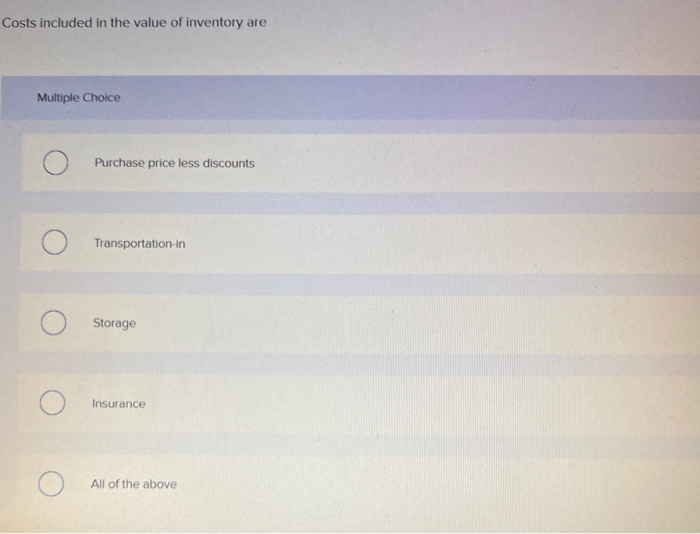

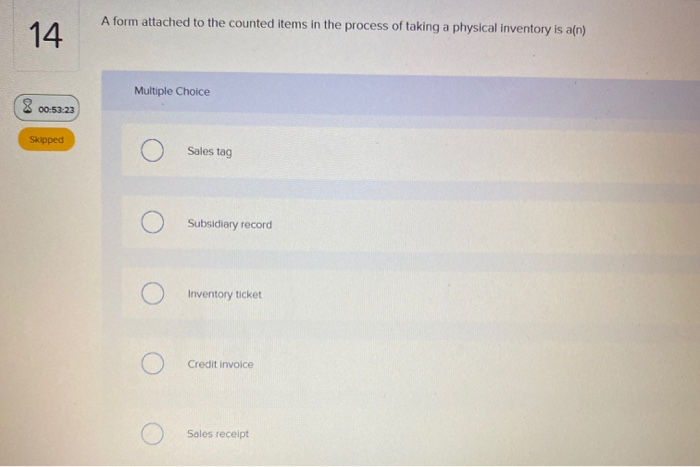

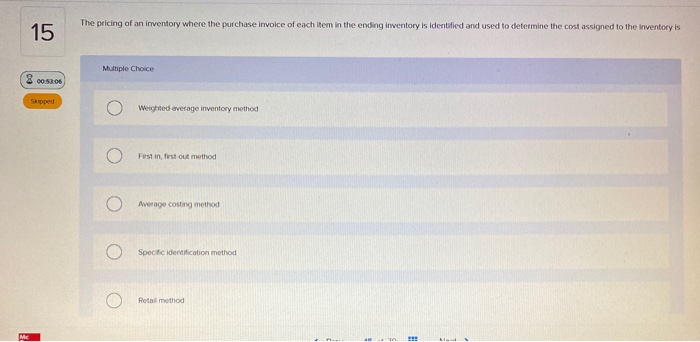

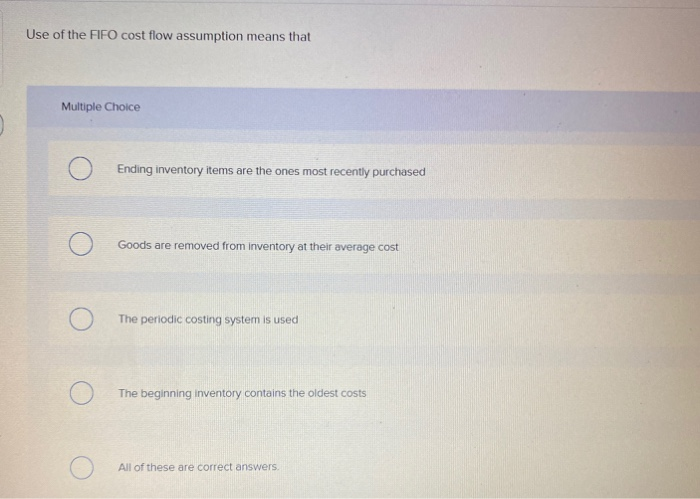

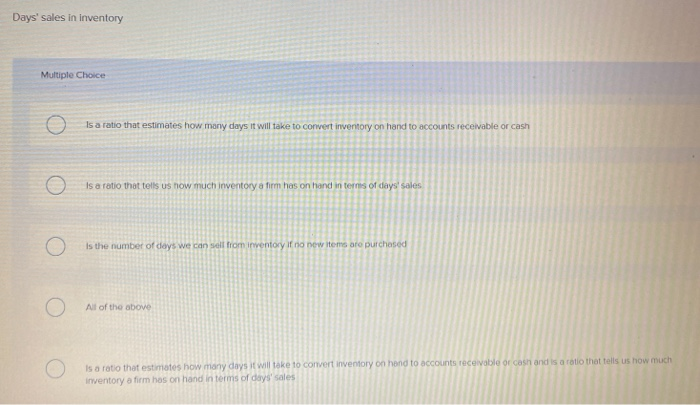

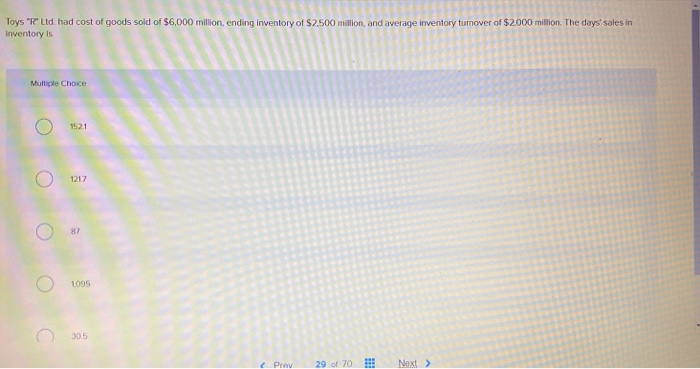

Costs included in the value of inventory are Multiple Choice Purchase price less discounts 0 Transportation in Storage Insurance All of the above A form attached to the counted items in the process of taking a physical inventory is an) 14 Multiple Choice 8 00:53:23 Skipped Sales tag O Subsidiary record Inventory ticket O Credit invoice Sales receipt The pricing of an inventory where the purchase invoice of each item in the ending inventory is identified and used to determine the cost assigned to the inventory is 15 Multiple Choice 8 00:53:00 Skipped Weighted average inventory method O First in, first-out method Average costing method O Specific identification method O Retal method ME Use of the FIFO Cost flow assumption means that Multiple Choice Ending inventory items are the ones most recently purchased Goods are removed from inventory at their average cost The periodic costing system is used The beginning inventory contains the oldest costs All of these are correct answers e full disclosure principle Multiple Choice O Requires that when a change in inventory cost flow assumption is made, the notes to the statements report the type of change Requires that when a change in inventory cost flow assumption is made, the notes to the statements report the justification for the change Requires that any change in net income due to changes in the inventory cost assumption be disclosed Does not require o company to use one cost flow assumption exclusively All of the above During a period of steadily rising prices, which inventory cost flow assumption results in reporting the highest inventory value? Multiple Choice Specific identification Average cost Moving weighted average FIFO Any of the above In the process of adjusting inventory, how can the lower of cost and net realizable value be applied to the ending inventory? Multiple Choice The inventory as a whole Current replacement cost Current sales price To groups of similar or related Items Purchase price Because an inventory error causes an offsetting error in the next period, Multiple Choice Managers can ignore the error. It is sometimes said to be self-correcting It affects only income statement accounts. If affects only balance sheet accounts. Managers can ignore the error and it is sometimes said to be self-correcting Days' sales in inventory Multiple Choice Is a ratio that estimates how many days it will take to convert inventory on hand to accounts receivable or cash Is a ratio that tells us how much inventory a firm has on hand in ternis of days sales Is the number of days we can sell from inventory if no new items are purchased All of the above is a ratio that estimates how many days it will take to convert inventory on hand to accounts receivable or cash and is a roto that tells us how much Inventory a firm has on hand in terms of days' sales Toys R Ltd. had cost of goods sold of $6,000 million, ending Inventory of $2.500 million, and average inventory turnover of $2.000 million. The days' sales in Inventory is Multiple Choice 1521 1217 82 1095 30.5