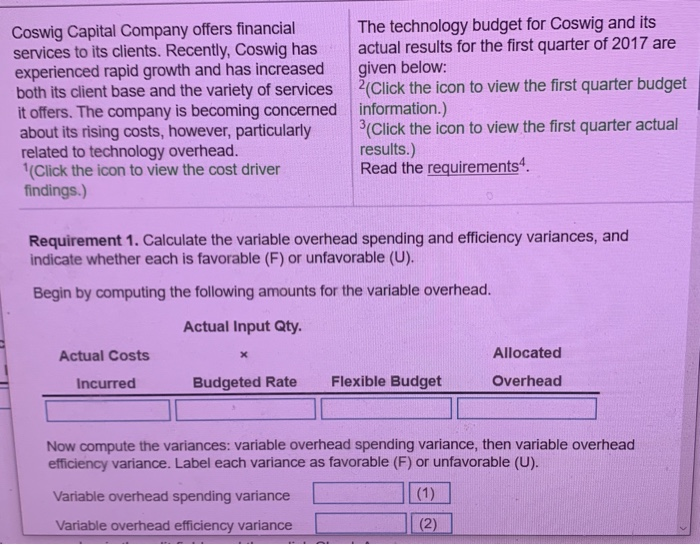

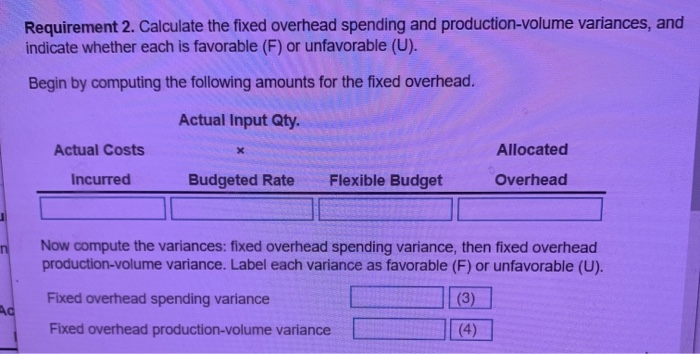

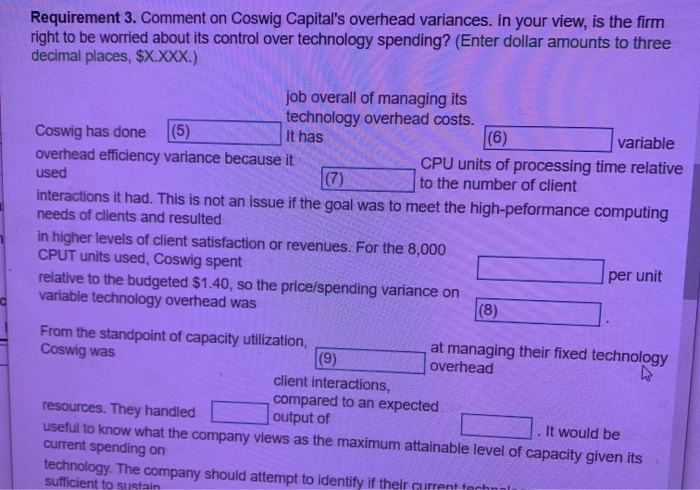

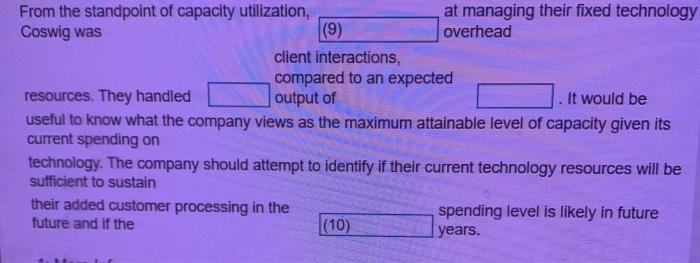

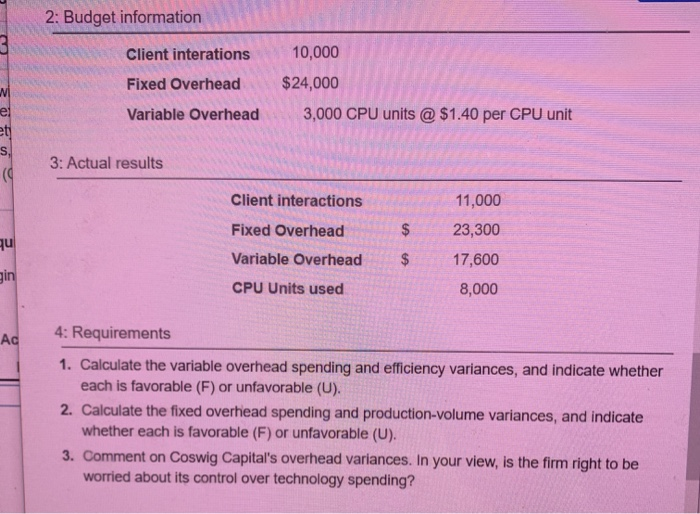

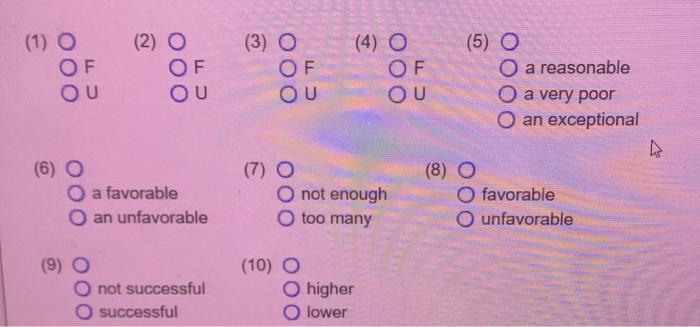

Coswig Capital Company offers financial services to its clients. Recently, Coswig has experienced rapid growth and has increased both its client base and the variety of services it offers. The company is becoming concerned about its rising costs, however, particularly related to technology overhead. (Click the icon to view the cost driver findings.) The technology budget for Coswig and its actual results for the first quarter of 2017 are given below: 2 Click the icon to view the first quarter budget information.) (Click the icon to view the first quarter actual results.) Read the requirements. Requirement 1. Calculate the variable overhead spending and efficiency variances, and indicate whether each is favorable (F) or unfavorable (U). Begin by computing the following amounts for the variable overhead. Actual Input Qty. Actual Costs Incurred Allocated Overhead Budgeted Rate Flexible Budget Now compute the variances: variable overhead spending variance, then variable overhead efficiency variance. Label each variance as favorable (F) or unfavorable (U). Variable overhead spending variance Variable overhead efficiency variance (2) Requirement 2. Calculate the fixed overhead spending and production-volume variances, and indicate whether each is favorable (F) or unfavorable (U). Begin by computing the following amounts for the fixed overhead. Actual Input Qty. Actual Costs Incurred Allocated Overhead Budgeted Rate Flexible Budget ESSE Now compute the variances: fixed overhead spending variance, then fixed overhead production-volume variance. Label each variance as favorable (F) or unfavorable (U). Ad Fixed overhead spending variance Fixed overhead production-volume variance (4) Requirement 3. Comment on Coswig Capital's overhead variances. In your view, is the firm right to be worried about its control over technology spending? (Enter dollar amounts to three decimal places, $X.XXX.) job overall of managing its technology overhead costs. Coswig has done (5) It has (6) variable overhead efficiency variance because it CPU units of processing time relative used (7) to the number of client interactions it had. This is not an issue if the goal was to meet the high-peformance computing needs of clients and resulted in higher levels of client satisfaction or revenues. For the 8,000 CPUT units used, Coswig spent per unit relative to the budgeted $1.40, so the price/spending variance on variable technology overhead was From the standpoint of capacity utilization, at managing their fixed technology Coswig was (9) overhead client interactions, compared to an expected resources. They handled output of . It would be useful to know what the company views as the maximum attainable level of capacity given its current spending on technology. The company should attempt to identify if their currer sufficient to sustain From the standpoint of capacity utilization, at managing their fixed technology Coswig was (9) overhead client interactions, compared to an expected resources. They handled output of . It would be useful to know what the company views as the maximum attainable level of capacity given its current spending on technology. The company should attempt to identify if their current technology resources will be sufficient to sustain their added customer processing in the spending level is likely in future future and if the (10) years. 1 2 : Budget information Client interations Fixed Overhead Variable Overhead 10,000 $24,000 3,000 CPU units @ $1.40 per CPU unit 03. 3: Actual results 11,000 ",000 Client interactions Fixed Overhead Variable Overhead CPU Units used $ $ 23,300 17,600 8,000 Ad 4: Requirements 1. Calculate the variable overhead spending and efficiency variances, and indicate whether each is favorable (F) or unfavorable (U). 2. Calculate the fixed overhead spending and production-volume variances, and indicate whether each is favorable (F) or unfavorable (U). 3. Comment on Coswig Capital's overhead variances. In your view, is the firm right to be worried about its control over technology spending? O (3) OF (4) OF OU (5) O O a reasonable O a very poor O an exceptional OI OU (6) O O a favorable O an unfavorable (7) O O not enough O too many (8) O O favorable O unfavorable (9) O O not successful O successful 000 (10) O higher O lower