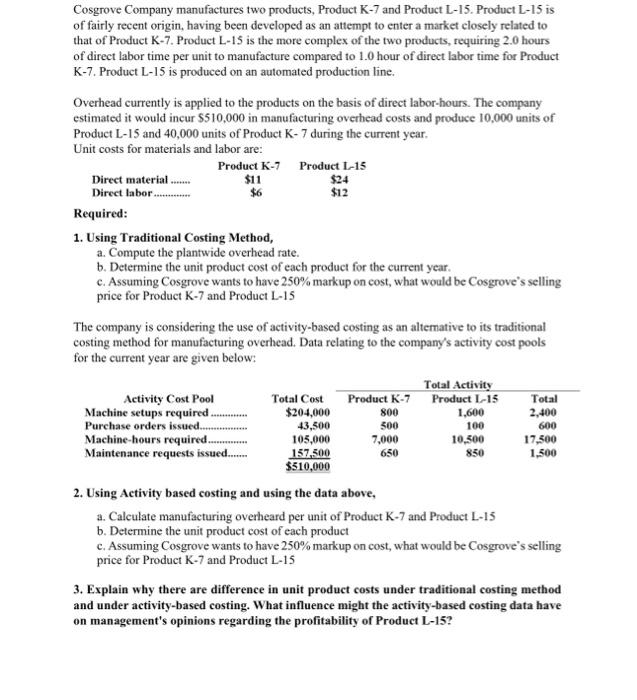

Cosgrove Company manufactures two products, Product K-7 and Product L-15. Product L-15 is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product K-7. Product L-15 is the more complex of the two products, requiring 2.0 hours of direct labor time per unit to manufacture compared to 1.0 hour of direct labor time for Product K7. Product L-15 is produced on an automated production line. Overhead currently is applied to the products on the basis of direct labor-hours. The company estimated it would incur $510,000 in manufacturing overhead costs and produce 10,000 units of Product L-15 and 40,000 units of Product K- 7 during the current year. Unit costs for materials and labor are: Required: 1. Using Traditional Costing Method, a. Compute the plantwide overhead rate. b. Determine the unit product cost of each product for the current year. c. Assuming Cosgrove wants to have 250% markup on cost, what would be Cosgrove's selling price for Product K-7 and Product L-15 The company is considering the use of activity-based costing as an altemative to its traditional costing method for manufacturing overhead. Data relating to the company's activity cost pools for the current year are given below: 2. Using Activity based costing and using the data above, a. Calculate manufacturing overheard per unit of Product K-7 and Product L-15 b. Determine the unit product cost of each product c. Assuming Cosgrove wants to have 250% markup on cost, what would be Cosgrove's selling price for Product K-7 and Product L-15 3. Explain why there are difference in unit product costs under traditional costing method and under activity-based costing. What influence might the activity-based costing data have on management's opinions regarding the profitability of Product L-15? Cosgrove Company manufactures two products, Product K-7 and Product L-15. Product L-15 is of fairly recent origin, having been developed as an attempt to enter a market closely related to that of Product K-7. Product L-15 is the more complex of the two products, requiring 2.0 hours of direct labor time per unit to manufacture compared to 1.0 hour of direct labor time for Product K7. Product L-15 is produced on an automated production line. Overhead currently is applied to the products on the basis of direct labor-hours. The company estimated it would incur $510,000 in manufacturing overhead costs and produce 10,000 units of Product L-15 and 40,000 units of Product K- 7 during the current year. Unit costs for materials and labor are: Required: 1. Using Traditional Costing Method, a. Compute the plantwide overhead rate. b. Determine the unit product cost of each product for the current year. c. Assuming Cosgrove wants to have 250% markup on cost, what would be Cosgrove's selling price for Product K-7 and Product L-15 The company is considering the use of activity-based costing as an altemative to its traditional costing method for manufacturing overhead. Data relating to the company's activity cost pools for the current year are given below: 2. Using Activity based costing and using the data above, a. Calculate manufacturing overheard per unit of Product K-7 and Product L-15 b. Determine the unit product cost of each product c. Assuming Cosgrove wants to have 250% markup on cost, what would be Cosgrove's selling price for Product K-7 and Product L-15 3. Explain why there are difference in unit product costs under traditional costing method and under activity-based costing. What influence might the activity-based costing data have on management's opinions regarding the profitability of Product L-15