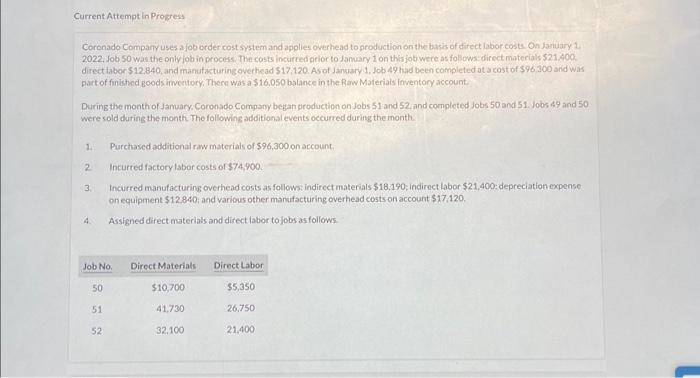

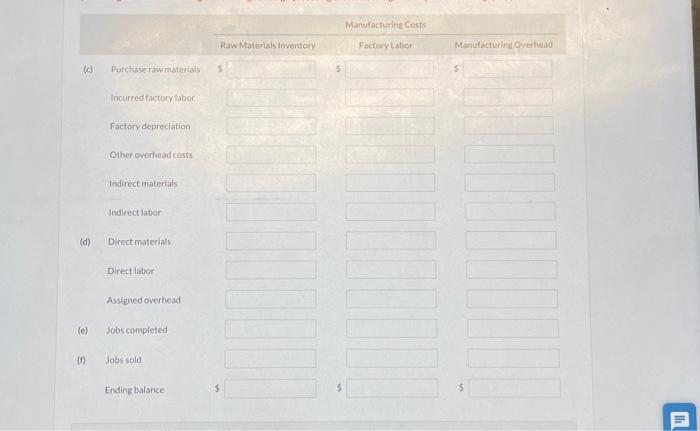

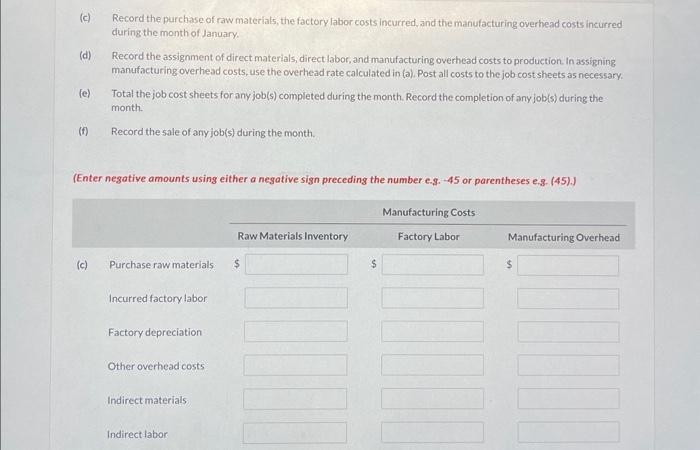

Coronado Company uses a job order cost system and applies overhead to production on the basis of ditect labor costs On january 1. 2022. Job 50 was the only job in process. The costs incurced prior to Jamuary 1 on this job were as follows: direct materials 521.400. direct laber $12,840, and manutacturing overhead $17,120. As of Jancrary 1, Job 49 had been completed at a cost of $96,300 arid was part of finished goods imentory, There was a $16,050 balance in the Raw Materiais lowentory account: During the month of Jamuary, Coronado Company beyan yroduction on Jobs 51 and 52 , and completed Jobs 50 and 51 . Jobs 49 and 50 were sold during the month The following additional events occurred during the inonth 1. Purchased additional raw materials of $96,300 on aecount. 2 Incurted factory labor costs of $74,900. 3. Incurred manufacturing overhead costs as follows: indirect materials $18,190; indirect labor $21,400; depreciation expense on equipment $12,840; and various other manufacturing overhead costs on account $17,120. 4. Assigned direct materials and direct iabor to jobs as follows. (c) Record the purchase of raw materials, the factory labor costs incurred, and the manufacturing overhead costs incurred during the month of January. (d) Record the assignment of direct materials, direct labor, andmanufacturing overhead costs to production. In assigning manufacturing overhead costs, use the overhead rate calculated in (a). Post all costs to the job cost sheets as necessary. (e) Total the job cost sheets for any job(s) completed during the month. Record the completion of any job(s) during the month. (f) Record the sale of any job(s) during the month. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.3. (45).) Coronado Company uses a job order cost system and applies overhead to production on the basis of ditect labor costs On january 1. 2022. Job 50 was the only job in process. The costs incurced prior to Jamuary 1 on this job were as follows: direct materials 521.400. direct laber $12,840, and manutacturing overhead $17,120. As of Jancrary 1, Job 49 had been completed at a cost of $96,300 arid was part of finished goods imentory, There was a $16,050 balance in the Raw Materiais lowentory account: During the month of Jamuary, Coronado Company beyan yroduction on Jobs 51 and 52 , and completed Jobs 50 and 51 . Jobs 49 and 50 were sold during the month The following additional events occurred during the inonth 1. Purchased additional raw materials of $96,300 on aecount. 2 Incurted factory labor costs of $74,900. 3. Incurred manufacturing overhead costs as follows: indirect materials $18,190; indirect labor $21,400; depreciation expense on equipment $12,840; and various other manufacturing overhead costs on account $17,120. 4. Assigned direct materials and direct iabor to jobs as follows. (c) Record the purchase of raw materials, the factory labor costs incurred, and the manufacturing overhead costs incurred during the month of January. (d) Record the assignment of direct materials, direct labor, andmanufacturing overhead costs to production. In assigning manufacturing overhead costs, use the overhead rate calculated in (a). Post all costs to the job cost sheets as necessary. (e) Total the job cost sheets for any job(s) completed during the month. Record the completion of any job(s) during the month. (f) Record the sale of any job(s) during the month. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.3. (45).)