Cost accounting p13-2 p13-3 p13-4

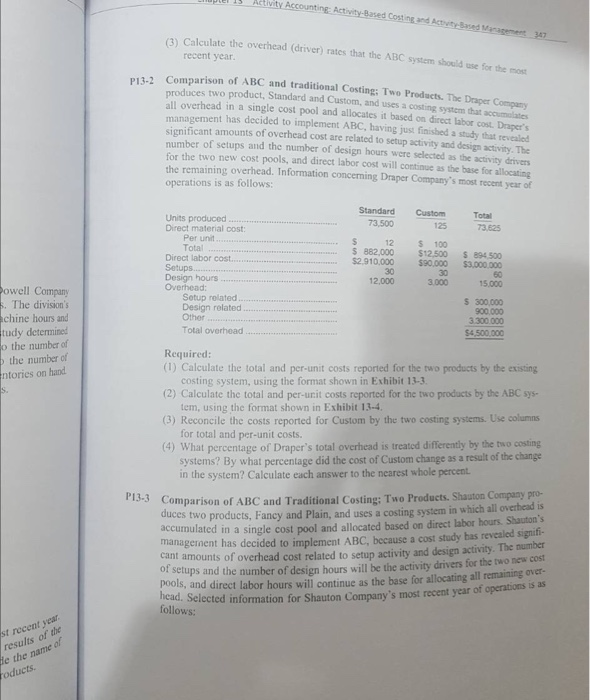

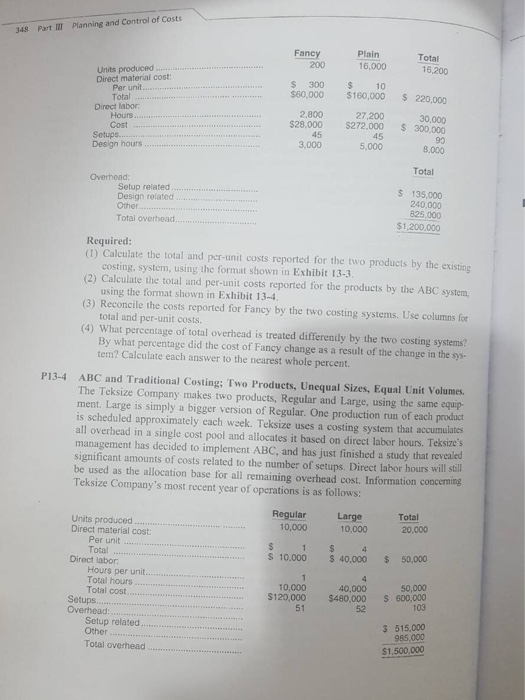

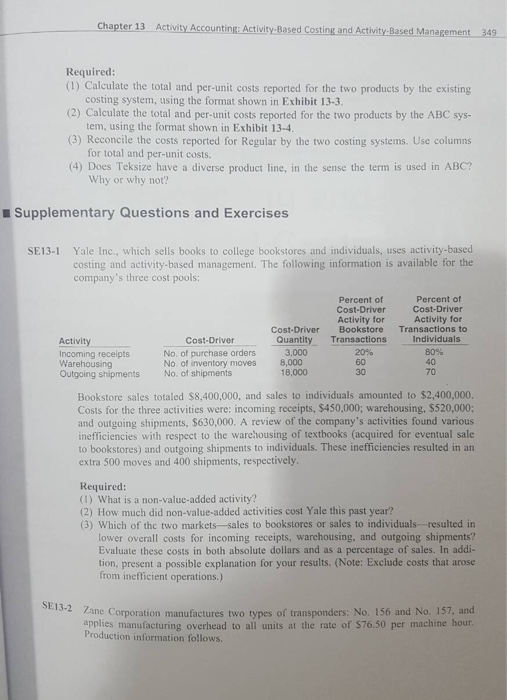

347 (3) Calculate the overhead (driver) rates that the ABC system shouid use for the mos recent year P13-2 Comparison of ABC and tradit roduces two product, Standard and Custom, and uses a costing system that accoumolates ional Costing: Two Products. The Draper Company all overhead in a single cost pool and allocates it based on direct labor cost. Draper's management has decided to implement ABC, having just finished a study that reveailod significant amounts of overhead cost are related to setup activity and design activity. The number of setups and the number of design hours were selected as the activity drivers for the two new cost pools, and direct labor cost will continue as the base for allocating the remaining overhead. Information concerning Draper Company's most recent year of operations is as follows StandardCustom 125 S 100 Total Units produced Direct material cost 73,500 Per unit Total $ 882,000 $12,500 $ 894 500 $90.000 $3,000.000 60 15.000 Direct labor cost... $2,910.000 30 Design hours. owell Company . The division's chine hours and tudy determined o the number of the number of ntories on hand Setup related Design related. 5 300,000 900,000 3.300000 54,500.000 Total overhead... Required: (1) Calculate the total and per-unit costs reported for the two products by the existing (2) Calculate the total and per-unit costs reported for the two products by the ABC sys- (3) Reconcile the costs reported for Custom by the two costing systems. Use columns costing system, using the format shown in Exhibit 13-3. tem, using the format shown in Exhibit 13-4 for total and per-unit costs (4) What percentage of Draper's total overhead is treated differently by the two costing systems? By what percentage did the cost of Custom change as a result of the change in the system? Calculate each answer to the nearest whole percent Comparison of ABC and Traditional Costing: Two Products. Shauton Company pro- ces two products, Fancy and Plain, and uses a costing system in which all overhead is e cost pool and allocated based on direct labor hours Shauton's managernent has decided to implement ABC, because a cost study has revealed signifi- amounts of overhead cost related to setup activity and design activity. The number setups and the number of design hours will be the activity drivers for the two new cost P13.3 accumulated in a sing hools, and direct labor hours will continue as the base for allocating all remaining over- head, selected information for Shauton Company's most recent year of operations is as follows: 347 (3) Calculate the overhead (driver) rates that the ABC system shouid use for the mos recent year P13-2 Comparison of ABC and tradit roduces two product, Standard and Custom, and uses a costing system that accoumolates ional Costing: Two Products. The Draper Company all overhead in a single cost pool and allocates it based on direct labor cost. Draper's management has decided to implement ABC, having just finished a study that reveailod significant amounts of overhead cost are related to setup activity and design activity. The number of setups and the number of design hours were selected as the activity drivers for the two new cost pools, and direct labor cost will continue as the base for allocating the remaining overhead. Information concerning Draper Company's most recent year of operations is as follows StandardCustom 125 S 100 Total Units produced Direct material cost 73,500 Per unit Total $ 882,000 $12,500 $ 894 500 $90.000 $3,000.000 60 15.000 Direct labor cost... $2,910.000 30 Design hours. owell Company . The division's chine hours and tudy determined o the number of the number of ntories on hand Setup related Design related. 5 300,000 900,000 3.300000 54,500.000 Total overhead... Required: (1) Calculate the total and per-unit costs reported for the two products by the existing (2) Calculate the total and per-unit costs reported for the two products by the ABC sys- (3) Reconcile the costs reported for Custom by the two costing systems. Use columns costing system, using the format shown in Exhibit 13-3. tem, using the format shown in Exhibit 13-4 for total and per-unit costs (4) What percentage of Draper's total overhead is treated differently by the two costing systems? By what percentage did the cost of Custom change as a result of the change in the system? Calculate each answer to the nearest whole percent Comparison of ABC and Traditional Costing: Two Products. Shauton Company pro- ces two products, Fancy and Plain, and uses a costing system in which all overhead is e cost pool and allocated based on direct labor hours Shauton's managernent has decided to implement ABC, because a cost study has revealed signifi- amounts of overhead cost related to setup activity and design activity. The number setups and the number of design hours will be the activity drivers for the two new cost P13.3 accumulated in a sing hools, and direct labor hours will continue as the base for allocating all remaining over- head, selected information for Shauton Company's most recent year of operations is as follows