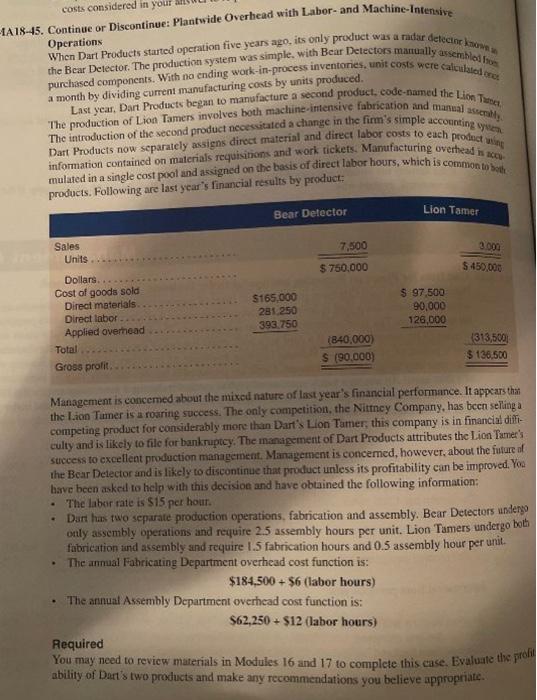

costs considered in your 1418-45. Continue or Discontinue: Plantwide Overhead with Labor- and Machine-Intensive Operations a month by dividing current manufacturing costs by units produced When Dart Products started operation tive years ago, its only product was a radar detecting purchased components. With no ending work-in-process inventores, unit costs were calculator the Bear Detector. The production system was simple, with Bear Detectors manually assemblaitos Last year, Dart Products began to manufacture a second product code-named the Lion The The production of Lion Tamers involves both machine intensive fabrication and manual analy The introduction of the second product nccessitated a change in the firm's simple accounting information contained on materials requisitions and work tickets. Manufacturing overhead is Dart Products now separately assiens direct material and direct labor costs to each produce mulated in a single cost pool and assigned on the basis of direct labor hours, which is common to both products. Following are last year's financial results by product: Lion Tamer Bear Detector 3.000 Sales Units 7.500 $ 750.000 $ 450,000 Dollars. Cost of goods sold Direct materials Direct labor Applied overhead Total Gross profit $165.000 281 250 393 750 $ 97 500 90,000 126,000 1840,000) $ (90,000) (313,500 $ 136,500 Management is concemed about the mixed nature of last year's financial performance. It appears that the Lion Tamer is a roaring success. The only competition, the Nittney Company, has been selling a competing product for considerably more than Dart's Lion Tamer, this company is in financial diffi- culty and is likely to file for bankruptcy. The management of Dart Products attributes the Lion Tamer's success to excellent production management Management is concered, however, about the future of the Bear Detector and is likely to discontinue that product unless its profitability can be improved. You have been asked to help with this decision and have obtained the following information: The labor rate is $15 per hour. Dart has two separate production operations, fabrication and assembly. Bear Detectors undergo only assembly operations and require 2.5 assembly hours per unit. Lion Tamers undergo both fabrication and assembly and require 1.5 fabrication hours and 0.5 assembly hour per unit. The annual Fabricating Department overhead cost function is: $184,500 + 56 (labor hours) The annual Assembly Department overhead cost function is: $62,250 + $12 (labor hours) Required You may need to review materials in Modules 16 and 17 to complete this case. Evaluate the pro ability of Dart's two products and make any recommendations you believe appropriate costs considered in your 1418-45. Continue or Discontinue: Plantwide Overhead with Labor- and Machine-Intensive Operations a month by dividing current manufacturing costs by units produced When Dart Products started operation tive years ago, its only product was a radar detecting purchased components. With no ending work-in-process inventores, unit costs were calculator the Bear Detector. The production system was simple, with Bear Detectors manually assemblaitos Last year, Dart Products began to manufacture a second product code-named the Lion The The production of Lion Tamers involves both machine intensive fabrication and manual analy The introduction of the second product nccessitated a change in the firm's simple accounting information contained on materials requisitions and work tickets. Manufacturing overhead is Dart Products now separately assiens direct material and direct labor costs to each produce mulated in a single cost pool and assigned on the basis of direct labor hours, which is common to both products. Following are last year's financial results by product: Lion Tamer Bear Detector 3.000 Sales Units 7.500 $ 750.000 $ 450,000 Dollars. Cost of goods sold Direct materials Direct labor Applied overhead Total Gross profit $165.000 281 250 393 750 $ 97 500 90,000 126,000 1840,000) $ (90,000) (313,500 $ 136,500 Management is concemed about the mixed nature of last year's financial performance. It appears that the Lion Tamer is a roaring success. The only competition, the Nittney Company, has been selling a competing product for considerably more than Dart's Lion Tamer, this company is in financial diffi- culty and is likely to file for bankruptcy. The management of Dart Products attributes the Lion Tamer's success to excellent production management Management is concered, however, about the future of the Bear Detector and is likely to discontinue that product unless its profitability can be improved. You have been asked to help with this decision and have obtained the following information: The labor rate is $15 per hour. Dart has two separate production operations, fabrication and assembly. Bear Detectors undergo only assembly operations and require 2.5 assembly hours per unit. Lion Tamers undergo both fabrication and assembly and require 1.5 fabrication hours and 0.5 assembly hour per unit. The annual Fabricating Department overhead cost function is: $184,500 + 56 (labor hours) The annual Assembly Department overhead cost function is: $62,250 + $12 (labor hours) Required You may need to review materials in Modules 16 and 17 to complete this case. Evaluate the pro ability of Dart's two products and make any recommendations you believe appropriate