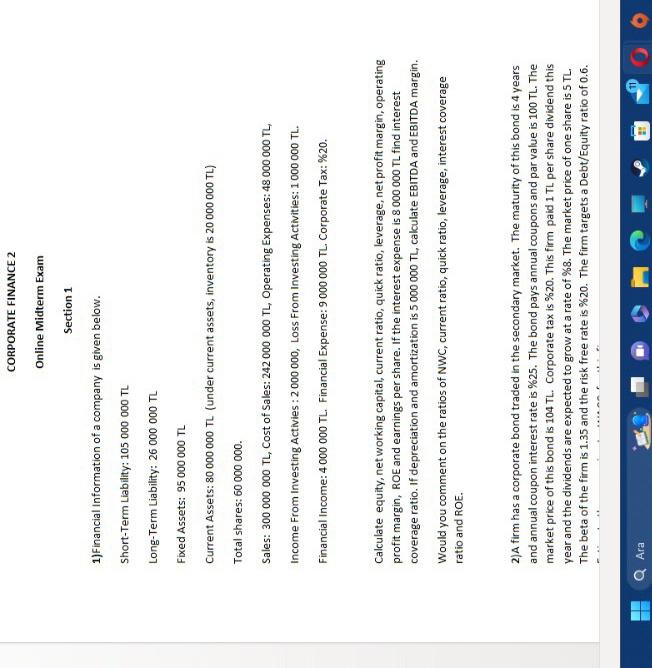

CORPORATE FINANCE 2 Online Midterm Exam Section 1 1)Financial Information of a company is given below. Short-Term Liability: 105000000TL Long-Term Liability: 26000000TL Fixed Assets: 95000000TL Current Assets: 80000000TL (under current assets, inventory is 20000000TL ) Total shares: 60000000 . Sales: 300000000 TL, Cost of Sales: 242000000 TL, Operating Expenses: 48000000 TL, Income From Investing Activies: 2000 000, Loss From Investing Activities: 1000000TL. Financial Income: 4000000 TL. Financial Expense: 9000000 TL. Corporate Tax: %20. Calculate equity, net working capital, current ratio, quick ratio, leverage, net profit margin, operating profit margin, ROE and earnings per share. If the interest expense is 8000000TL find interest coverage ratio. If depreciation and amortization is 5000000TL, calculate EBITDA and EBITDA margin. Would you comment on the ratios of NWC, current ratio, quick ratio, leverage, interest coverage ratio and ROE. 2)A firm has a corporate bond traded in the secondary market. The maturity of this bond is 4 years and annual coupon interest rate is %25. The bond pays annual coupons and par value is 100 TL. The market price of this bond is 104TL. Corporate tax is %20. This firm paid 1TL per share dividend this year and the dividends are expected to grow at a rate of %8. The market price of one share is 5TL. The beta of the firm is 1.35 and the risk free rate is %20. The firm targets a Debt/Equity ratio of 0.6 . CORPORATE FINANCE 2 Online Midterm Exam Section 1 1)Financial Information of a company is given below. Short-Term Liability: 105000000TL Long-Term Liability: 26000000TL Fixed Assets: 95000000TL Current Assets: 80000000TL (under current assets, inventory is 20000000TL ) Total shares: 60000000 . Sales: 300000000 TL, Cost of Sales: 242000000 TL, Operating Expenses: 48000000 TL, Income From Investing Activies: 2000 000, Loss From Investing Activities: 1000000TL. Financial Income: 4000000 TL. Financial Expense: 9000000 TL. Corporate Tax: %20. Calculate equity, net working capital, current ratio, quick ratio, leverage, net profit margin, operating profit margin, ROE and earnings per share. If the interest expense is 8000000TL find interest coverage ratio. If depreciation and amortization is 5000000TL, calculate EBITDA and EBITDA margin. Would you comment on the ratios of NWC, current ratio, quick ratio, leverage, interest coverage ratio and ROE. 2)A firm has a corporate bond traded in the secondary market. The maturity of this bond is 4 years and annual coupon interest rate is %25. The bond pays annual coupons and par value is 100 TL. The market price of this bond is 104TL. Corporate tax is %20. This firm paid 1TL per share dividend this year and the dividends are expected to grow at a rate of %8. The market price of one share is 5TL. The beta of the firm is 1.35 and the risk free rate is %20. The firm targets a Debt/Equity ratio of 0.6