Question

Cookie Creations 4 (Part Level Submission) Need help with part B Cookie Creations is gearing up for the winter holiday season. During the month of

Cookie Creations 4 (Part Level Submission)

Need help with part B

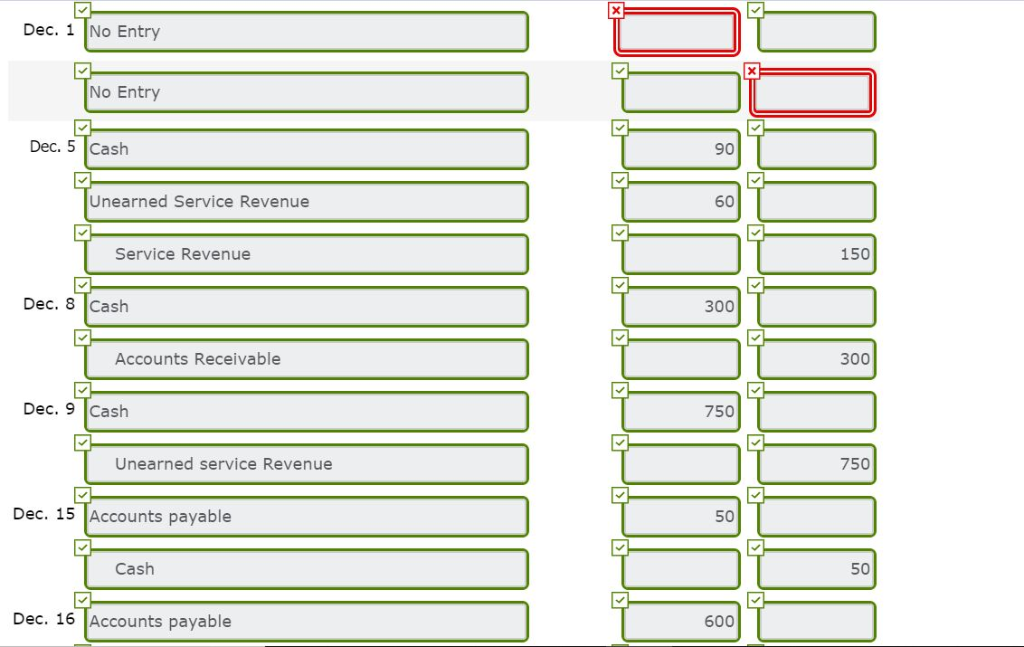

Cookie Creations is gearing up for the winter holiday season. During the month of December 2017, the following transactions occur.

| Dec. 1 | Natalie hires an assistant at an hourly wage of $8 to help with cookie making and some administrative duties. | |

| 5 | Natalie teaches the class that was booked on November 25. The balance outstanding is received. | |

| 8 | Cookie Creations receives a check for the amount due from the neighborhood school for the class given on November 30. | |

| 9 | Cookie Creations receives $750 in advance from the local school board for five classes that the company will give during December and January. | |

| 15 | Pays the cell phone invoice outstanding at November 30. | |

| 16 | Issues a check to Natalies brother for the amount owed for the design of the website. | |

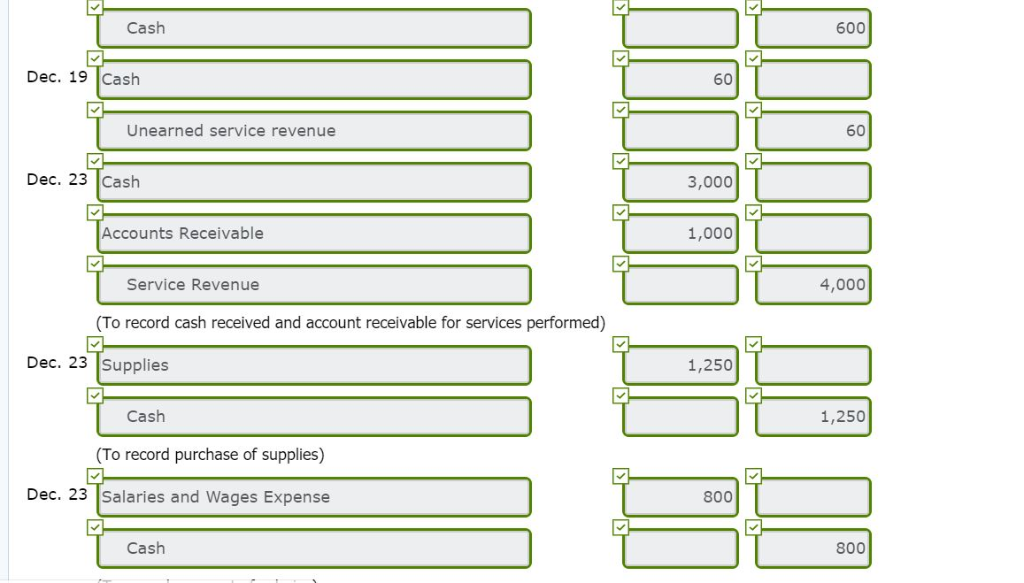

| 19 | Receives a deposit of $60 on a cookie class scheduled for early January. | |

| 23 | Additional revenue during the month for cookie-making classes amounts to $4,000. (Natalie has not had time to account for each class individually.) $3,000 in cash has been collected and $1,000 is still outstanding. (This is in addition to the December 5 and December 9 transactions.) | |

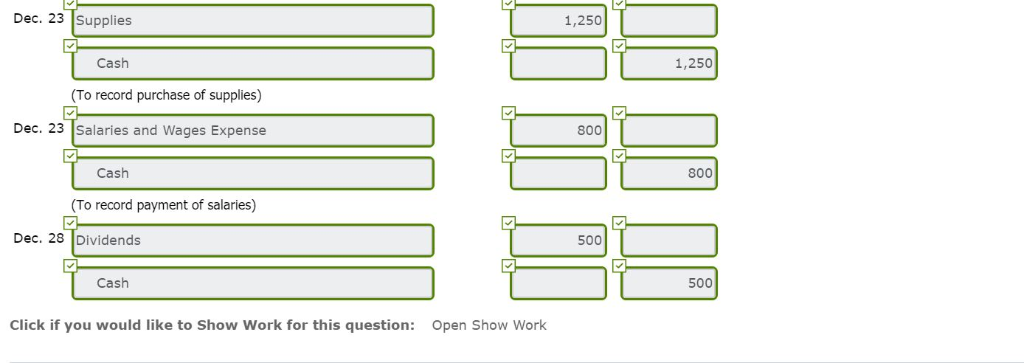

| 23 | Additional baking supplies purchased during the month for sugar, flour, and chocolate chips amount to $1,250 cash. | |

| 23 | Issues a check to Natalies assistant for $800. Her assistant worked approximately 100 hours from the time in which she was hired until December 23. | |

| 28 | Pays a dividend of $500 to the common shareholder (Natalie). |

As of December 31, Cookie Creations year-end, the following adjusting entry data are provided.

| 1. | A count reveals that $45 of brochures and posters were used. | |

| 2. | Depreciation is recorded on the baking equipment purchased in November. The baking equipment has a useful life of 5 years. Assume that 2 months worth of depreciation is required. | |

| 3. | Amortization (which is similar to depreciation) is recorded on the website. (Credit the Website account directly for the amount of the amortization.) The website is amortized over a useful life of 2 years and was available for use on December 1. | |

| 4. | Interest on the note payable is accrued. (Assume that 1.5 months of interest accrued during November and December. Interest rate is 9%.) | |

| 5. | One months worth of insurance has expired. | |

| 6. | Natalie is unexpectedly telephoned on December 28 to give a cookie class at the neighborhood community center on December 31. In early January Cookie Creations sends an invoice for $450 to the community center. | |

| 7. | A count reveals that $1,025 of baking supplies were used. | |

| 8. | A cell phone invoice is received for $75. The invoice is for services provided during the month of December and is due on January 15. | |

| 9. | Because the cookie-making class occurred unexpectedly on December 31 and is for such a large group of children, Natalies assistant helps out. Her assistant worked 7 hours at a rate of $8 per hour. | |

| 10. | An analysis of the unearned revenue account reveals that two of the five classes paid for by the local school board on December 9 still have not been taught by the end of December. The $60 deposit received on December 19 for another class also remains unearned. |

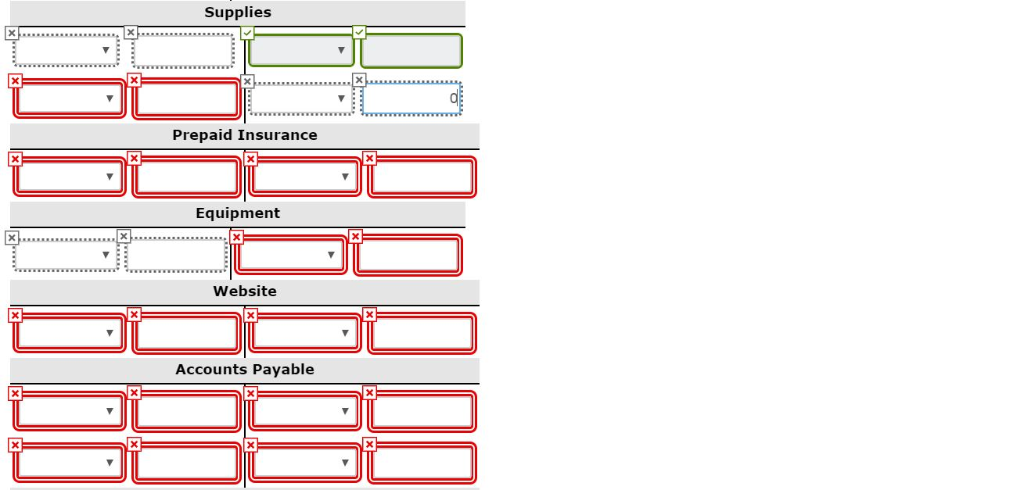

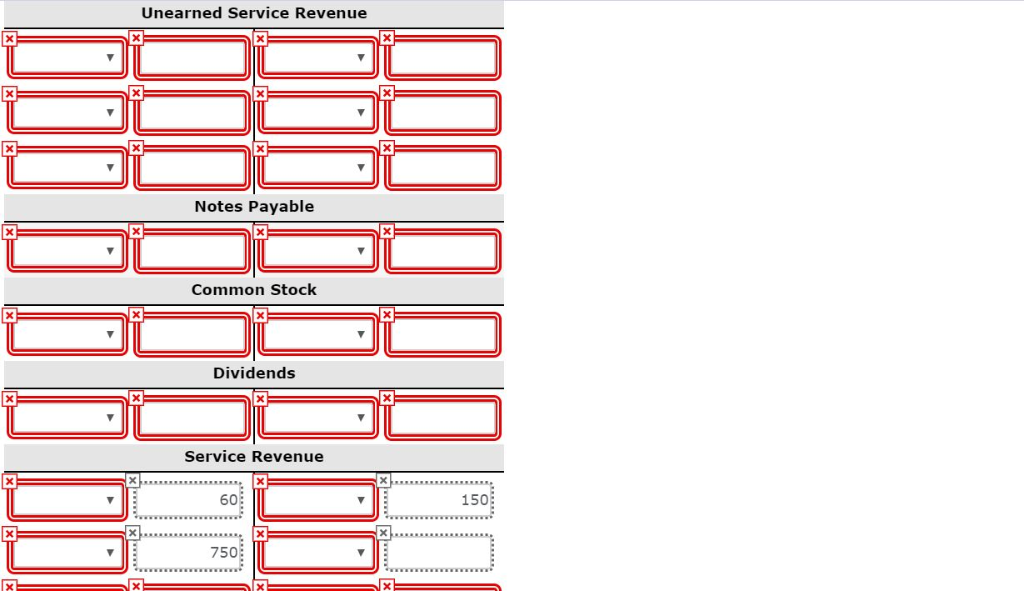

this is part A for refernce

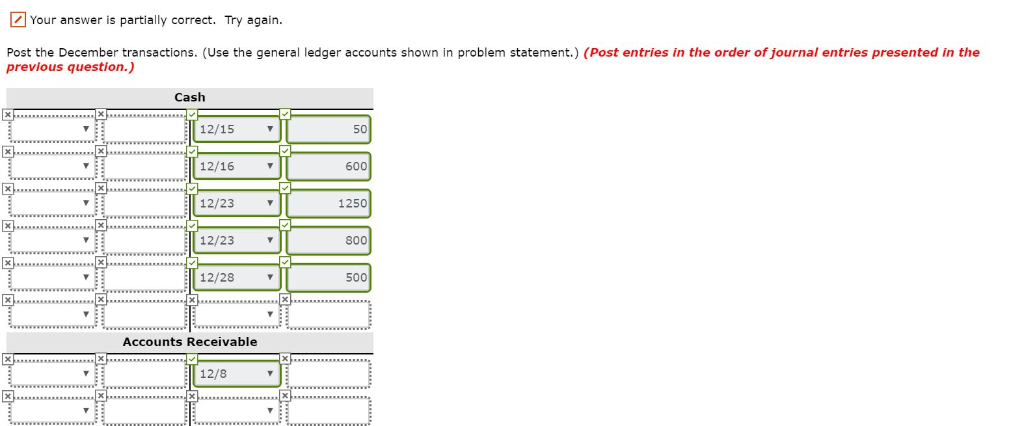

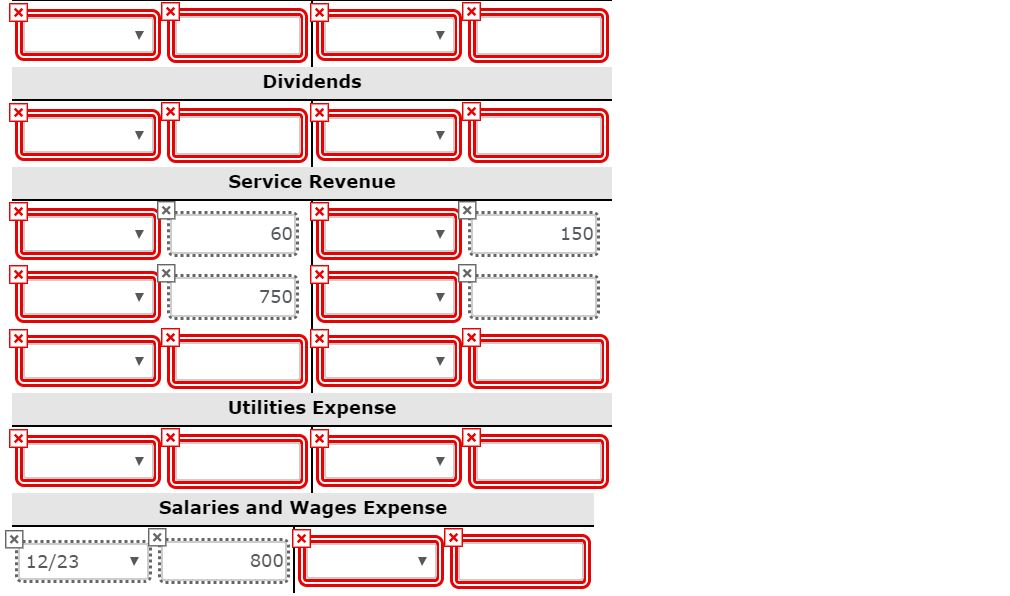

This is the part I need help on

This is the part I need help on

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started