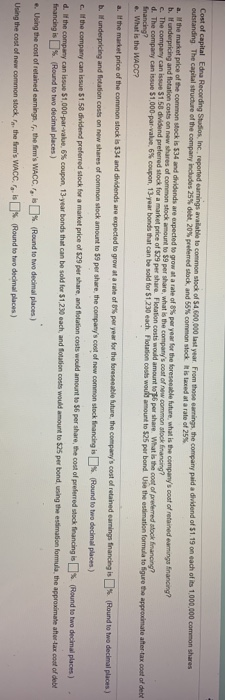

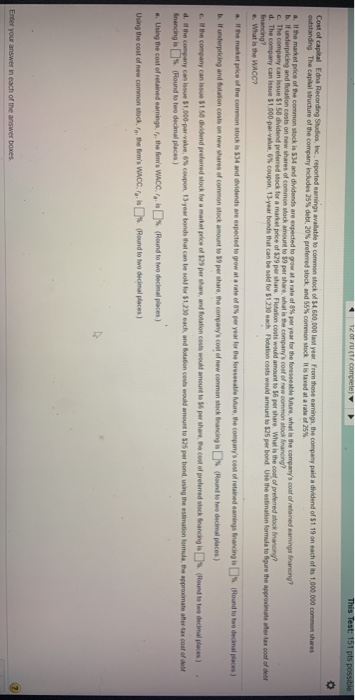

Cost of capital Edna Recording Studios, Inc. reported earnings available to common stock of $4,600,000 last year. From those earnings, the company paid a dividend of $1 19 on each of its 1.000.000 common shares outstanding the capital structure of the company Indiades 25% debt 20 preferred stock and 55% common stock is faced at a rate of 25% a. the market price of the common stockis 34 and dividends are expected to grow at a rate of 6% per year for the foreseeable future, what is the company's cost of retained earnings financing? b. If underpricing and flotation costs on new shares of common stock amount to $9 per share, what is the company's cost of new common stock nanong? c. The company can issue 51.58 dividend preferred stock for a market price of $29 per share. Flotation costs would amount 56 per share. What is the cost of preferred stock financing d. The company can issue $1.000 par value 6% coupon, 13-year bonds that can be sold for $1230 each Flotation costs would amount to $25 per bond Use the estimation formula to figure the approximate after tax cost of debt financing e. What is the WACC? a. If the market price of the common stock is $34 and dividends are expected to grow at a rate of per year for the foreseeable future, the company's cost of retained earnings financing is % (Hound to two decimal places) b. Wunderpricing and tation costs on new shares of common stock amount to 59 per share the company's cost of new common stock financing is (Round to two decimal places) the company can issue $158 dividend preferred stock for a market price of $29 per share, and flotation costs would amount to 56 per share the cost of preferred stock financing is Round to two decimal places) d. If the company can issue $1,000-par-value 6% coupon, 13-year bonds that can be sold for $1.250 each, and fotation costs would amount to 25 per bond, using the estimation formula, the approximate after tax cost of debt financing is (Round to two decimal places) .. Using the cost of retained earnings.. the firm's WACC., % (Round to two decimal places) Using the cost of new common stock, to the firm's WACC is 1% (Round to two decimal places) 12 of completely This Test: 151 pts possible Cost of capital Edna Recording Studios, he reported earnings available to common stock of 54,600,000 last year from those earnings, the company paid a dividend of 51 19 on each of its 1.000.000 common shares outstanding the capital structure of the company Indudes 25% debt, 20% preferred stock and 55% Common stock It is taxed at a rate of 25% all the market price of the common stockis 34 and dividends are expected to grow at a rate of per year for the foreseeable ture, what is the company's cost of retained eaming nancing b. If underpricing and location costs on new shares of common stock amount to 9 per share, what is the company's cost of new como fock Rancing? C. The company can issue $1.50 dividend preferred stock for a market price of 29 per share. Flotation costs would amount to 56 per share. What is the cost of preferred to inanong? d. The company can b e $1.000 pat value 6 coupon, 13-year bonds that can be sold for 51230 each otion costs would amount to $25 per bond Use the estimation formula to figure the approximate lax cost of debt financing e. What is the WACC? a. If the market price of the common stock is $34 and vidends are expected to grow at a rate of os per year for the foreseeable are the company's cost of retained earnings financing s o und to two decimal places) b. I underpricing and flation costs on new shares of common stock amount to 59 per share the company's cost of new common stock financing s o und to two decimal places) c. W the company can dividend preferred stock for a market price of per share and fortation costs would amount to per share out of preferred stock inancing s d. of the company cas e $1.000 par value coupon 1 year bonds that can be so for $1.250 each, and folation costs would amount to $25 per band using the estimation for financing is Round to two decimal places) o und to decimal places) the approdate after tax cost of door .. Using the cost of retained earnings the 'WACC. (Round to two decimal places) Using the cost of new common stock the firm's WACC. (Round to two decimal places) Emner your answer in each of the answer boxes