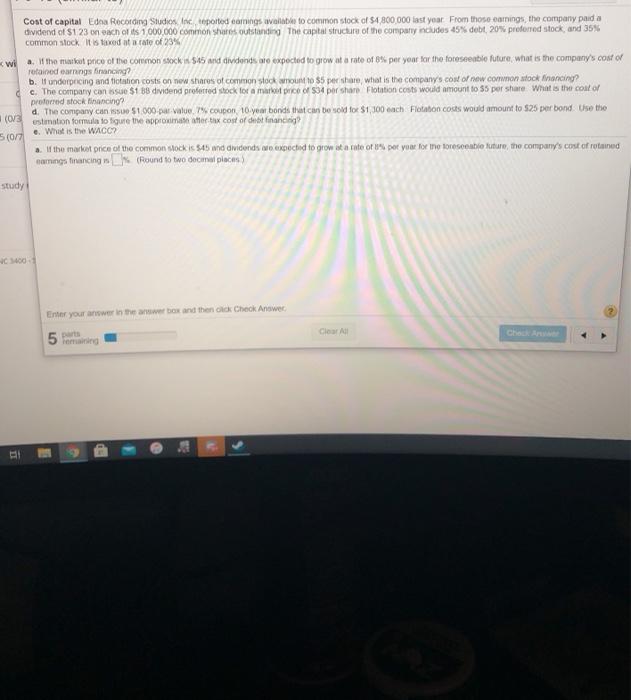

Cost of capital Edna Recording Studies Inc. teported comings volle to common stock of $4,800.000 last year From those comings, the company paida dividend of $123 DOMAS 1.000.000 common shares outstanding the capital structure of the company includes 45% debt, 20% proferred stock, and 35% common stock laxed at tale of 23% Wi a. W the market price of the common stock in $45 and dividends are expected to grow at a rate of 8% per year for the foreseeable future, what is the company's cost of retained earnings financing? b. If underpricing and fittion costs on new shares of common stock out to $5 per share, what is the company's cost of new common stock inancing dc. The company can se $1 8 dividend proferred stock for a market price of 534 per share Flotation costs would amount to 55 per share. What is the cost of proferred stock inancing d. The company can 1.000 par Value Coupon 10 year bonds that can be sold for $1,300 each Flotation costs would amount to $25 per bond. Use the (03 estimation formula do ligue te approximate after tax cost of debt financing e. What is the WACC? 5(017 a. If the markot price of the common stock is $45 and dividends we expected to grow at a toto or as per yone tor me toresonatio future, the company's cost of retained namang hinancing (Round to two decimal places study 100 Enter your answer in the box and then ack Check Answer Clear All 5 parts org Cost of capital Edna Recording Studies Inc. teported comings volle to common stock of $4,800.000 last year From those comings, the company paida dividend of $123 DOMAS 1.000.000 common shares outstanding the capital structure of the company includes 45% debt, 20% proferred stock, and 35% common stock laxed at tale of 23% Wi a. W the market price of the common stock in $45 and dividends are expected to grow at a rate of 8% per year for the foreseeable future, what is the company's cost of retained earnings financing? b. If underpricing and fittion costs on new shares of common stock out to $5 per share, what is the company's cost of new common stock inancing dc. The company can se $1 8 dividend proferred stock for a market price of 534 per share Flotation costs would amount to 55 per share. What is the cost of proferred stock inancing d. The company can 1.000 par Value Coupon 10 year bonds that can be sold for $1,300 each Flotation costs would amount to $25 per bond. Use the (03 estimation formula do ligue te approximate after tax cost of debt financing e. What is the WACC? 5(017 a. If the markot price of the common stock is $45 and dividends we expected to grow at a toto or as per yone tor me toresonatio future, the company's cost of retained namang hinancing (Round to two decimal places study 100 Enter your answer in the box and then ack Check Answer Clear All 5 parts org