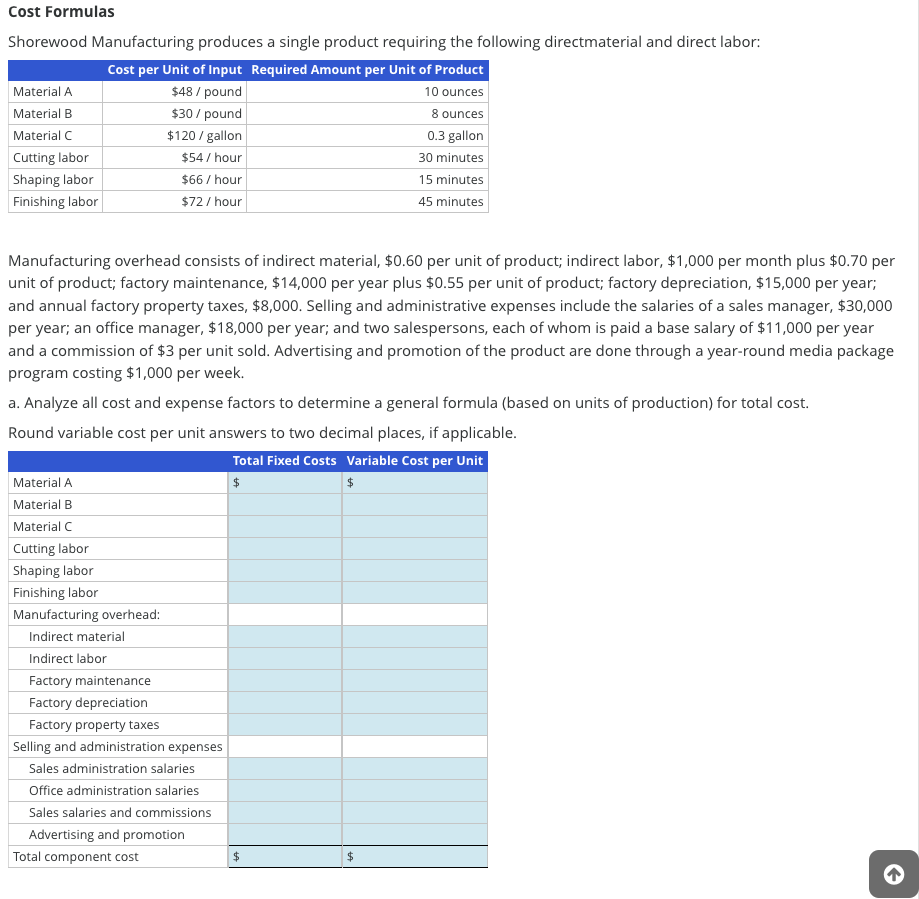

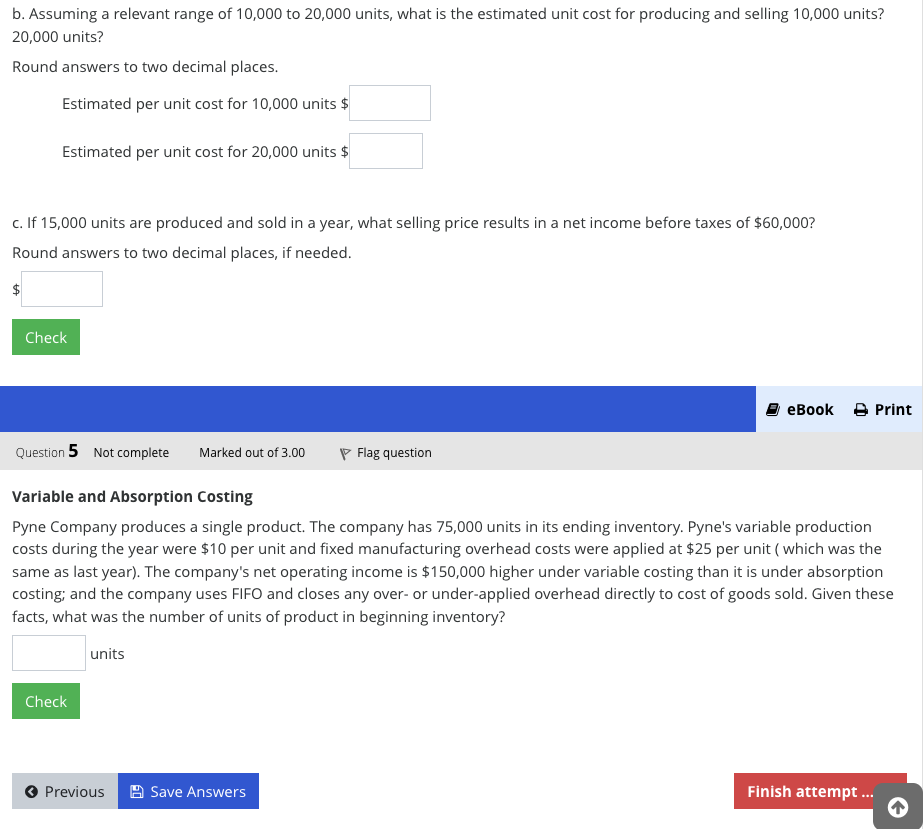

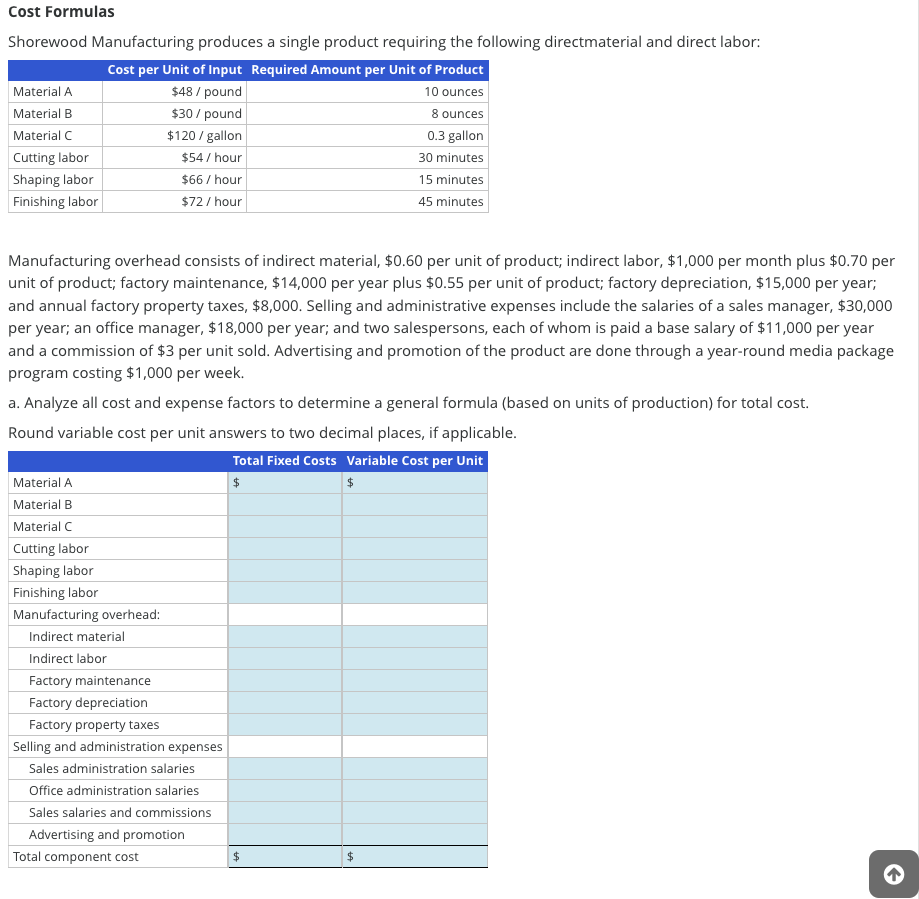

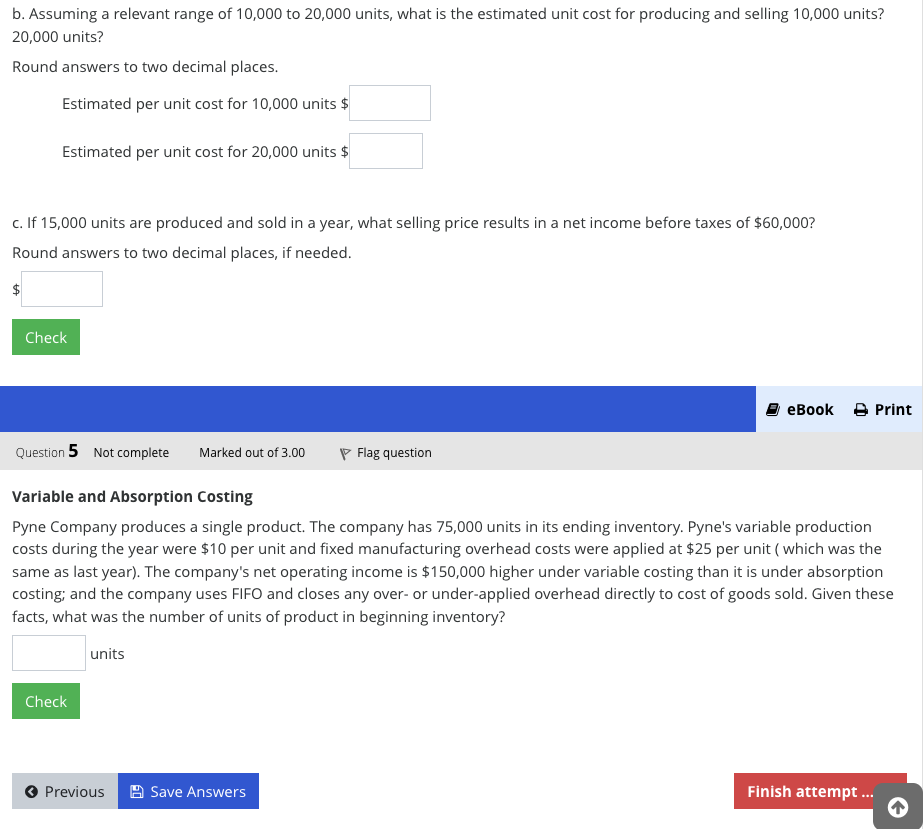

Cost Formulas Shorewood Manufacturing produces a single product requiring the following directmaterial and direct labor: Manufacturing overhead consists of indirect material, $0.60 per unit of product; indirect labor, $1,000 per month plus $0.70 per unit of product; factory maintenance, $14,000 per year plus $0.55 per unit of product; factory depreciation, $15,000 per year; and annual factory property taxes, $8,000. Selling and administrative expenses include the salaries of a sales manager, $30,000 per year; an office manager, $18,000 per year; and two salespersons, each of whom is paid a base salary of $11,000 per year and a commission of $3 per unit sold. Advertising and promotion of the product are done through a year-round media package program costing $1,000 per week. a. Analyze all cost and expense factors to determine a general formula (based on units of production) for total cost. Round variable cost per unit answers to two decimal places, if applicable. b. Assuming a relevant range of 10,000 to 20,000 units, what is the estimated unit cost for producing and selling 10,000 units? 20,000 units? Round answers to two decimal places. Estimated per unit cost for 10,000 units $ Estimated per unit cost for 20,000 units $ c. If 15,000 units are produced and sold in a year, what selling price results in a net income before taxes of $60,000 ? Round answers to two decimal places, if needed. $ Question 5 P Flag question Variable and Absorption Costing Pyne Company produces a single product. The company has 75,000 units in its ending inventory. Pyne's variable production costs during the year were $10 per unit and fixed manufacturing overhead costs were applied at $25 per unit ( which was the same as last year). The company's net operating income is $150,000 higher under variable costing than it is under absorption costing; and the company uses FIFO and closes any over-or under-applied overhead directly to cost of goods sold. Given these facts, what was the number of units of product in beginning inventory? units Cost Formulas Shorewood Manufacturing produces a single product requiring the following directmaterial and direct labor: Manufacturing overhead consists of indirect material, $0.60 per unit of product; indirect labor, $1,000 per month plus $0.70 per unit of product; factory maintenance, $14,000 per year plus $0.55 per unit of product; factory depreciation, $15,000 per year; and annual factory property taxes, $8,000. Selling and administrative expenses include the salaries of a sales manager, $30,000 per year; an office manager, $18,000 per year; and two salespersons, each of whom is paid a base salary of $11,000 per year and a commission of $3 per unit sold. Advertising and promotion of the product are done through a year-round media package program costing $1,000 per week. a. Analyze all cost and expense factors to determine a general formula (based on units of production) for total cost. Round variable cost per unit answers to two decimal places, if applicable. b. Assuming a relevant range of 10,000 to 20,000 units, what is the estimated unit cost for producing and selling 10,000 units? 20,000 units? Round answers to two decimal places. Estimated per unit cost for 10,000 units $ Estimated per unit cost for 20,000 units $ c. If 15,000 units are produced and sold in a year, what selling price results in a net income before taxes of $60,000 ? Round answers to two decimal places, if needed. $ Question 5 P Flag question Variable and Absorption Costing Pyne Company produces a single product. The company has 75,000 units in its ending inventory. Pyne's variable production costs during the year were $10 per unit and fixed manufacturing overhead costs were applied at $25 per unit ( which was the same as last year). The company's net operating income is $150,000 higher under variable costing than it is under absorption costing; and the company uses FIFO and closes any over-or under-applied overhead directly to cost of goods sold. Given these facts, what was the number of units of product in beginning inventory? units