Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Coolio Traders sold inventory on 1 March 209 to Sisqo Ltd for C307 800 (including VAT). - This customer must pay for the inventory 24

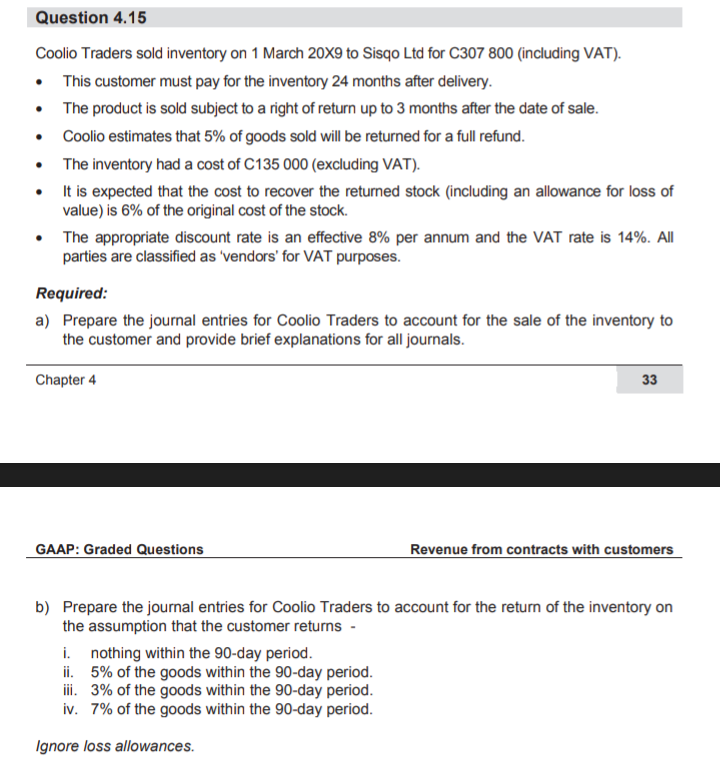

Coolio Traders sold inventory on 1 March 209 to Sisqo Ltd for C307 800 (including VAT). - This customer must pay for the inventory 24 months after delivery. - The product is sold subject to a right of return up to 3 months after the date of sale. - Coolio estimates that 5% of goods sold will be returned for a full refund. - The inventory had a cost of C135000 (excluding VAT). - It is expected that the cost to recover the returned stock (including an allowance for loss of value) is 6% of the original cost of the stock. - The appropriate discount rate is an effective 8% per annum and the VAT rate is 14%. All parties are classified as 'vendors' for VAT purposes. Required: a) Prepare the journal entries for Coolio Traders to account for the sale of the inventory to the customer and provide brief explanations for all journals. Chapter 4 33 GAAP: Graded Questions Revenue from contracts with customers b) Prepare the journal entries for Coolio Traders to account for the return of the inventory on the assumption that the customer returns - i. nothing within the 90 -day period. ii. 5% of the goods within the 90 -day period. iii. 3% of the goods within the 90 -day period. iv. 7% of the goods within the 90 -day period. Ignore loss allowances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started