Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cool Breeze limited produces environmentally friendly ar conditioning system for its local ad Internationd market. The design departments currently working on two potential product lines:

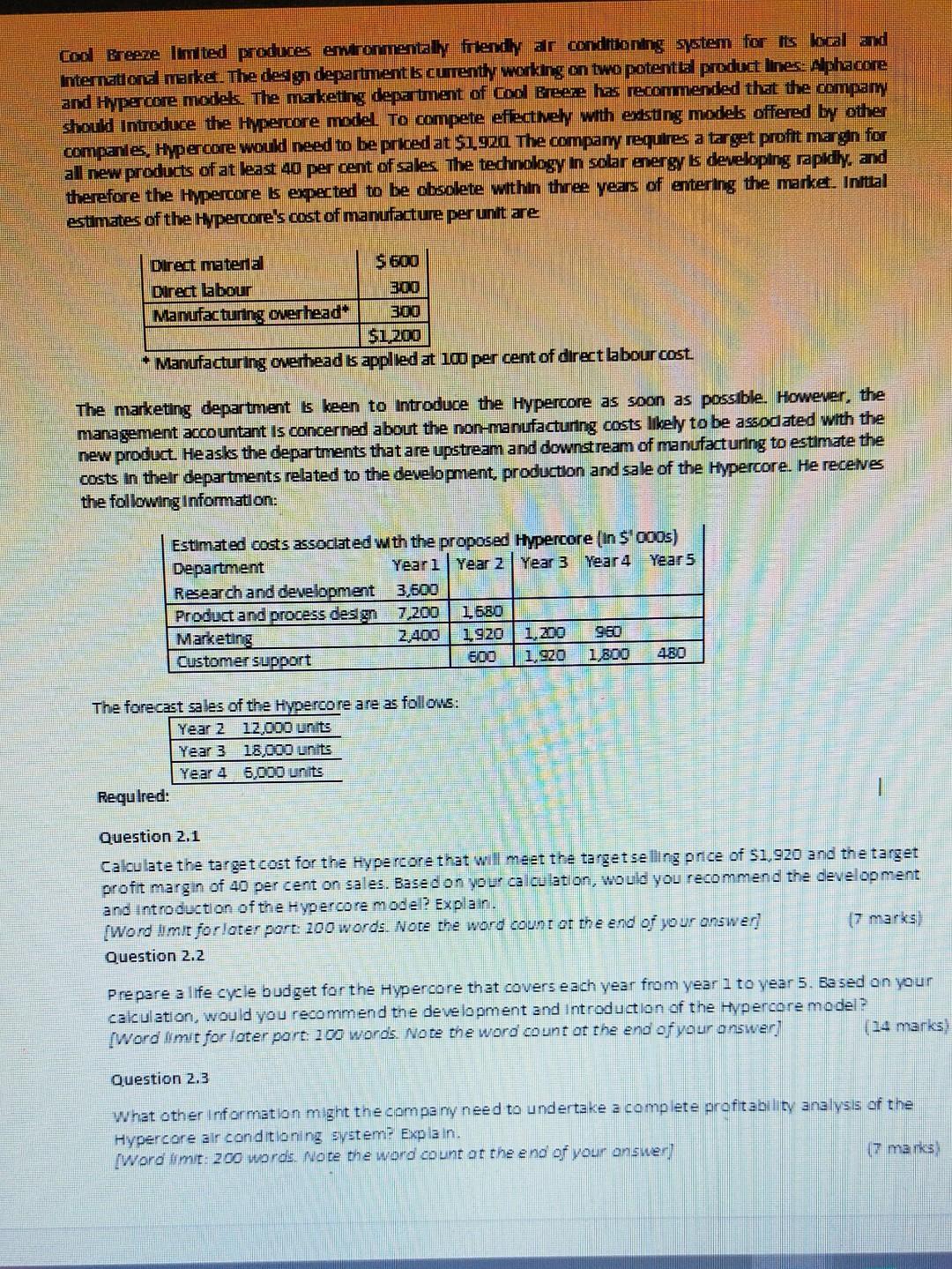

Cool Breeze limited produces environmentally friendly ar conditioning system for its local ad Internationd market. The design departments currently working on two potential product lines: Aphacore and Hypercore models. The marketing department of Cool Breer has recommended that the company should Introduce the Hypercore model. To compete effectively with exking models offered by other companie, Hypercore would need to be priced at $1.920 The company requires a target profit margin for all new products of at least 40 per cent of sales The technology in solar energy is developing rapidly, and therefore the Hypercore is expected to be obsolete within three years of entering the market. Initial estimates of the Hypercore's cost of manufacture peruntt are Direct matera $ 600 Direct labour 300 Manufacturing overhead 300 $1.200 * Manufacturing overhead is applied at 100 per cent of direct labour cost The marketing department is keen to introduce the Hypercore as soon as possible. However, the management accountant is concerned about the non-manufacturing costs likely to be assodated with the new product. Heasks the departments that are upstream and downstream of manufactunng to estimate the costs in their departments related to the development, production and sale of the Hypercore. He receive the following information: Estimated costs associated with the proposed Hypercore (in $'ooos) Department Yeari Year 2 Year 3 Year4 Year 5 Research and development 3,600 Product and process design 7,200 1,680 Marketing 2,400 1920 1.200 960 Customer support 600 1.920 1 800 480 The forecast sales of the Hypercore are as follows: Year 2 12,000 units Year 3 18,000 units Year 4 5,000 units Required: Question 2.1 Calculate the targetcost for the Hypercore that will meet the target selling price of 51,920 and the target profit margin of 40 per cent on sales. Based on your calculation, would you recommend the development and introduction of the hypercore model? Explain. (Word limit forloter pore 100 words. Note the word count or the end of your answer (7 marks) Question 2.2 Prepare a life cycle budget for the Hypercore that covers each year from year I to year 5. Ea sed on your calculation, would you recommend the development and introduction of the Hypercore model? Word limit for loter part 100 words. Note the word count of the end of your answer) (14 marks) Question 2.3 What other information might the company need to undertake a complete profitability analysis of the Hypercore air conditioning system? Explain. [Word limit: 200 words. Note the word count or the end of your answer) (2 marks) Cool Breeze limited produces environmentally friendly ar conditioning system for its local ad Internationd market. The design departments currently working on two potential product lines: Aphacore and Hypercore models. The marketing department of Cool Breer has recommended that the company should Introduce the Hypercore model. To compete effectively with exking models offered by other companie, Hypercore would need to be priced at $1.920 The company requires a target profit margin for all new products of at least 40 per cent of sales The technology in solar energy is developing rapidly, and therefore the Hypercore is expected to be obsolete within three years of entering the market. Initial estimates of the Hypercore's cost of manufacture peruntt are Direct matera $ 600 Direct labour 300 Manufacturing overhead 300 $1.200 * Manufacturing overhead is applied at 100 per cent of direct labour cost The marketing department is keen to introduce the Hypercore as soon as possible. However, the management accountant is concerned about the non-manufacturing costs likely to be assodated with the new product. Heasks the departments that are upstream and downstream of manufactunng to estimate the costs in their departments related to the development, production and sale of the Hypercore. He receive the following information: Estimated costs associated with the proposed Hypercore (in $'ooos) Department Yeari Year 2 Year 3 Year4 Year 5 Research and development 3,600 Product and process design 7,200 1,680 Marketing 2,400 1920 1.200 960 Customer support 600 1.920 1 800 480 The forecast sales of the Hypercore are as follows: Year 2 12,000 units Year 3 18,000 units Year 4 5,000 units Required: Question 2.1 Calculate the targetcost for the Hypercore that will meet the target selling price of 51,920 and the target profit margin of 40 per cent on sales. Based on your calculation, would you recommend the development and introduction of the hypercore model? Explain. (Word limit forloter pore 100 words. Note the word count or the end of your answer (7 marks) Question 2.2 Prepare a life cycle budget for the Hypercore that covers each year from year I to year 5. Ea sed on your calculation, would you recommend the development and introduction of the Hypercore model? Word limit for loter part 100 words. Note the word count of the end of your answer) (14 marks) Question 2.3 What other information might the company need to undertake a complete profitability analysis of the Hypercore air conditioning system? Explain. [Word limit: 200 words. Note the word count or the end of your answer) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started