Answered step by step

Verified Expert Solution

Question

1 Approved Answer

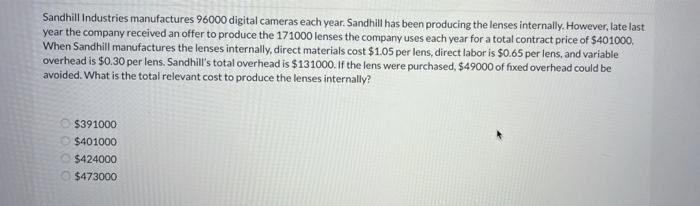

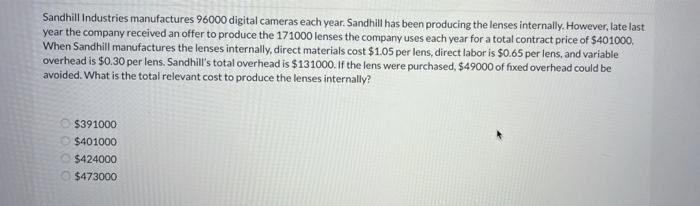

COST ACCT Sandhill Industries manufactures 96000 digital cameras each year. Sandhill has been producing the lenses internally. However, late last year the company received an

COST ACCT

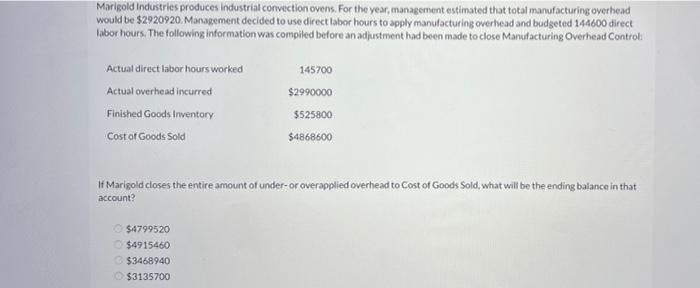

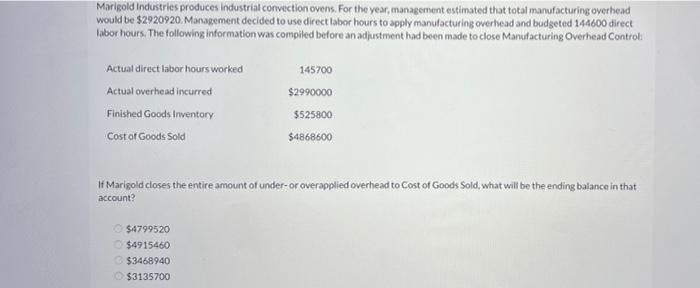

Sandhill Industries manufactures 96000 digital cameras each year. Sandhill has been producing the lenses internally. However, late last year the company received an offer to produce the 171000 lenses the company uses each year for a total contract price of $401000, When Sandhill manufactures the lenses internally, direct materials cost $1.05 per lens, direct labor is $0.65 per lens, and variable overhead is $0.30 per lens, Sandhill's total overhead is $131000. If the lens were purchased, $49000 of fixed overhead could be avoided. What is the total relevant cost to produce the lenses internally? $391000 $401000 $424000 $473000 Marigold industries produces Industrial convection overs. For the year, management estimated that total manufacturing overhead would be $2920920. Management decided to use direct labor hours to apply manufacturing overhead and budgeted 144600 direct labor hours. The following information was compiled before an adjustment had been made to close Manufacturing Overhead Control 145700 $2990000 Actual direct labor hours worked Actual overhead incurred Finished Goods Inventory Cost of Goods Sold $525800 $4868600 If Marigold closes the entire amount of under- or overapplied overhead to Cost of Goods Sold, what will be the ending balance in that account? $4799520 $4915460 $3468940 $3135700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started