Question

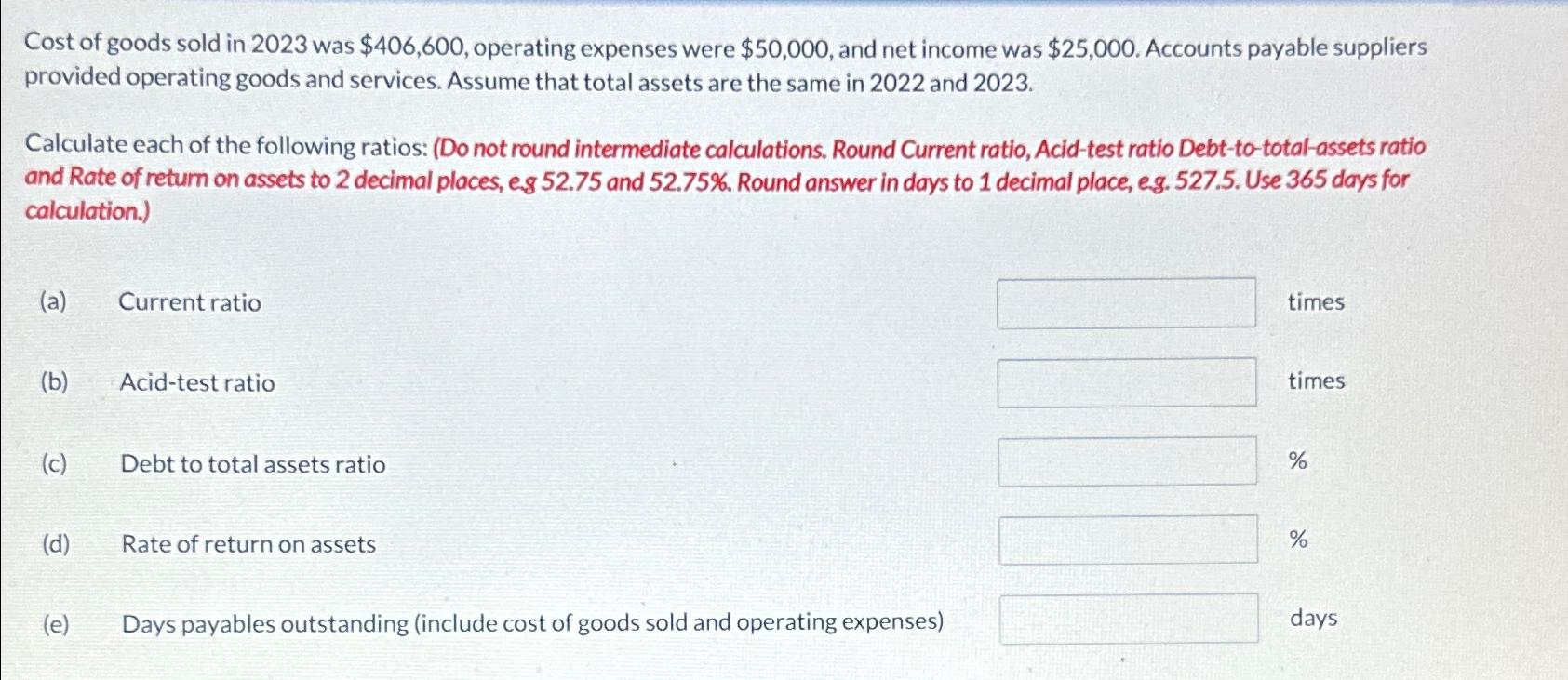

Cost of goods sold in 2023 was $406,600 , operating expenses were $50,000 , and net income was $25,000 . Accounts payable suppliers provided operating

Cost of goods sold in 2023 was

$406,600, operating expenses were

$50,000, and net income was

$25,000. Accounts payable suppliers provided operating goods and services. Assume that total assets are the same in 2022 and 2023.\ Calculate each of the following ratios: (Do not round intermediate calculations. Round Current ratio, Acid-test ratio Debt-to-total-assets ratio and Rate of return on assets to 2 decimal places, es 52.75 and

52.75%. Round answer in days to 1 decimal place, eg. 527.5. Use 365 days for calculation.)\ (a) Current ratio\ times\ (b) Acid-test ratio\ times\ (c) Debt to total assets ratio\

%\ (d) Rate of return on assets\

%\ (e) Days payables outstanding (include cost of goods sold and operating expenses)\ days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started