Answered step by step

Verified Expert Solution

Question

1 Approved Answer

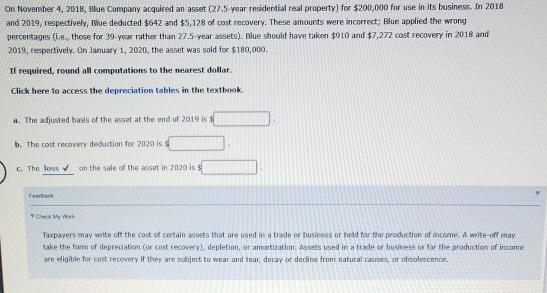

On November 4, 2018, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2018 and 2019,

On November 4, 2018, Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business. In 2018 and 2019, respectively, Blue deducted $642 and $3,128 of cost recovery. These amounts were incorrect; Blue applied the wrong percentages (ie., those for 39 year rather than 27.5 year assets). Blue should have taken $910 and $7,272 cost recovery in 2018 and 2019, respectively. On January 1, 2020, the asset was sold for $180,000, If required, round all computations to the nearest dollar. Click here to access the depreciation tables in the texthook. a. The adjusted basis of the asset at the end of 2019 is b. The cost recovery deduction for 2020 is C. The loss V on the sale of the asset in 2020 is Peectuck FCheck Vy Wrk Taxpayers may write oft the cost of certain assets that are used in a trade or business or held for the production of income, A write-off may take the form of depreciation (or cost recovery), depletion, or amortization. Assets used in a trade or business or for the production of income are eligible for cost recovery if they are subject to wear and tear, decay or decine from natural causes, or obsolescence.

Step by Step Solution

★★★★★

3.44 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Cost of Asset 200000 Less Greater of allowed and allowable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d8b27044fb_176596.pdf

180 KBs PDF File

635d8b27044fb_176596.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started