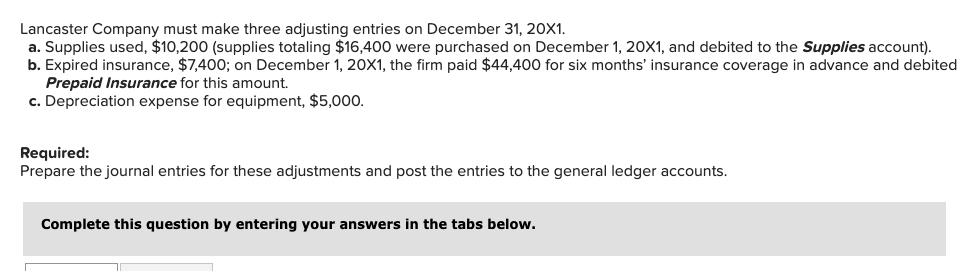

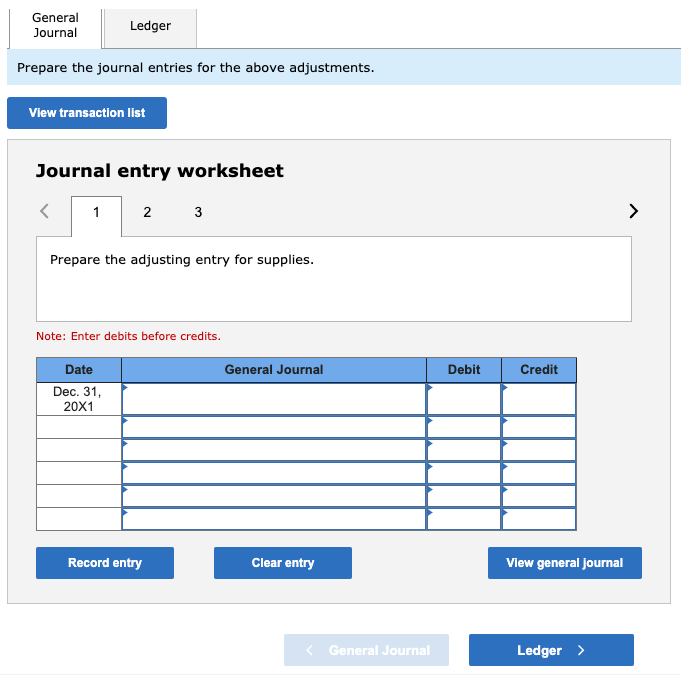

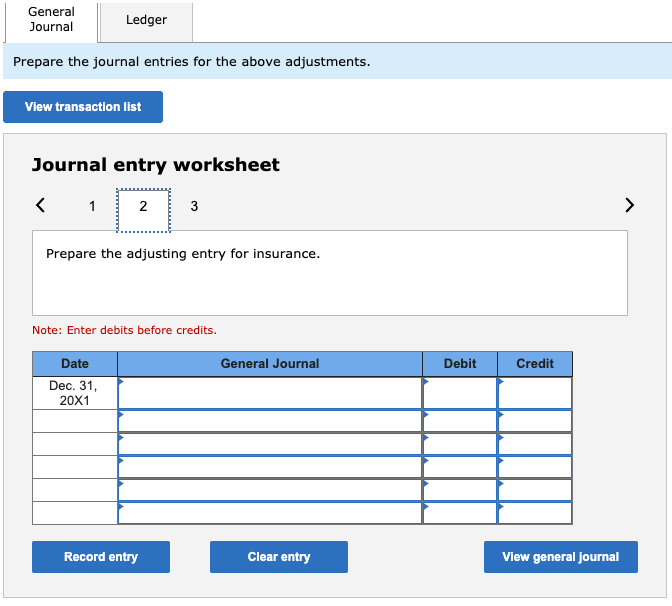

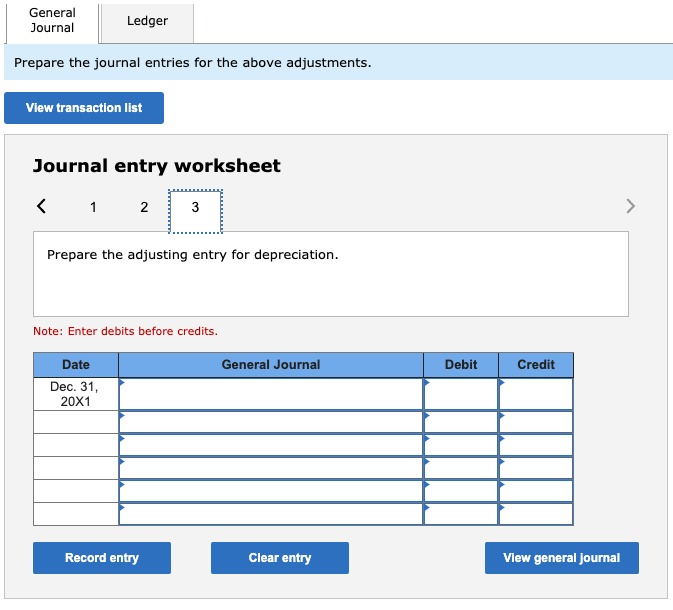

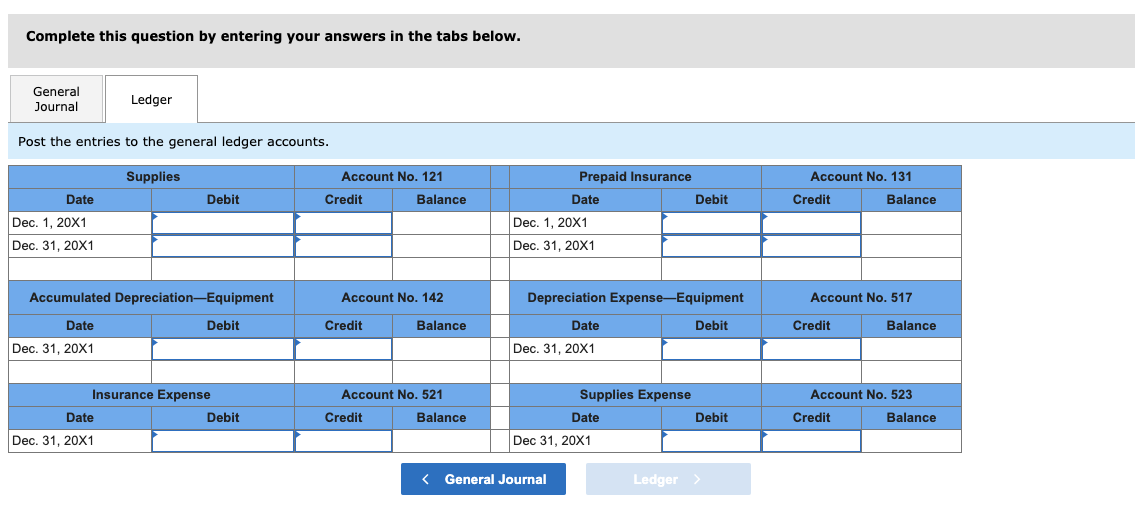

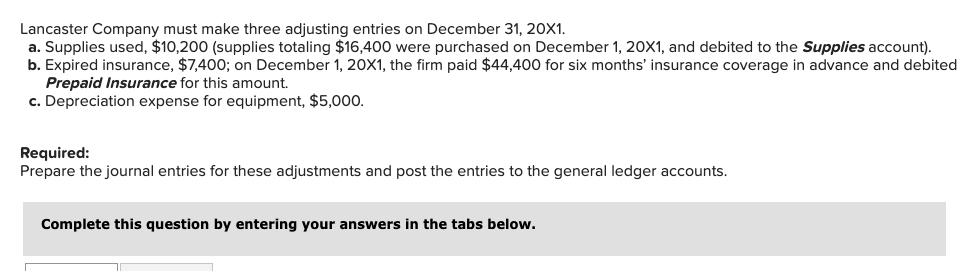

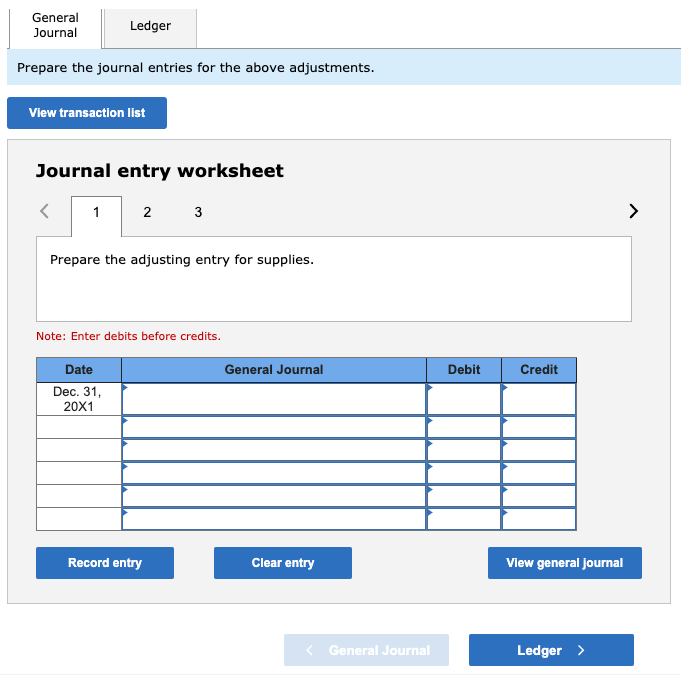

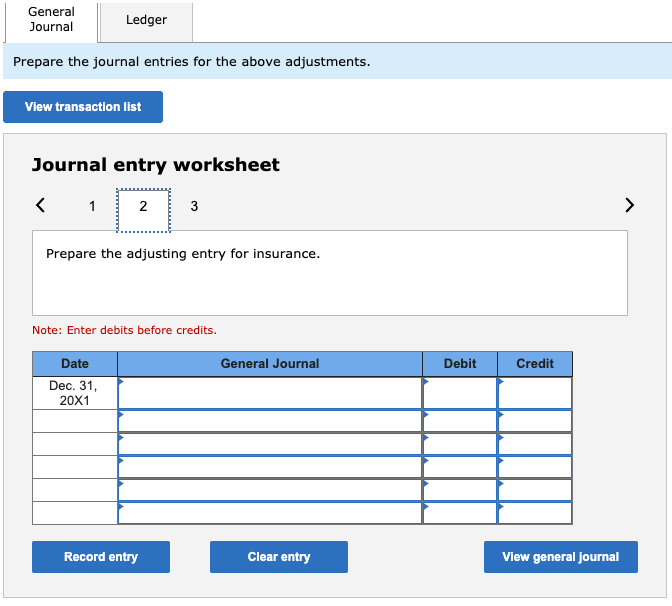

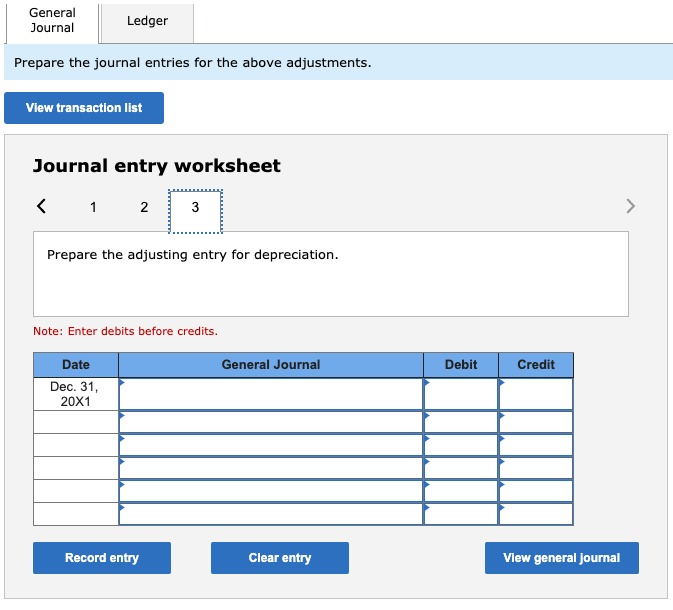

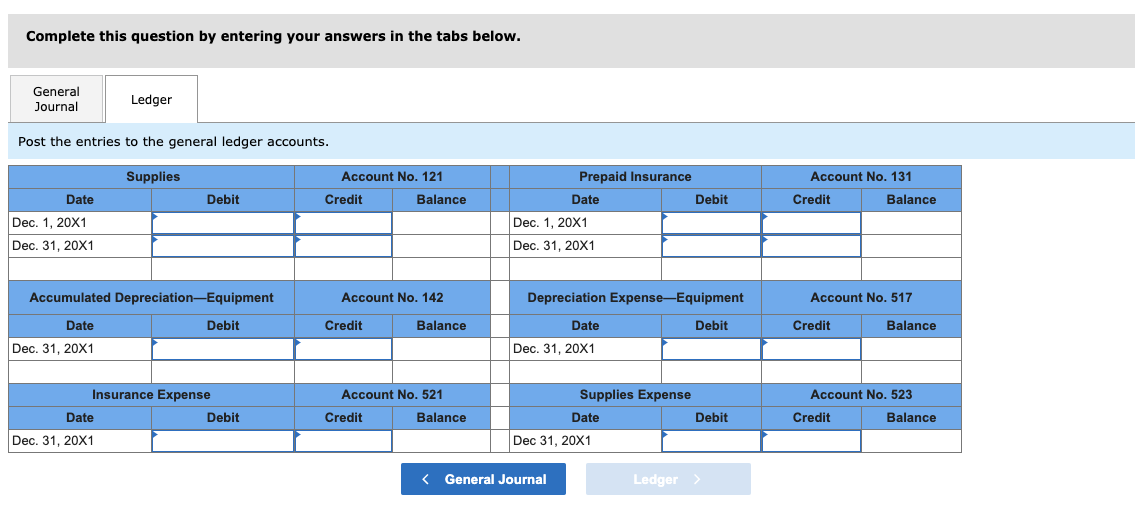

Lancaster Company must make three adjusting entries on December 31, 20X1. a. Supplies used, $10,200 (supplies totaling $16,400 were purchased on December 1, 20X1, and debited to the Supplies account). b. Expired insurance, $7,400; on December 1, 20X1, the firm paid $44,400 for six months' insurance coverage in advance and debited Prepaid Insurance for this amount. c. Depreciation expense for equipment, $5,000. Required: Prepare the journal entries for these adjustments and post the entries to the general ledger accounts. Complete this question by entering your answers in the tabs below. General Journal Ledger Prepare the journal entries for the above adjustments. View transaction list Journal entry worksheet 1 2 3 > Prepare the adjusting entry for supplies. Note: Enter debits before credits. General Journal Debit Credit Date Dec. 31, 20X1 Record entry Clear entry View general journal General Journal Ledger > General Journal Ledger Prepare the journal entries for the above adjustments. View transaction list Journal entry worksheet Prepare the adjusting entry for insurance. Note: Enter debits before credits. Date General Journal Debit Credit Dec. 31, 20X1 Record entry Clear entry View general Journal General Journal Ledger Prepare the journal entries for the above adjustments. View transaction list Journal entry worksheet Prepare the adjusting entry for depreciation. Note: Enter debits before credits. General Journal Debit Credit Date Dec. 31, 20X1 Record entry Clear entry View general Journal Complete this question by entering your answers in the tabs below. General Journal Ledger Post the entries to the general ledger accounts. Supplies Account No. 121 Credit Balance Account No. 131 Credit Balance Date Debit Prepaid Insurance Date Debit Dec. 1, 20X1 Dec. 31, 20X1 Dec. 1, 20X1 Dec. 31, 20X1 Accumulated Depreciation-Equipment Account No. 142 Depreciation Expense-Equipment Account No. 517 Date Debit Credit Balance Date Debit Credit Balance Dec. 31, 20X1 Dec. 31, 20X1 Insurance Expense Date Debit Dec. 31, 20X1 Account No. 521 Credit Balance Supplies Expense Date Debit Dec 31, 20X1 Account No. 523 Credit Balance