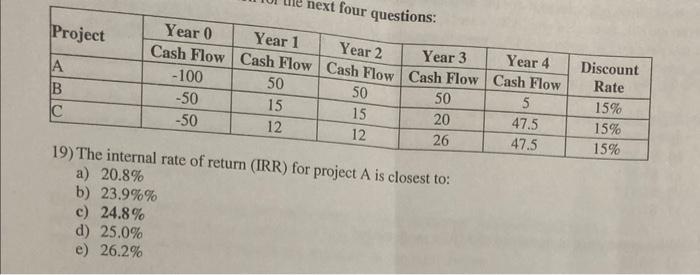

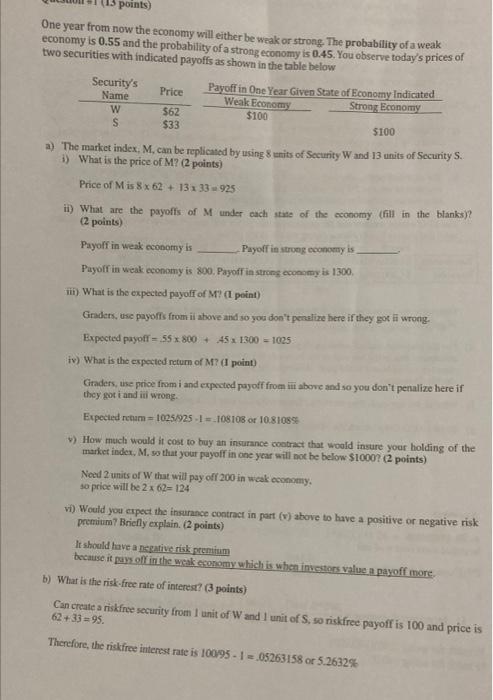

next four questions: Year 0 Project Year 1 Year 2 Year 3 Year 4 Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow A -100 50 50 50 5 B -50 15 15 20 47.5 -50 12 12 26 47.5 19) The internal rate of return (IRR) for project A is closest to: a) 20.8% b) 23.9%% c) 24.8% 25.0% e) 26.2% Discount Rate 15% 15% 15% points) One year from now the economy will either be weak or strong. The probability of a weak economy is 0.55 and the probability of a strong economy is 0.45. You observe today's prices of two securities with indicated payoffs as shown in the table below Security's Price Payoff in One Year Given State of Economy indicated Name Weak Economy Strong Economy w $62 $100 S $33 $100 a) The market index, M. can be replicated by using 8 units of Security W and 13 units of Security S. 1) What is the price of M? (2 points) Price of Mis 8 x 62 + 13 1 33 925 in) What are the payoffs of M under each state of the economy (fill in the blanks)? (2 points) Payoff in weak economy is Payoff in strong economy is Payoff in weak economy is 800. Payoff in strong economy is 1300 tin) What is the expected payoff of M? (1 point) Graders, use payoffs from it above and so you don't penalize here if they got it wrong. Expected payoff = 55 x 800+ 45 x 1300 = 1025 iv) What is the expected return of M? (1 point) Graders, use price from i and expected payoff from it above and so you don't penalize here if they got i and it wrong. Expected retum= 1025/925 -1 =108108 or 10.81089 ) How much would it cost to buy an insurance contract that would insure your holding of the market index, M. so that your payoff in one year will not be below S10007(2 points) Need 2 units of W that will pay off 200 in weak cconomy, so price will be 2 x 62= 124 vi) Would you expect the insurance contract in part (v) above to have a positive or negative risk premium? Briefly explain. (2 points) It should have a negative risk premium because it pays off in the weak economy which is when investors value a payoff more. b) What is the risk-free rate of interest? (3 points) Can create a riskfree security from 1 unit of Wand I unit of S, so riskfree payoff is 100 and price is 62 +33 = 95. Therefore, the riskfree interest rate is 10095-105263158 or 5.263296