correct numbers are shown. dont know how to get those. please help.

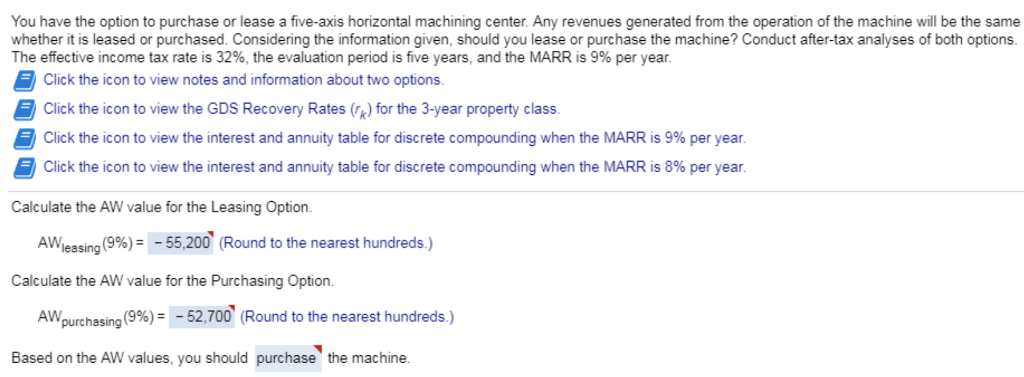

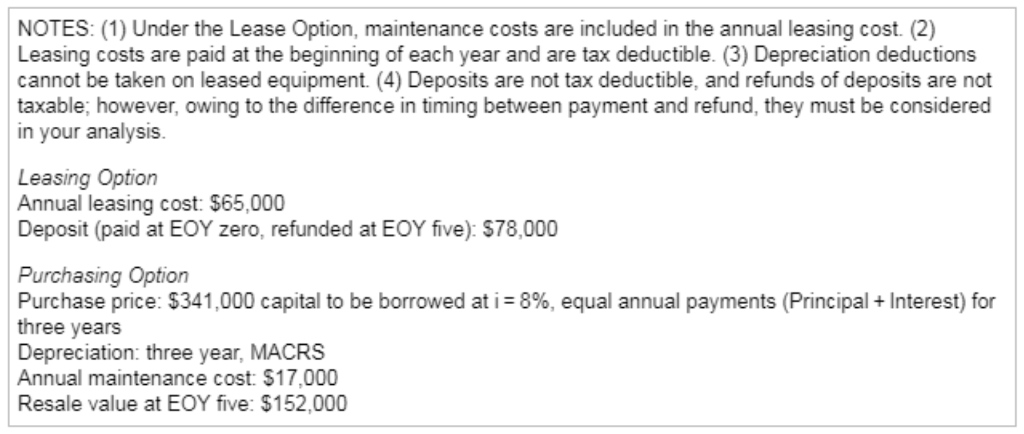

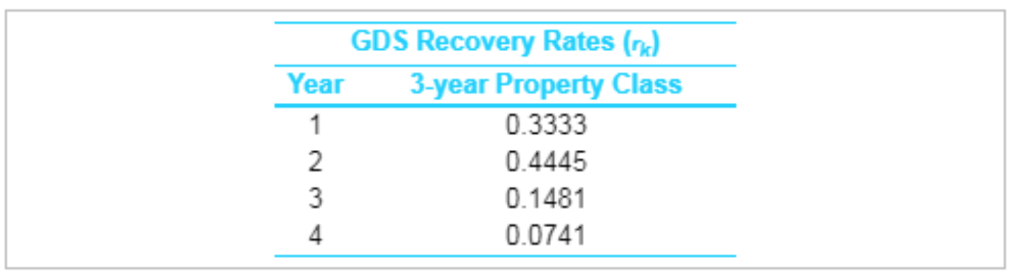

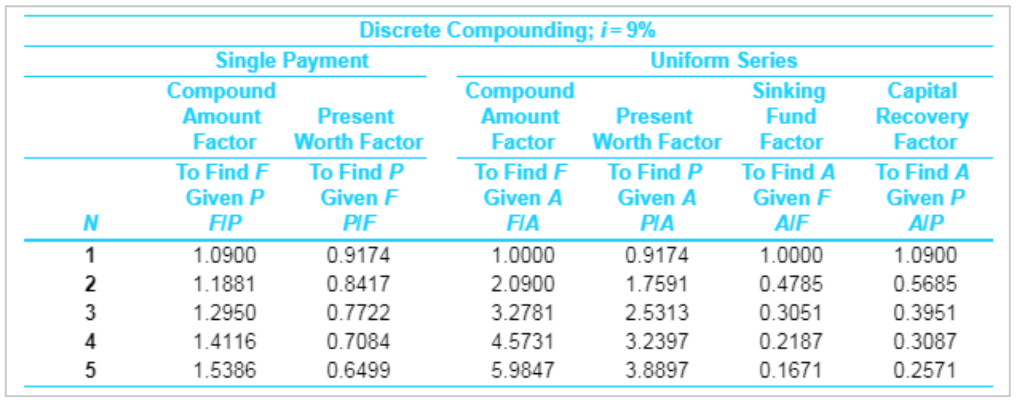

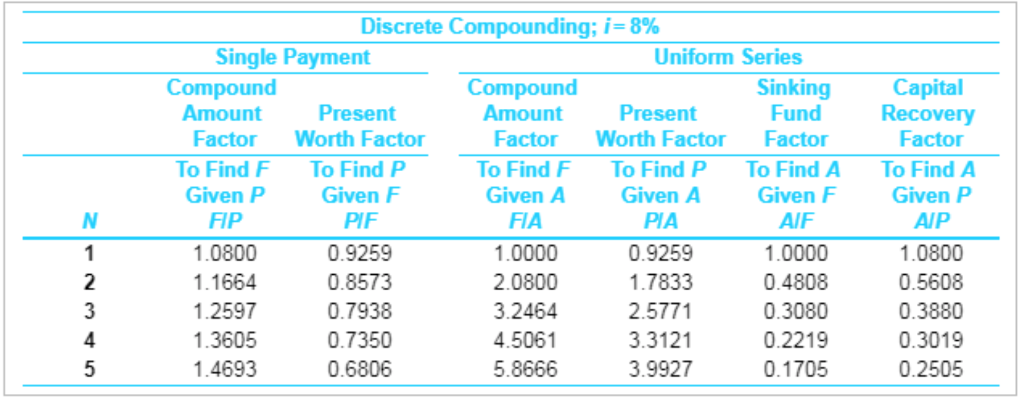

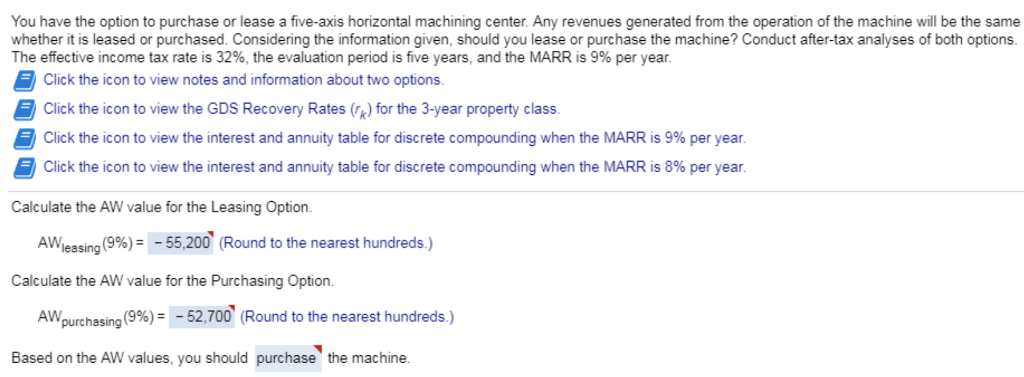

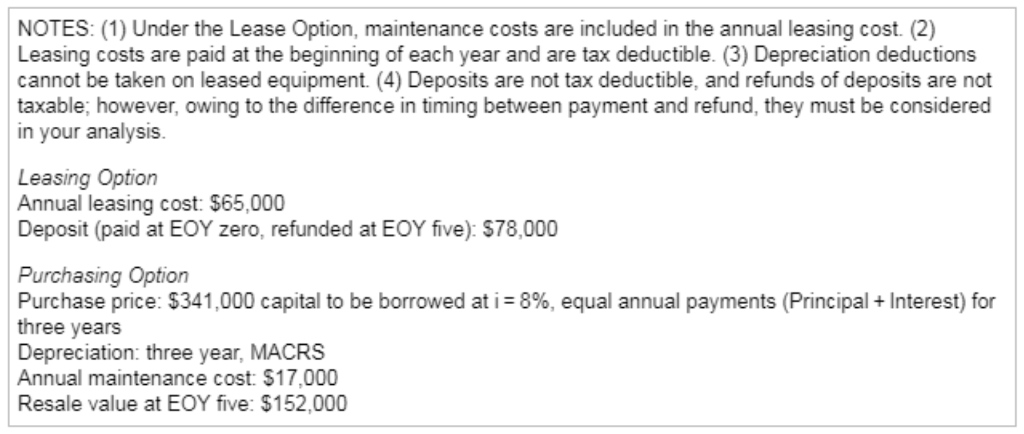

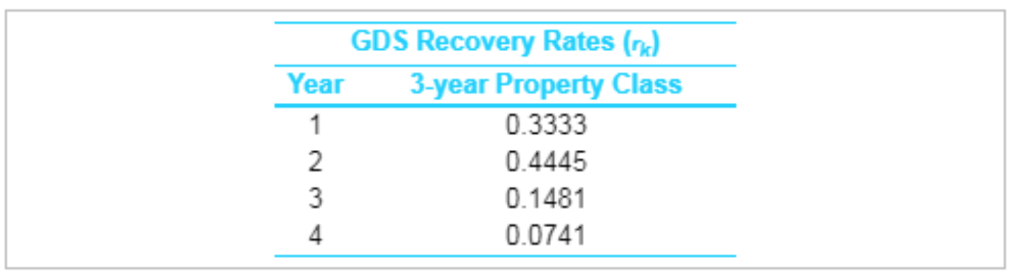

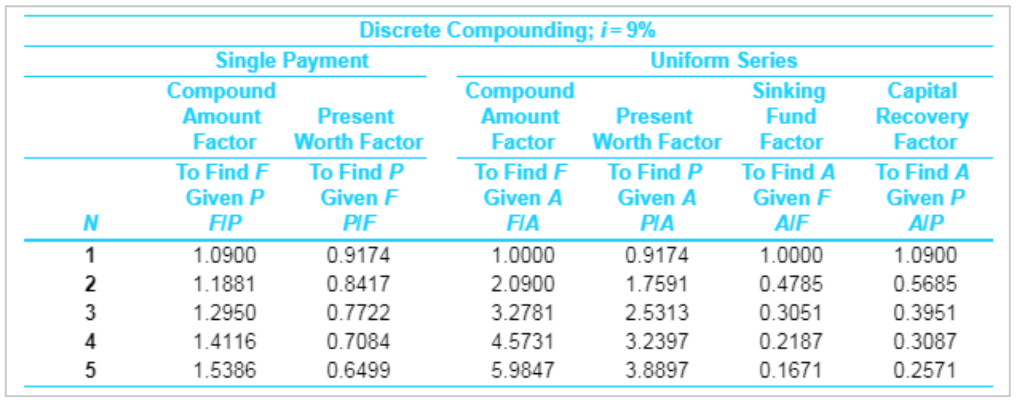

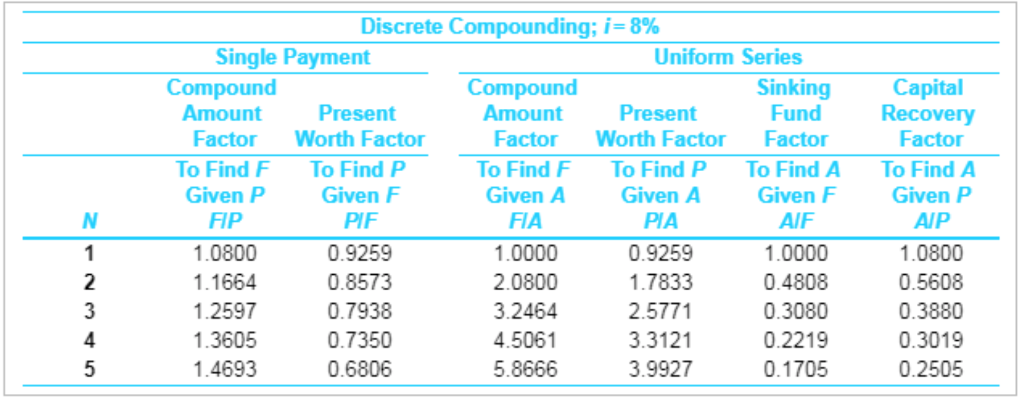

You have the option to purchase or lease a five-axis horizontal machining center. Any revenues generated from the operation of the machine will be the same whether it is leased or purchased. Considering the information given, should you lease or purchase the machine? Conduct after-tax analyses of both options. The effective income tax rate is 32%, the evaluation period is five years, and the MARR is 9% per year. Click the icon to view notes and information about two options. Click the icon to view the GDS Recovery Rates () for the 3-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 9% per year. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% per year. Calculate the AW value for the Leasing Option. AWeasing (9%) -55,200 (Round to the nearest hundreds.) Calculate the AW value for the Purchasing Option. AWpurchasing (9%) = -52,700 (Round to the nearest hundreds.) Based on the AW values, you should purchase the machine. NOTES: (1) Under the Lease Option, maintenance costs are included in the annual leasing cost. (2) Leasing costs are paid at the beginning of each year and are tax deductible. (3) Depreciation deductions cannot be taken on leased equipment. (4) Deposits are not tax deductible, and refunds of deposits are not taxable; however, owing to the difference in timing between payment and refund, they must be considered in your analysis Leasing Option Annual leasing cost: $65,000 Deposit (paid at EOY zero, refunded at EOY five): $78,000 Purchasing Option Purchase price: $341,000 capital to be borrowed at i 8%, equal annual payments (Principal Interest) for three years Depreciation: three year, MACRS Annual maintenance cost: $17,000 Resale value at EOY five: $152,000 + GDS Recovery Rates (n) 3-year Property Class Year 0.3333 1 0.4445 2 0.1481 4 0.0741 Discrete Compounding; i=9% Uniform Series Single Payment Compound Amount Capital Recovery Factor Compound Amount Sinking Fund Present Present Factor Worth Factor Factor Worth Factor Factor To Find P Given F To Find F To Find F To Find P To Find A To Find A Given A FIA Given P AIP Given P FIP Given A Given F PIA AIF PIF 1.0900 0.9174 1.0000 0.9174 1.0000 1.0900 1 2 1.1881 0.8417 2.0900 1.7591 0.4785 0.5685 1.2950 3.2781 3 0.7722 2.5313 0.3051 0.3951 4 3.2397 1,4116 0.7084 4.5731 0.2187 0.3087 1.5386 0.2571 5 0.6499 5.9847 3.8897 0.1671 Discrete Compounding; i=8% Single Payment Uniform Series Compound Amount Compound Amount Factor Sinking Capital Recovery Factor Present Present Fund Factor Worth Factor Worth Factor Factor To Find F Given A To Find F To Find P To Find P To Find A To Find A Given F Given P AIP Given A Given F Given P FIP PIF FIA PIA AIF 1.0800 0.9259 1.0000 0.9259 1.0800 1.0000 2 1.1664 0.8573 2.0800 1.7833 0.4808 0.5608 0.7938 1.2597 3.2464 2.5771 0.3080 0.3880 4.5061 4 1.3605 0.7350 3.3121 0.2219 0.3019 5.8666 5 1.4693 0.6806 3.9927 0.1705 0.2505 LO