Answered step by step

Verified Expert Solution

Question

1 Approved Answer

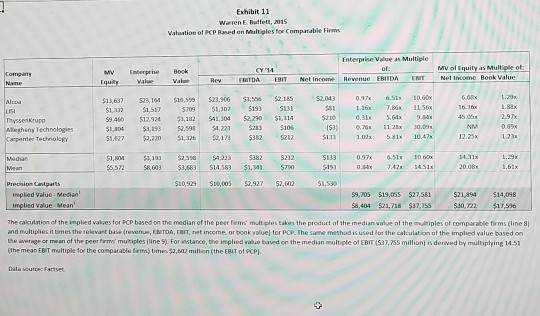

corp finance course Exhibit 11 Warren E. Buffett, 015 Valastion of PCP Baved on Multiples for Compatable Firms Enterprise Value as Multiple Mv Enterprie Book

corp finance course

Exhibit 11 Warren E. Buffett, 015 Valastion of PCP Baved on Multiples for Compatable Firms Enterprise Value as Multiple Mv Enterprie Book CY14 MV of Equity as Multipile of Re ENIDAEBIT Net Income Revenue EBIDA ENIT Net Income Book Value Iquity Vlue Vae 13,637 3,1 10 $23,906 1 2185 $2,043 0 6.51 10.60 51,332 $1,527 09 52,302193 $131 59,450 $12.324 $3,182 $41,304 $2,230 $2,314 1.29 sa1 116 7.8 11 56 Thyssenkrupp Alegheny Technologies 0$3,193 $,38 $4,223 $106 51.627 $2,220 $1,326$2,173 382$212 112x 30.0 rpente Technoleey 133 1.0x 5a1x 12.25x 123 Precihion Cnlparts $10,929 S,005 $2.927 $2,602 1,530 impied value- Median 59,05 $19,065 $27,581 $21,8 $14,098 mglied Value Mean 404 521,718 $37,355 sa,722 $17,5 The calculytion of the implied values for PCP based on the median of the peer fems moltiples takes the product of the median value of the multiples of comparable firms (line 8 nd multiplies n tres the elevant bas. (revenue, EurA . r et income or book-aluel tor PCP The same method is used ior te akultee nuhe implied value used the average or mean of the peer firme mutiples lline S For instance, the implied vakue baved con the median multiple of EBIT (537,755 million) is derived by multiplying 14.51i (the mean EBIT multiple for the comparable fems) time $2,602 million (the EBIT ot PCP. 3. * Use Exhibit 11 to calculate the weighted average cost of capital (WACC) for both BRK and PCP. Follow the prampts to locate the inputs in the case and perform the calculations. On the surface, which cost of capital is the appropriate hurdle rate to evaluate BRK's investment in PCP? Why? Exhibit 11 Warren E. Buffett, 015 Valastion of PCP Baved on Multiples for Compatable Firms Enterprise Value as Multiple Mv Enterprie Book CY14 MV of Equity as Multipile of Re ENIDAEBIT Net Income Revenue EBIDA ENIT Net Income Book Value Iquity Vlue Vae 13,637 3,1 10 $23,906 1 2185 $2,043 0 6.51 10.60 51,332 $1,527 09 52,302193 $131 59,450 $12.324 $3,182 $41,304 $2,230 $2,314 1.29 sa1 116 7.8 11 56 Thyssenkrupp Alegheny Technologies 0$3,193 $,38 $4,223 $106 51.627 $2,220 $1,326$2,173 382$212 112x 30.0 rpente Technoleey 133 1.0x 5a1x 12.25x 123 Precihion Cnlparts $10,929 S,005 $2.927 $2,602 1,530 impied value- Median 59,05 $19,065 $27,581 $21,8 $14,098 mglied Value Mean 404 521,718 $37,355 sa,722 $17,5 The calculytion of the implied values for PCP based on the median of the peer fems moltiples takes the product of the median value of the multiples of comparable firms (line 8 nd multiplies n tres the elevant bas. (revenue, EurA . r et income or book-aluel tor PCP The same method is used ior te akultee nuhe implied value used the average or mean of the peer firme mutiples lline S For instance, the implied vakue baved con the median multiple of EBIT (537,755 million) is derived by multiplying 14.51i (the mean EBIT multiple for the comparable fems) time $2,602 million (the EBIT ot PCP. 3. * Use Exhibit 11 to calculate the weighted average cost of capital (WACC) for both BRK and PCP. Follow the prampts to locate the inputs in the case and perform the calculations. On the surface, which cost of capital is the appropriate hurdle rate to evaluate BRK's investment in PCP? WhyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started