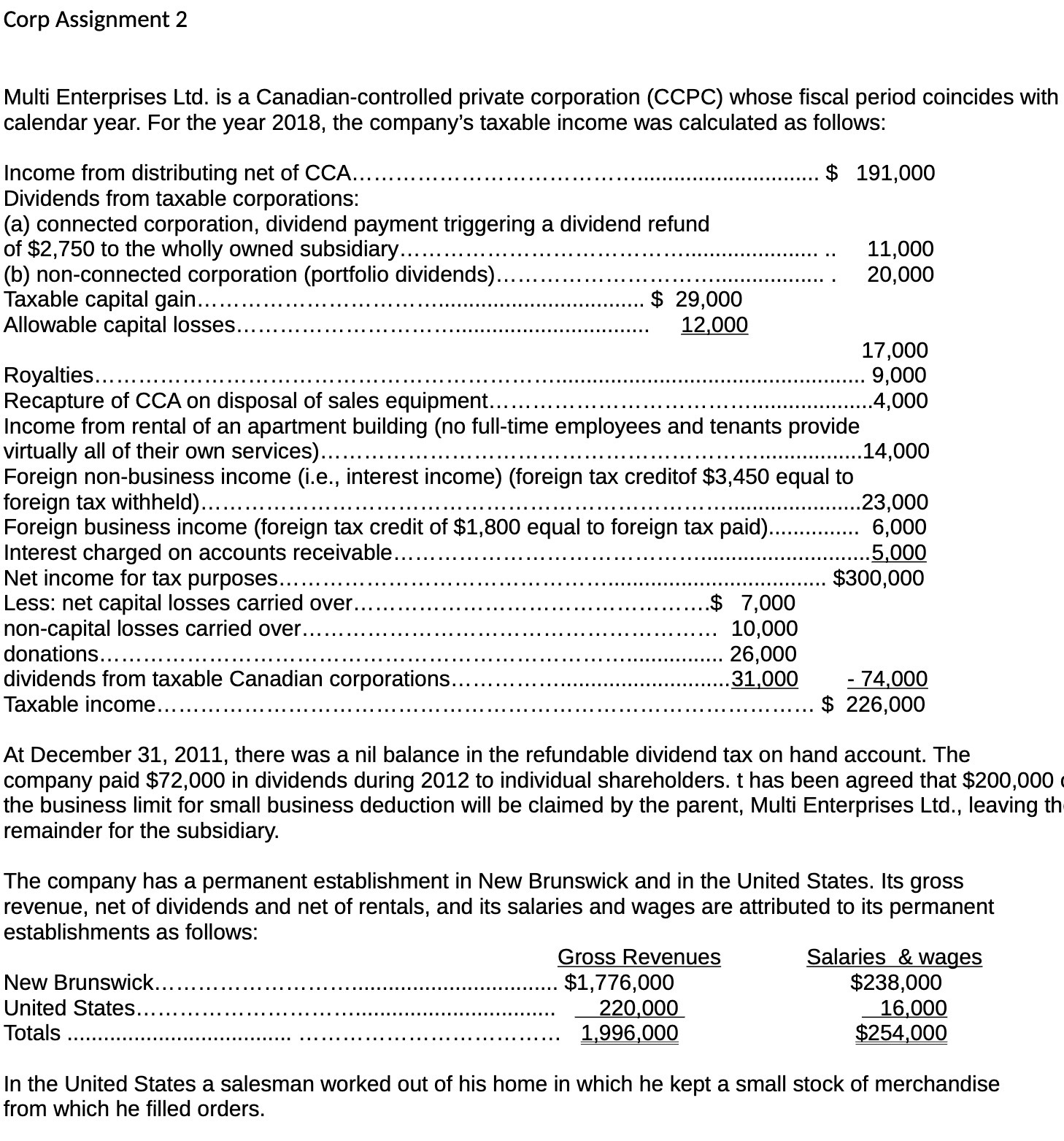

Corp Assignment 2 Multi Enterprises Ltd. is a Canadian-controlled private corporation (CCPC) whose fiscal period coincides with calendar year. For the year 2018, the company's taxable income was calculated as follows: Income from distributing net of CCA ..................................................................... $ 191,000 Dividends from taxable corporations: (a) connected corporation, dividend payment triggering a dividend refund of $2,750 to the wholly owned subsidiary ............................................................... 11,000 (b) non-connected corporation (portfolio dividends) ................................................ . 20,000 Taxable capital gain ................................................................... $ 29,000 Allowable capital losses .............................................................. 12,000 17,000 Royalties .................................................................................................................. 9,000 Recapture of CCA on disposal of sales equipment ........................................................ 4,000 Income from rental of an apartment building (no full-time employees and tenants provide virtually all of their own services) ............................................................................. 14,000 Foreign non-business income (i.e., interest income) (foreign tax creditof $3,450 equal to foreign tax withheld) .............................................................................................. 23,000 Foreign business income (foreign tax credit of $1,800 equal to foreign tax paid) ............... 6,000 Interest charged on accounts receivable ...................................................................... 5,000 Net income for tax purposes ................................................................................. $300,000 Less: net capital losses carried over ................................................. $ 7,000 non-capital losses carried over ......................................................... 10,000 donations ........................................................................................ 26,000 dividends from taxable Canadian corporations ........................................... 31,000 - 74,000 Taxable income .......................................................................................... $ 226,000 At December 31, 2011, there was a nil balance in the refundable dividend tax on hand account. The company paid $72,000 in dividends during 2012 to individual shareholders. t has been agreed that $200,000 I the business limit for small business deduction will be claimed by the parent, Multi Enterprises Ltd., leaving thu remainder for the subsidiary. The company has a permanent establishment in New Brunswick and in the United States. Its gross revenue, net of dividends and net of rentals, and its salaries and wages are attributed to its permanent establishments as follows: Gross Revenues Salaries &wages New Brunswick ............................................................. $1,776,000 $238,000 United States ............................................................... 220 000 16 000 Totals 1996 000 $254,000 In the United States a salesman worked out of his home in which he kept a small stock of merchandise from which he filled orders