Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cost-Volume-Profit Analysis: Variable cost, variable cost ratio, contribution margin, break even point (units), break-even point (sales), operating income, sales dollars that need to be earned

Cost-Volume-Profit Analysis: Variable cost, variable cost ratio, contribution margin, break even point (units), break-even point (sales), operating income, sales dollars that need to be earned

This is for a review im doing, if you could show your work I would appreciate it. Im going to be using this to check against the work im doing, and I want to know how to fix something if i get it wrong. If you could make it easy to determine what answer goes where i woudl appreciate it. Thank you!

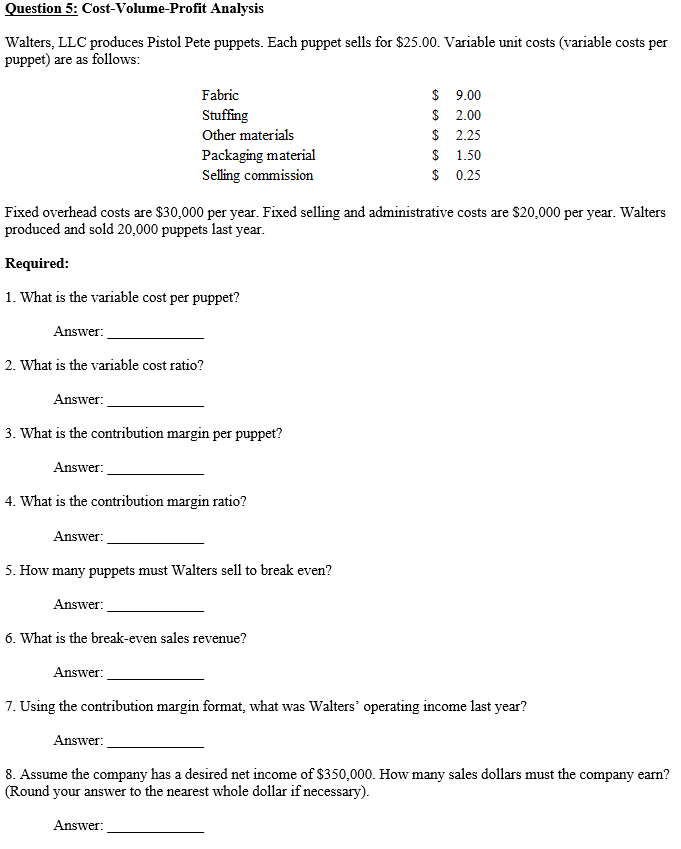

Question 5: Cost-Volume-Profit Analysis Walters, LLC produces Pistol Pete puppets. Each puppet sells for $25.00. able unit costs (variable costs per puppet) are as follows Fabric 9.00 Stuffing 2.00 Other materials 2.25 Packaging material 1.50 Selling commission 0.25 Fixed overhead costs are $30,000 per year. Fixed selling and administrative costs are $20,000 per year. Walters produced and sold 20,000 puppets last year. Required: 1. What is the variable cost per puppet? Answer: 2. What is the variable cost ratio Answer: 3. What is the contribution margin per puppet? Answer: 4. What is the contribution margin ratio? Answer: 5. How many puppets must Walters sell to break even? Answer: 6. What is the break-even sales revenue? Answer: 7. Using the contribution margin format, what was Walters' operating income last year? Answer: 8. Assume the company has a desired net income of $350,000. How many sales dollars must the company earn? Round your answer to the nearest whole dollar if necessary)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started