Answered step by step

Verified Expert Solution

Question

1 Approved Answer

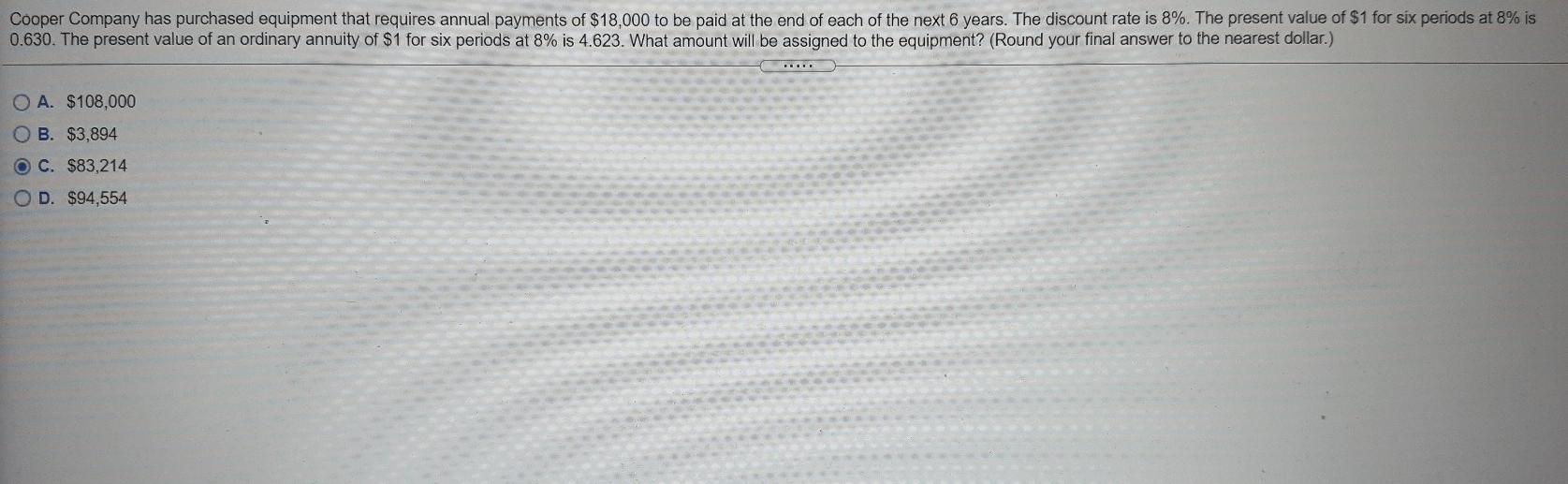

Cooper Company has purchased equipment that requires annual payments of $18,000 to be paid at the end of each of the next 6 years. The

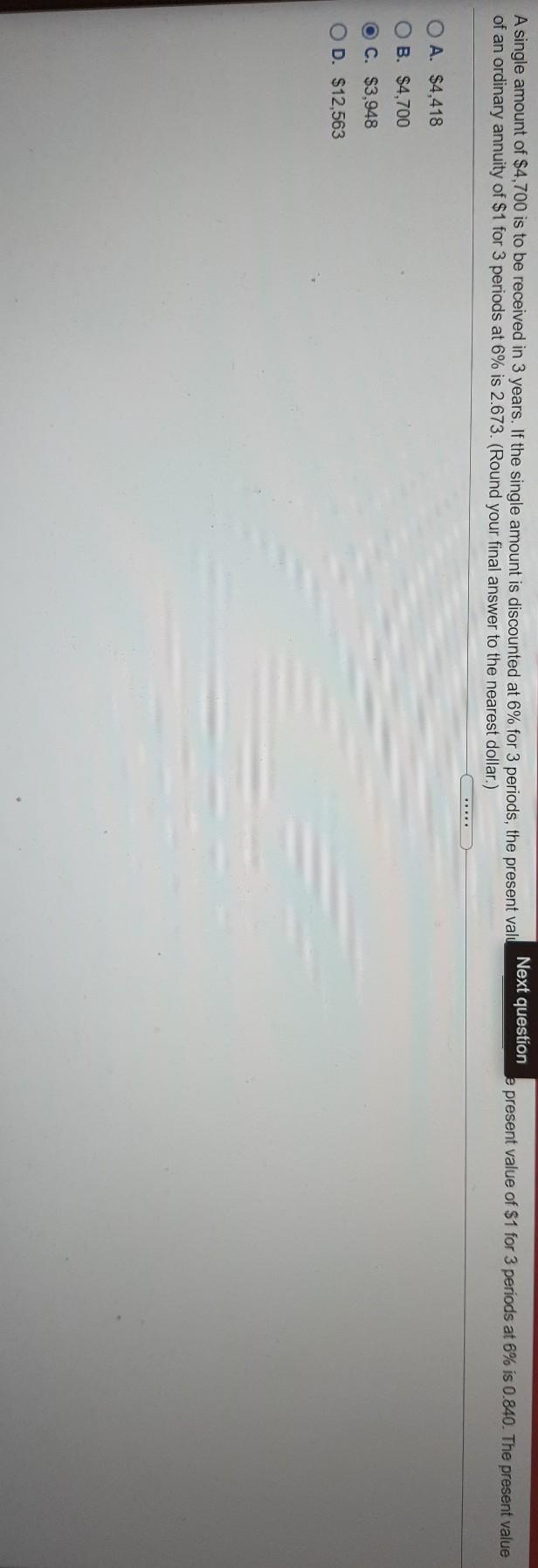

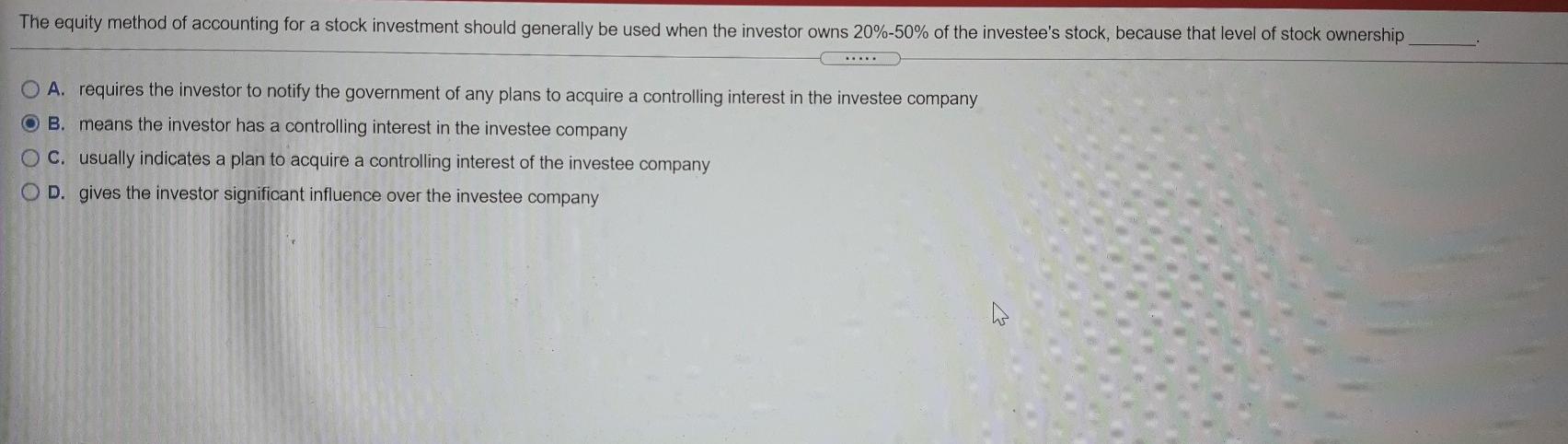

Cooper Company has purchased equipment that requires annual payments of $18,000 to be paid at the end of each of the next 6 years. The discount rate is 8%. The present value of $1 for six periods at 8% is 0.630. The present value of an ordinary annuity of $1 for six periods at 8% is 4.623. What amount will be assigned to the equipment? (Round your final answer to the nearest dollar.) O A. $108,000 O B. $3,894 O C. $83,214 OD. $94,554 A single amount of $4,700 is to be received in 3 years. If the single amount is discounted at 6% for 3 periods, the present valu of an ordinary annuity of $1 for 3 periods at 6% is 2.673. (Round your final answer to the nearest dollar.) Next question e present value of $1 for 3 periods at 6% is 0.840. The present value O A. $4.418 OB. C. $3,948 OD. $12,563 The equity method of accounting for a stock investment should generally be used when the investor owns 20%-50% of the investee's stock, because that level of stock ownership A. requires the investor to notify the government of any plans to acquire a controlling interest in the investee company B. means the investor has a controlling interest in the investee company O c. usually indicates a plan to acquire a controlling interest of the investee company O D. gives the investor significant influence over the investee company The future value of $1 will always be O A. greater than $1 B. equal to the interest rate C. less than $1 D. equal to $1 A short-term investment is not A. referred to as a marketable security B. referred to as a temporary investment C. a current asset O D. intended to be converted to cash in more than one year is at arri Suppose an investor purchases $100,000 of 5% Government of Canada bonds at a price of $95,735 on June 1, 2020. The bonds pay interest on June 1 and December 1. The investor intends to hold the bonds until their maturity on June 2, 2025. The bonds will be outstanding for five years (10 interest periods). The investor paid a discounted price for the bonds $95,735 (an effective interest rate of 6%). What amount will be reported for the long-term investment in bonds on the balance sheet on December 31, 2020? O A. $96,108 OB. $95,735 O OLGO C. $96,172 D. $100,000 Amortization of a discount or premium on the bond affects all of the following except A. the amount of cash received when interest payments are made B. the carrying value of the bonds on the investor's books C. interest revenue of the investor D. retained earnings of the investor The amortization of a discount on a long-term bond investment A. increases the investor's interest expense B. increases the investor's interest revenue C. decreases the investor's Long-Term Investment account O D. decreases the investor's interest revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started