Question

Corin must decide which properties to invest in and the amount to be invested. There are 12 options that are under consideration, each of which

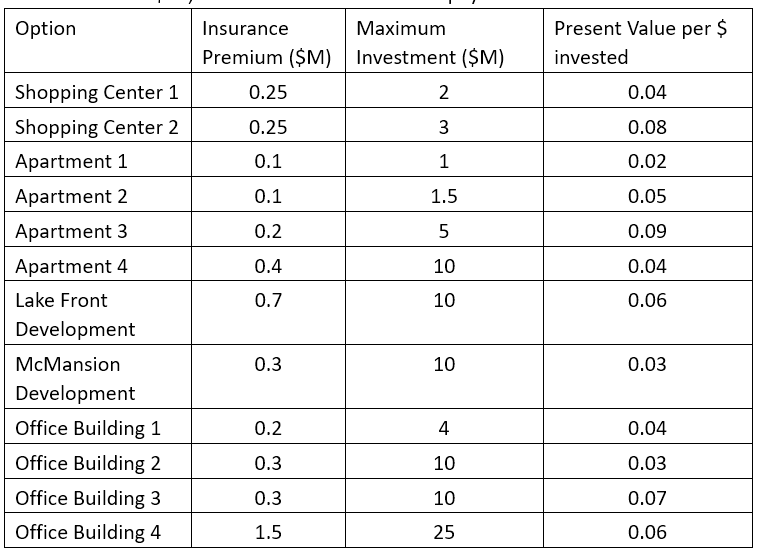

Corin must decide which properties to invest in and the amount to be invested. There are 12 options that are under consideration, each of which will have several investors. The amount that Corin invests in any of the options cannot exceed that investments maximum. For each dollar invested in a particular option, there is an associated present value that will be achieved. For each property that she chooses to invest in, Corin must also pay a one-time insurance premium. Corin has two spending budgets, one for the actual property investments and one for the insurance premiums.

For example, if Corin chooses to invest in Shopping Center 1, she could do so at any amount up to $2 million. Suppose she chooses to invest $1.5 million. Then she would realize a present value of $1.5 million x 0.04 = $60,000. She would also have to pay a one-time fixed insurance cost of $250,000

She has an investment budget of $50 million and an insurance budget of $1.5 million. Her goal is to maximize her total present value. Note, the amount of money invested in properties and the amount spent on insurance are already incorporated into the present value, so no adjustments need to be made to calculate the total present value (you can simply add up the present values from each of the investments). There are some additional considerations that Corin must heed:

- To maintain visibility for her firm, she must invest in at least one of the developments (Lake Front or McMansion).

- Governmental regulations require that at least two apartments are invested in.

- There is also a contractual stipulation requiring that, if an investment is made in office building 3, then there must also be an investment made in shopping center 2.

- The amount invested in apartments cannot exceed $14 million

- Shopping Center 1 cannot be invested in unless Apartment 1 or Apartment 2 are invested in.

- Finally, the amount invested in office buildings cannot exceed $20 million.

What investments should Corin choose, and how much should she invest in them?

***Please use excel solver, show all formulas as well as the actual final values for each variable***

\begin{tabular}{|l|c|c|c|} \hline Option & InsurancePremium($M) & MaximumInvestment($M) & PresentValueper$invested \\ \hline Shopping Center 1 & 0.25 & 2 & 0.04 \\ \hline Shopping Center 2 & 0.25 & 3 & 0.08 \\ \hline Apartment 1 & 0.1 & 1 & 0.02 \\ \hline Apartment 2 & 0.1 & 1.5 & 0.05 \\ \hline Apartment 3 & 0.2 & 5 & 0.09 \\ \hline Apartment 4 & 0.4 & 10 & 0.04 \\ \hline LakeFrontDevelopment & 0.7 & 10 & 0.06 \\ \hline McMansionDevelopment & 0.3 & 10 & 0.03 \\ \hline Office Building 1 & 0.2 & 4 & 0.04 \\ \hline Office Building 2 & 0.3 & 10 & 0.03 \\ \hline Office Building 3 & 0.3 & 10 & 0.07 \\ \hline Office Building 4 & 1.5 & 25 & 0.06 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started