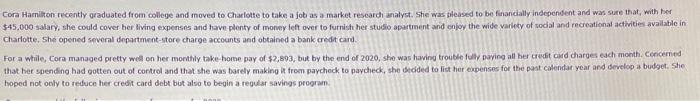

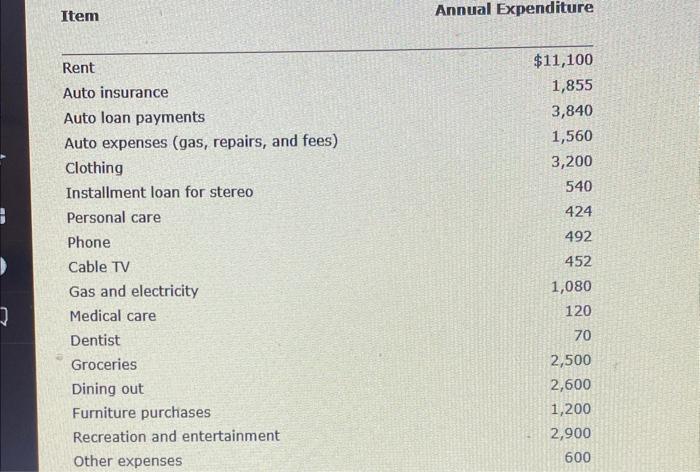

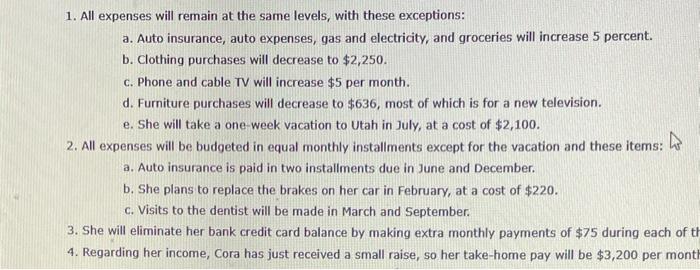

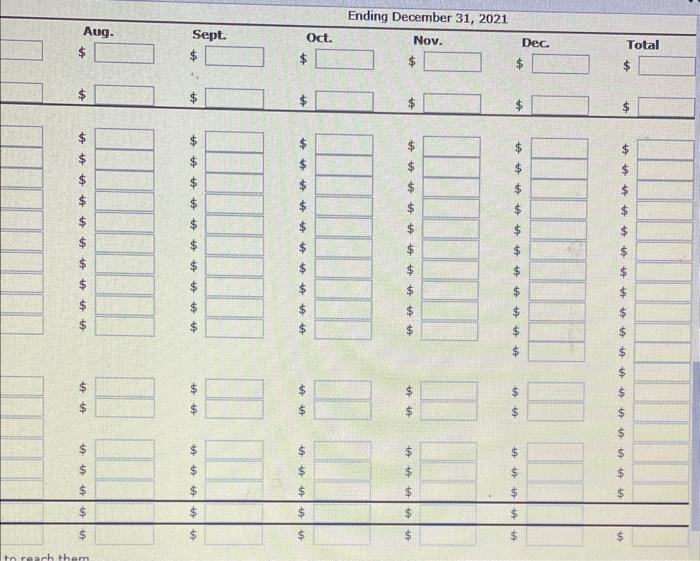

Cora Hamliton recently graduated from college and moved to Charlotte to take a job as a market researdi analyst. She was theased to be finandially independent and was sure that, with ber 545,000 salary, she could cover her fiving expenses and have plenty of money left over to furnish her stucio apurtment and enjoy the wide valiety of social and receational activities avaliable in charlotte. She opened several department-store charge accounts and obtained a bank credt cand. For a while, Cora managed pretty well on her monthly take home pay of $2;803, but by the end of 2020 , she was havino trouble fully paring all ber credit card diarges each month. Concemind that her spending had potten out of contel and that she was barely making in frem paycheck to paycheck, she sedided to list her expenses for the past calendar year and serelop a budget, She hoped not ooly to reduce her credit card debt but also to begin a regular savings program. Item Annual Expenditure 1. All expenses will remain at the same levels, with these exceptions: a. Auto insurance, auto expenses, gas and electricity, and groceries will increase 5 percent. b. Clothing purchases will decrease to $2,250. c. Phone and cable TV will increase $5 per month. d. Furniture purchases will decrease to $636, most of which is for a new television. e. She will take a one-week vacation to Utah in July, at a cost of $2,100. 2. All expenses will be budgeted in equal monthly installments except for the vacation and these items: a. Auto insurance is paid in two installments due in June and December. b. She plans to replace the brakes on her car in February, at a cost of $220. c. Visits to the dentist will be made in March and September. 3. She will eliminate her bank credit card balance by making extra monthly payments of $75 during each of 4. Regarding her income, Cora has just received a small raise, so her take-home pay will be $3,200 per mon For the year INCOME Take-home pay Ending December 31, 2021 Cora Hamliton recently graduated from college and moved to Charlotte to take a job as a market researdi analyst. She was theased to be finandially independent and was sure that, with ber 545,000 salary, she could cover her fiving expenses and have plenty of money left over to furnish her stucio apurtment and enjoy the wide valiety of social and receational activities avaliable in charlotte. She opened several department-store charge accounts and obtained a bank credt cand. For a while, Cora managed pretty well on her monthly take home pay of $2;803, but by the end of 2020 , she was havino trouble fully paring all ber credit card diarges each month. Concemind that her spending had potten out of contel and that she was barely making in frem paycheck to paycheck, she sedided to list her expenses for the past calendar year and serelop a budget, She hoped not ooly to reduce her credit card debt but also to begin a regular savings program. Item Annual Expenditure 1. All expenses will remain at the same levels, with these exceptions: a. Auto insurance, auto expenses, gas and electricity, and groceries will increase 5 percent. b. Clothing purchases will decrease to $2,250. c. Phone and cable TV will increase $5 per month. d. Furniture purchases will decrease to $636, most of which is for a new television. e. She will take a one-week vacation to Utah in July, at a cost of $2,100. 2. All expenses will be budgeted in equal monthly installments except for the vacation and these items: a. Auto insurance is paid in two installments due in June and December. b. She plans to replace the brakes on her car in February, at a cost of $220. c. Visits to the dentist will be made in March and September. 3. She will eliminate her bank credit card balance by making extra monthly payments of $75 during each of 4. Regarding her income, Cora has just received a small raise, so her take-home pay will be $3,200 per mon For the year INCOME Take-home pay Ending December 31, 2021