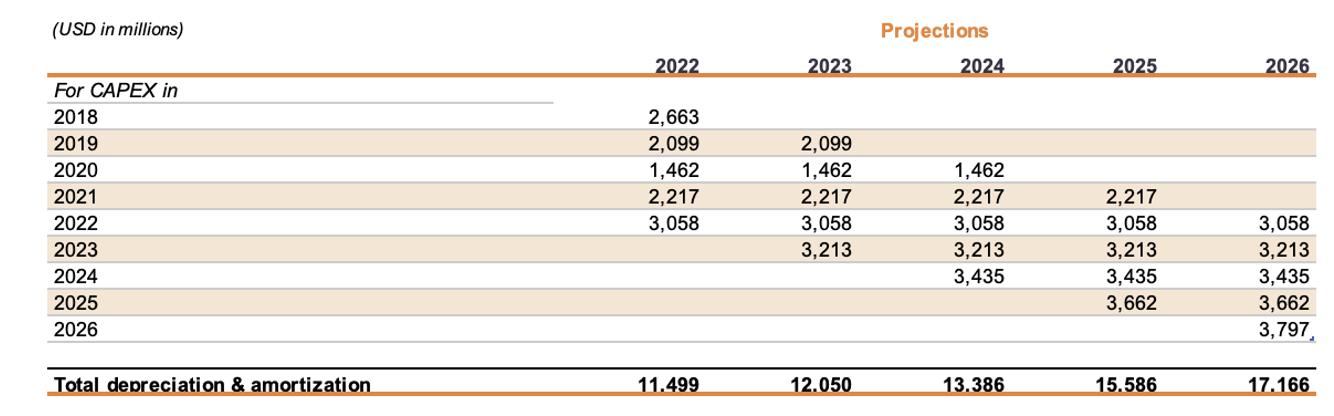

Free Cash Flow FCF Net Income Depreciation Amortization Capex Change in Net Working Capital NWC Here...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started